Onyxcoin price is trying to stabilize after one of its sharpest corrections in months. The XCN coin has dropped nearly 60% between January 6 and January 31, following a massive 216% rally in late December and early January. Since then, price has been trading inside a falling wedge on the 12-hour chart, a pattern that usually signals weakening selling pressure.

At the same time, retail participation has slowed sharply, suggesting that many traders are staying cautious after the steep decline. Despite this hesitation, large holders are moving in the opposite direction, pointing to a growing divergence between smart money and broader market sentiment.

Retail Focuses on Bearish Signals as Buying Activity Slows

On the 12-hour chart, XCN continues to trade inside a falling wedge after its 60% correction. While this structure is technically bullish, it is now being challenged by a potential bearish crossover between the 50-period and 100-period exponential moving averages (EMAs). If confirmed, this crossover would signal growing downside pressure and weaken the short-term recovery outlook.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This technical risk appears to be influencing retail behavior. Exchange flow data shows that buying activity has cooled significantly. In early January, daily exchange outflows peaked near 1.51 billion XCN, reflecting strong accumulation. By early February, outflows had dropped to around 13.16 million XCN, marking a decline of more than 99%.

Falling outflows mean fewer coins are being withdrawn from exchanges for long-term holding. This usually signals reduced confidence and weaker dip-buying demand. In practical terms, retail traders are choosing caution over accumulation as bearish signals build on higher timeframes.

This slowdown in participation helps explain why the price has struggled to generate strong follow-through despite holding inside a bullish pattern. But something seems to be changing fast!

Whales Accumulate Aggressively as Cost-Basis Zones Limit Downside

While retail interest has faded, large holders have been accumulating aggressively. Over the past 24 hours, XCN whale wallets increased their holdings from about 42.5 billion XCN to roughly 52.19 billion XCN. That represents an addition of nearly 10 billion tokens (9.7 billion to be exact).

At current prices, this accumulation is worth roughly $55 million, highlighting strong conviction from larger players.

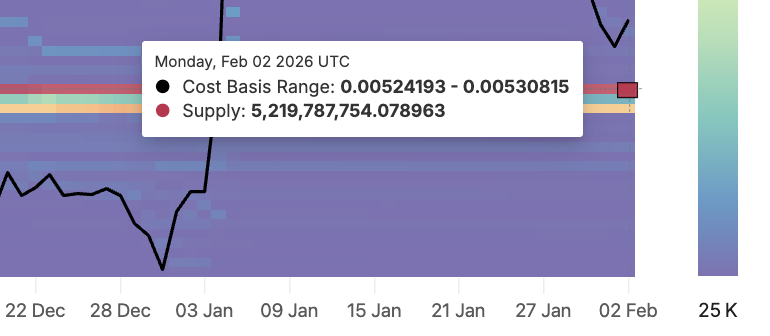

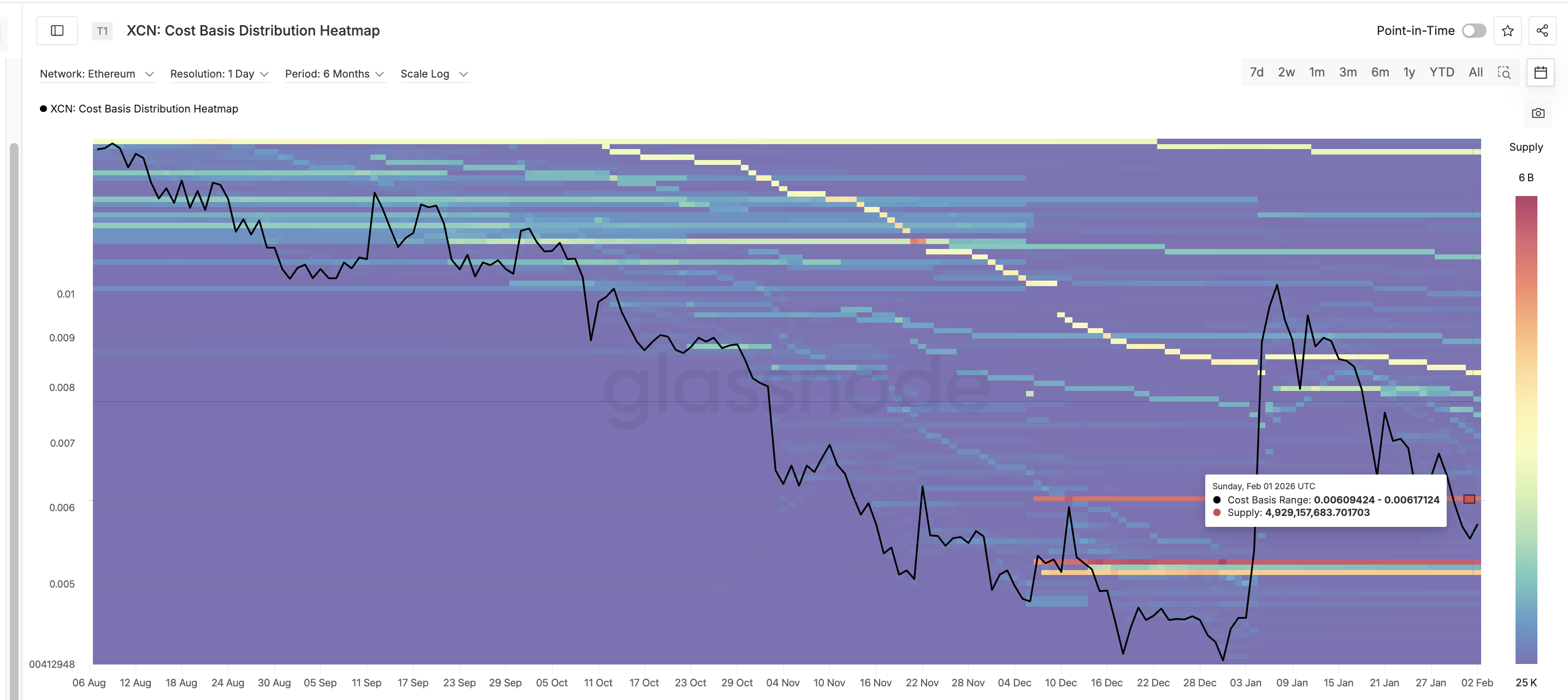

This sudden buying behavior appears linked to favorable cost-basis zones. On-chain data shows a major demand cluster between $0.0052 and $0.0053, representing more than 5.2 billion XCN. This area acts as strong structural support, limiting downside risk even if the price weakens further.

On the upside, a major supply cluster sits between $0.0060 and $0.0061, containing around 4.9 billion XCN. If the price breaks through this zone, led by whale buying, it could trigger forced covering and fresh momentum.

Whales may be positioning early near support, betting that downside risk is limited while upside potential remains significant if resistance is cleared. And charts do show why the cluster on the upside might not be as strong as it looks.

Hidden Onyxcoin Price Divergence Explains Why Whales Are Positioning Early

The most important signal supporting whale optimism appears on the lower timeframe, which retail seems to have missed to date.

On the 4-hour chart, the XCN price has formed a bullish divergence between January 21 and February 3. During this period, price made a lower low, while the Relative Strength Index (RSI), a momentum indicator, formed a higher low. This pattern often signals fading selling pressure and early bounces on a shorter timeframe

At the same time, price is approaching the 20-period exponential moving average (EMA) on the 4-hour timeframe. This level has acted as a key trigger in the past. On January 28, a clean reclaim of this EMA led to an 18% rally within days.

A similar setup is now developing, but with a more layered, domino-like angle.

If the XCN price manages a sustained 4-hour close above $0.0057, which aligns with the EMA and short-term resistance, momentum could accelerate. The next target would sit near $0.0061. A break above this zone would clear the major supply cluster (discussed earlier) and open the door toward $0.0070 and potentially $0.0076 in a relief rally.

This layered structure explains whale behavior. They are positioning near strong support, ahead of a possible divergence-driven breakout, while retail remains focused on higher-timeframe risks. The structure turns bearish only if the Onyxcoin price closes under $0.0052 on the 4-hour timeframe.

Read More

- Silver Rate Forecast

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Is Onyxcoin’s Rocket Losing Steam or Just Fueling Up? 🚀🧐

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Gold Rate Forecast

- Crypto Drama: Coinbase Ditches MOVE—Scandal, Swoon & a $100M Hangover 🍸

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

- 11,000 Wallets Fight for NIGHT Tokens in Cardano Airdrop-And It’s a Disaster 🤦♂️

2026-02-04 00:31