Markets

What to know:

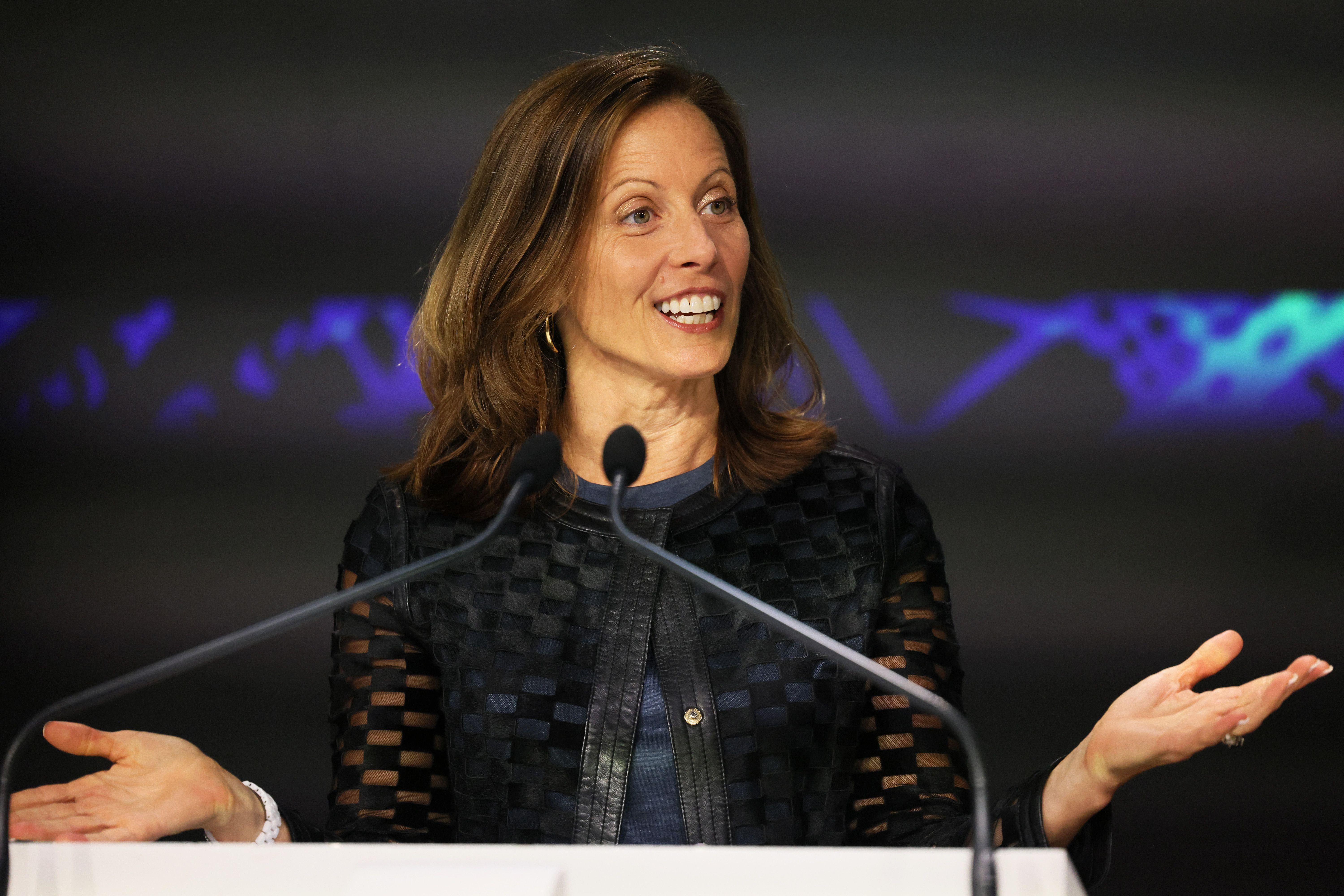

- Nasdaq CEO Adena Friedman says blockchain can streamline post-trade systems that still rely on outdated infrastructure.

- She sees digital assets enabling faster collateral movement, freeing capital tied up in clearinghouses and brokers.

- Friedman believes improving payment systems with blockchain could reduce global friction and boost investor access.

Alright, folks. Nasdaq CEO Adena Friedman, in her infinite wisdom, is telling us that blockchain is the future of finance-no big surprise there, right? But she’s really onto something here, making some bold claims about how blockchain could shake up the way finance has been working for decades. Who knew? Maybe it’s time we stop pretending the current system doesn’t feel like it was built with a typewriter and a fax machine.

Here’s the thing. According to Friedman, blockchain could be a game-changer in three key areas:

- Post-trade infrastructure, which is like the tired old guy still using a flip phone in 2025.

- Collateral mobility-getting assets from Point A to Point B, without that awkward delay where you just stare at the screen wondering if your money is ever coming back.

- And finally, payments-because honestly, how many times have you tried to move money internationally and thought, “Wow, this is so fast…said no one ever.”

She put it perfectly at a conference in New York, chatting with Ripple President Monica Long. “There’s just so much capital trapped, whether it’s in clearinghouses or clearing brokers,” she said. Translation: We’re all sitting on piles of money, but no one knows how to actually use it. Great job, guys.

Apparently, this whole post-trade thing is a mess-shocking, right? The systems that finalize transactions are still stuck in the 1980s, and while some complexity is necessary (because, you know, risk and stuff), a lot of it is just dragging us down. Imagine trying to use your grandma’s dial-up internet to check your bank balance. That’s the vibe we’re working with here.

And let’s talk collateral-basically, the stuff you pledge in trades or loans to make sure you don’t lose your shirt. Friedman’s big idea? Make it easier to transfer this stuff across borders, like, immediately. We could actually get some capital moving around instead of letting it collect dust in some fancy vault, waiting for the next financial crisis.

Now, payments. Oh, payments. When was the last time you made a cross-border payment and didn’t want to throw your laptop out the window? It’s like trying to shove an elephant through a revolving door. But blockchain could change that, making payments smoother, faster, and-dare I say-almost pleasant. It’s almost like magic, but less ‘Hogwarts’ and more ‘please don’t take a week to process my transfer.’

Nasdaq is already on the move, filing with the SEC to let investors trade tokenized securities. Basically, you could flag a trade for tokenized settlement, and boom-your assets are in a digital wallet. It’s like taking your trades to the future, but without all the weird sci-fi stuff.

But don’t get too excited. Friedman wasn’t trying to suggest that blockchain will replace everything. She knows the U.S. equity markets are like that solid friend who never lets you down-reliable. But what if we could just toss some tech in there to make it a bit easier to, you know, do business? Imagine the possibilities.

So there you have it. Tokenized markets may be just the beginning. It could eventually reshape how securities are issued and traded. Maybe one day we’ll be telling our kids how we used to wait three days for a payment to go through. But don’t hold your breath.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Pi Network Flashback: Did the Founder Reveal When Pi Coin Will Actually Start Rising?

- SEC Gives Galaxy Digital a Green Light—But Will They Survive Delaware?

- Bitcoin’s Bumpy Ride: Will it Sink or Swim? Find Out Before Your Coffee Gets Cold! 🚀💸

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Tokens, Trinkets, and Trials: The Crypto Conundrum Unveiled!

- Brent Oil Forecast

- XRP Boss Bails… But Wait, He’s Back? 😏

- XRP’s DeFi Adventure: The Liquidity Awakens! 🚀💸

2025-11-04 20:38