O cruel fate! Until the great stone hearts of Wall Street deemed Bitcoin suitable for the likes of you-the mere mortal with mere thousands, not millions-the beast remained locked behind velvet curtains of exclusivity. But lo! Morgan Stanley, that titan of tutus and terminals, now bestows its crowd with the divine right to taint retirement savings with cryptocurrencies. 401(k)s tremble! IRAs panic!

Behold the numbers! $45.8 trillion in pensions, enough to buy every avocado on Earth. Now, should Morgan Stanley’s 16,000 scribes (armed with spreadsheets and existential dread) whisper sweet markdowns into clients’ ears, the Bitcoin markets shall rise and fall like a disgruntled puppet. Institutions, dear reader, are not human. Institutions are forces of nature with a 401(k) obsession.

“Mainstream era,” quoth the oracle of X. One might suspect he speaks in riddles after burning all his socks on the cryptostove.

The Iron Cages of Capital

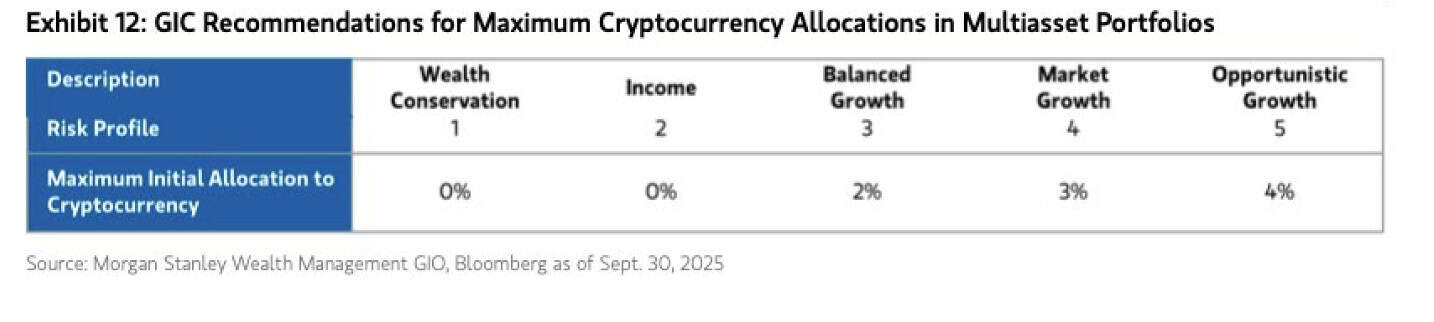

Fear not, ye gentle investors! Morgan Stanley, guardian of frost and fees, shall not let chaos run rampant. Allocations are shackled by algorithms, protected by the Advisory Committee’s trembling fingers. Aggressive portfolios: 4% max. Balanced ones: 2%. Conservative? Had enough of this plebeian cryptocurrency nonsense 🐎. Thus, in their infinite wisdom, they curb innovation to keep the blockchain within the stables.

Wall Street’s Awkward Waltz

Fidelity, JPMorgan, BlackRock-these titans shuffle their feet like first-day ballet students. Fidelity offers crypto pensions. JPMorgan accepts ETFs as collateral (if loans could yawn… they never do). And BlackRock? Oh, they tokenize ETFs for fun now, because why not? DeFi collaterals, 24/7 trading, and the delirious joy of fees that… persist. Institutions “see digital assets as an investable asset class.” One might say they finally noticed the elephant in the room with a Bitcoin tattoo.

The line between crypto and finance? Fading as if erased by a caffeine-deprived intern. Morgan Stanley just kicked it another foot. Or perhaps poked it with a $6-quadrillion trident.

The Bigger Picture (Here Lies the Sequel)

This is not merely policy-it is CMYK proclamation! When a $6 trillion beast whispers “digitize this” in its moneyforumers… it becomes gospel. Now, digital assets are infrastructure, a word that sounds distinguished but means “tablets with ads.” And as Wall Street tokenizes what’s left of common sense, we must ask: what is next? NFT golden loofahs? Dogecoin corgi mortgages?

In the end, the banks warned you…Bitcoin was risky, speculative, a gateway drug. Now they sell it to you for $19.99/month, plus a consultation fee from Satan himself. 🤝💰

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- Whale of a Time! BTC Bags Billions!

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- Bitcoin Miners’ Revenue Tumbles 11% – Will They Surrender? 🤯

2025-10-11 03:06