Oh, the crypto crowd’s at it again, buzzing about Neobanks like they’ve just discovered fire. 🔥 Suddenly, everyone’s all, “Real-world applications? Sign me up!” because, you know, hype-driven valuations were so last season. 🌈✨

Low-cap altcoins in this space? Undervalued, darling. They’re like the ugly ducklings of the crypto world, but guess what? They might just swan into your portfolio and make it rain. 💰🦢

Neobanks: The Digital Banks That Don’t Need Your Judgmental Teller Face

So, a Neobank in Web3 is basically a bank that’s all, “Physical branches? Ew, no thanks.” It’s fully digital, blockchain-based, and comes with DeFi perks like self-custody, yield-bearing accounts, and crypto spending cards. 🏦✨ Unlike traditional neobanks, these bad boys are all about transparency, cutting out the middlemen, and cross-chain connectivity. Because who needs intermediaries when you can have chaos… I mean, freedom? 🤷♀️

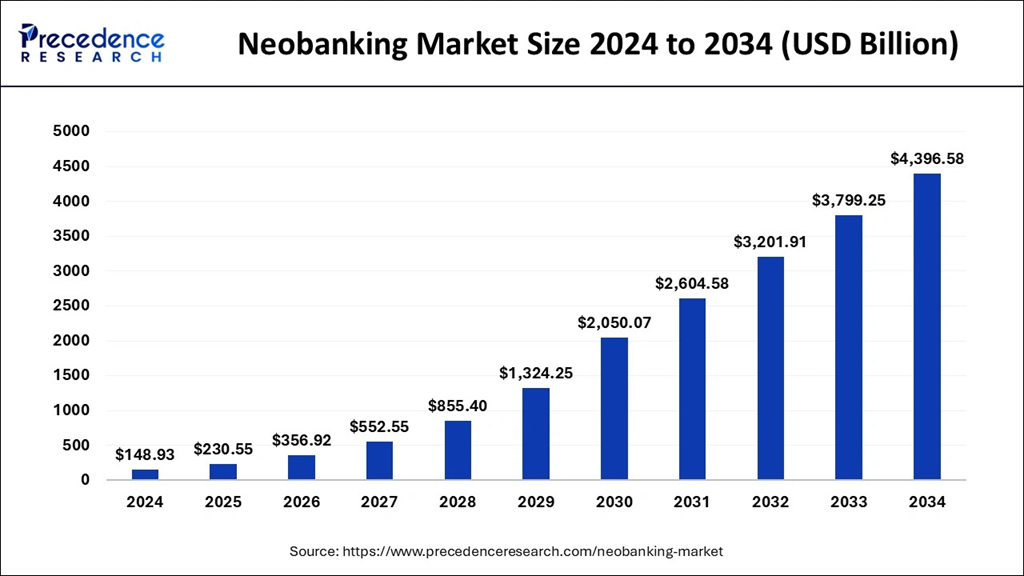

According to some fancy report, the neobanking market hit $148.93 billion in 2024 and is projected to grow at a CAGR of 40.29%, reaching $4,396.58 billion by 2034. That’s a lot of zeros, honey. 🤑

Why the growth? Stablecoins are having a moment, and investors are finally realizing that real-world utility > meme coins. 🤓 Plus, Mike S (yes, the investor) says Web2 identity infra can’t keep up if stablecoins power Neobanks. Drama! 🍿

“If stablecoin is to power Neobanks on-chain, then the current Web2 identity infra won’t be able to keep up,” investor Mike S predicted. 🧙♂️

Coingecko says the Neobank category has a total market cap of $4.19 billion, with 13 projects. Mantle’s leading the pack with $3.31 billion, followed by Ether.fi at $412 million. Not too shabby, eh? 💪

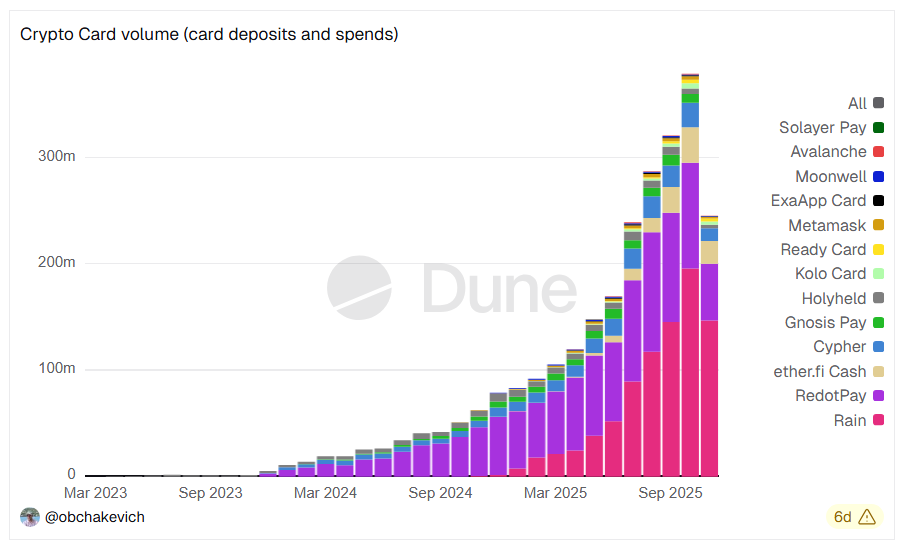

Oh, and Dune data says physical card transaction volume hit a record $379 million last month. Small potatoes? Maybe. But analysts are frothing at the mouth over its growth potential. 🥔📈

Crypto investors are betting Neobanks will explode thanks to AI agents and blockchain privacy. Some even say they’ll be the big narrative in 2026. Mark your calendars, folks! 📅✨

Low-Cap Altcoins: The Underdogs That Might Just Make You Rich (or Break Your Heart)

Sure, Mantle, Ether.fi, and Plasma had a rough November, but some low-cap altcoins are having a moment. Let’s spill the tea. ☕

1. Avici (AVICI) – The Solana Darling 💖

Avici is all about self-custodial crypto banking on Solana, with spending cards and on-chain swaps. Its market cap went from “meh” to $77 million in two months, and its price is now over $6. Go off, queen! 👑

Stalkchain says someone’s been hoarding $35K worth of AVICI at $266 per minute. That’s commitment, or a really bad case of FOMO. 🤔

A wallet is actively accumulating $35K worth of $AVICI @AviciMoney buying $266 every 1 min. With $2.2M LP and a $68M mcap, those buys add 1.57% of the entire LP in buying pressure. Estimated impact: A 1.5%-2.8% pump, higher only if the buy continues beyond this session. On… 🤑💨

Their Avici Card hit 100,000 transactions in November. Investors are dreaming of $50-$100. Ambition, I like it! 💫

2. Cypher (CYPR) – The Underappreciated Gem 💎

Cypher’s on Base Chain, rewarding users with CYPR tokens for card transactions. It’s all about open economic models and growth. Market cap? Under $10 million. Analysts say it’s undervalued. 🕵️♀️

@Cypher_HQ_ keeps going under the radar despite impressive metrics. Only behind EtherFi’s Cash in cards volume and consistently processing ~2x its market cap in payments value. Low liquidity and limited CEX listings are holding it back. 🤦♀️

3. Machines-cash (MACHINES) – The Privacy Lover’s Dream 🕶️

New kid on the block, Machines-cash, is all about privacy on Base. Market cap? Under $5 million. Analysts think it could 10x, just like AVICI. The team’s got ex-MetaMask, Trust Wallet, and DARPA folks. Plus, an AVICI advisor’s on board. Fancy! 🎩

If you missed my $AVICI call that printed a 10x for us, then don’t miss $MACHINES. Many KOLs are just now starting to push AVICI which we had very very early, and the same will happen with this one. @machines_cash is a privacy-focused crypto payment platform on Base. The… 🚀

It lets you make anonymous Visa card payments with alias accounts. Privacy’s hot right now, so this could be a winner. 👀

But let’s not forget, the market’s still gloomy, and picking winners in this space is like choosing the least messy character in a Phoebe Waller-Bridge show. Good luck! 🍀

Jay Yu from Pantera Capital says retention, card volume, and user count will crown the winners. So, keep your eyes peeled, darlings. 👁️✨

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Silver Rate Forecast

- Unmasking the Whale: Ethereum’s Shocking, Witty Crypto Power Move Revealed 😎

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Schumer’s Secret Stablecoin Standoff—What They Don’t Want You To Know 🪙🤐

- Brent Oil Forecast

- How I Lost $1.25M Talking to Myself (And Thought It Was MrBeast) 😂💸

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

2025-11-24 16:58