Right, so apparently the stock market is having a bit of a moment. Like that one friend who insists they’re *totally fine* after five espresso martinis, Wall Street is pretending everything’s just peachy despite the chaos swirling around. Investors have decided to ignore tariff tensions (because who needs peace and stability?) and focus instead on tech earnings season. Because nothing says “smart money” like betting your life savings on whether Alphabet or Tesla will make their quarterly numbers. 🙄📈

The Dow decided to shimmy up 220 points (that’s 0.52%, in case you’re keeping score), while the S&P 500 and Nasdaq followed suit with gains of 0.58% and 0.75%, respectively. It’s almost like everyone collectively agreed to pretend we’re not living in an economic version of Jenga—where one wrong move could send the whole thing crashing down. But hey, optimism! 🎉✨

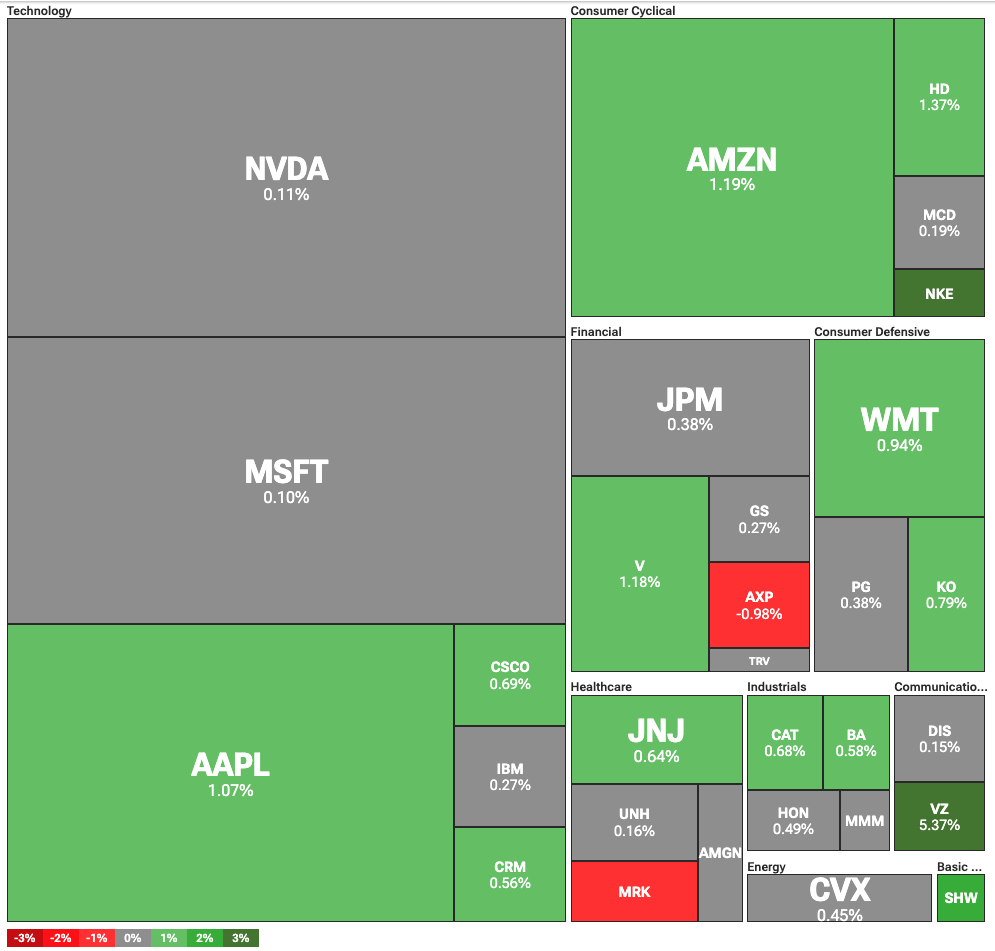

And oh, tech stocks are hotter than a summer fling right now. Traders are piling into shares faster than you can say “AI revolution,” all because Alphabet and Tesla are about to drop their earnings reports. Spoiler alert: If those results don’t live up to expectations, this party might end with more tears than a rom-com marathon. Economists are already waving red flags, warning us about an AI-fueled bubble bigger than your ex’s ego. Torsten Slok—the chief economist at Apollo Global Management—has basically declared it official: Valuations for companies like Nvidia, Microsoft, and Apple are officially bonkers. Like, dot-com bubble levels of bonkers. And if you know anything about history, that did NOT end well. 😬💣

But wait, there’s more! Because apparently, risking billions on overvalued tech stocks wasn’t enough drama, let’s throw trade wars into the mix. Yes, folks, the EU is ready to bring the thunder if the U.S. doesn’t play nice. One German official summed it up perfectly: “If they want war, they will get war.” Subtle, right? This comes after President Donald Trump—because of course it does—upped his demands for tariffs on EU goods. Now he wants 20%, which honestly feels less like negotiation and more like trying to haggle for sunglasses at a dodgy market stall. Meanwhile, the EU is clinging to its dream of a 10% baseline tariff, hoping someone will listen to reason. Spoiler: They probably won’t. 🇺🇸⚔️🇪🇺

Torsten Slok: “The difference between the IT bubble in the 1990s and the AI bubble today is that the top 10 companies in the S&P 500 today are more overvalued than they were in the 1990s.”

— zerohedge (@zerohedge) July 16, 2025

So here’s the tea: The top dogs of the S&P 500—Nvidia, Microsoft, Apple—are floating on valuations so high they make Mount Everest look like a molehill. Slok even compared their P/E ratios to the absolute peak of the dot-com bubble. And guess what? These numbers are worse. Much worse. So congrats, humanity—we’ve officially outdone ourselves. 🏔️📉

Trade Wars: The Sequel Nobody Asked For

Meanwhile, back in reality, tensions between the U.S. and EU continue to simmer. It’s like watching two exes argue over who gets custody of the shared Spotify account. Except instead of playlists, it’s global trade policies. Fun times! 🌍🔥

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Brent Oil Forecast

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- New ETF: Bitcoin and Gold Tango to Save Your Wallet from Currency Woes!

- SEI’s Suicide Dive to $0.20! 🚀😱 Or the Greatest Trick Since Woland Came to Moscow?

- XRP ETF: Will Crenshaw’s Stubborn Soul Crush Crypto Dreams? 😱

- USD TRY PREDICTION

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

2025-07-21 21:25