Behold, dear reader, the grand comedy of nations: the United States and Venezuela, locked in a pas de deux of indignation since the dawn of 2025, when the Trumpian symphony resumed its cacophonous refrain. Maritime strikes, seized tankers, and sanctions-oh, what a tangled web of petro-political spite! Polymarket bettors, those modern-day soothsayers, whisper that the likelihood of Nicolás Maduro’s ouster before Jan. 31, 2026, stands at 21%. A paltry sum, yet a wager nonetheless.

Polymarket Traders Bet on When – Not If – U.S. Pressure Forces Maduro Out

For years, the United States hath gazed upon Nicolás Maduro’s reign with the skepticism of a man who once trusted a fox to guard a henhouse. Election fraud, the slow strangulation of democracy-Maduro’s rule is a farce draped in the garb of legitimacy. With Donald J. Trump, that most theatrical of presidents, back in the saddle, Maduro’s government now faces accusations of narco-trafficking, as if Venezuela were a mere pawn in a drug-running chess match. One might think the Cartel de los Soles were but a figment of American paranoia, yet here we are.

Since September, the seas have become a theater of absurdity: over 20 maritime strikes on suspected drug-smuggling vessels, each one a slap in the face to Maduro’s dignity. The U.S., in its infinite wisdom, seized the Venezuelan-linked tanker Skipper on Dec. 10, a vessel carrying 2 million barrels of crude and a heart full of spite. Maduro, ever the Shakespearean tragic figure, decried the act as “criminal naval piracy.” A noble protest, if one ignores the fact that his regime’s economic policies have left Venezuela in tatters. 🚢💥

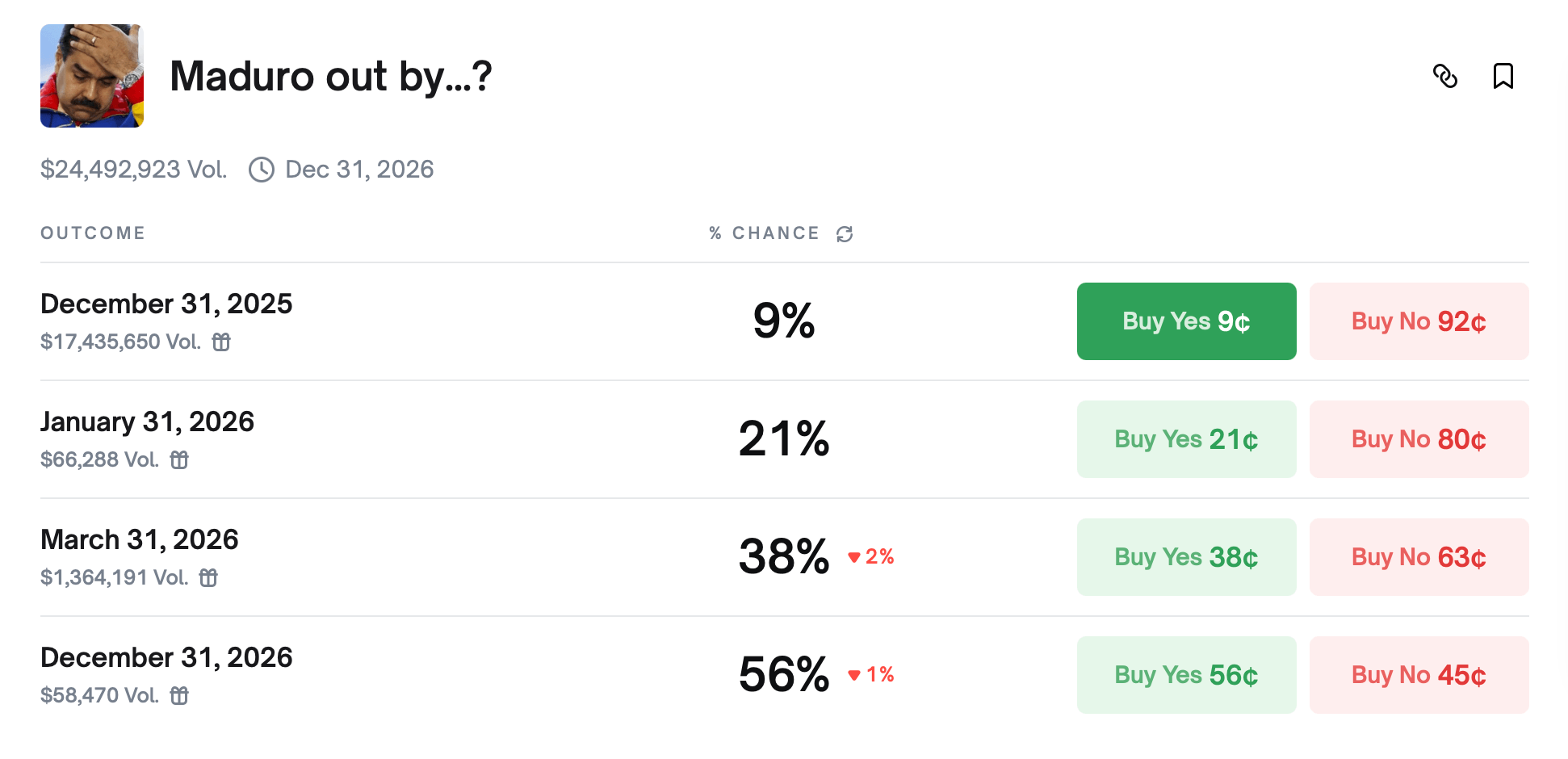

This maelstrom of geopolitics has turned Maduro and his court into the subject of wagers. Polymarket, that digital agora of speculation, now hosts 13 markets tied to the dictator and the standoff. One particularly juicy market has drawn $24.49 million in bets, all focused on when Maduro will depart. The bettors, though not yet stamping their feet in celebration, are slowly adjusting their odds like a miser counting coins. 💸

The odds of Maduro’s exit by Dec. 31, 2025? A frigid 9%, as if the market were muttering, “Not today, Satan.” By January 2026, confidence warms to 21%, a flicker of hope in a world of cynicism. By March 31, 2026, the odds swell to 38%, as traders ponder whether sustained pressure might finally crack the regime’s veneer. Ah, the sweet thrill of incrementalism!

Extend the timeline to Dec. 31, 2026, and the market’s patience curdles into 56% certainty. Maduro, once thought an immovable object, now faces the inexorable march of time. Another market suggests a 13% chance of Maduro engaging in talks with Trump-a meeting of titans? Or a farce in the making? Meanwhile, the odds of Maduro fleeing by March 31, 2026, stand at 37%, a number as optimistic as a snowball in hell. ❄️

Trump, ever the provocateur, has threatened land strikes against Venezuela’s narcotics operations, as if the world were a game of Risk and he the last player standing. Polymarket assigns a 57% chance of military engagement by March 31, 2026, while giving an 80% chance that nothing escalates this year. A full U.S. invasion? A mere 16%-one might say the market has more faith in unicorns. 🦄

For now, the betting boards reflect a stalemate: Maduro clings to power, the rhetoric crescendos, and traders tally their chips. Will 2026 bring resolution or further absurdity? The clock ticks, and patience, that most fragile of virtues, wears thin. Prediction markets, in their cold calculus, remind us: all empires end, even if the timeline is written in sand. 🕰️

FAQ 🇺🇸 🇻🇪

- What is Polymarket betting on with Nicolás Maduro? Polymarket traders are wagering on when, or if, Maduro is removed from power amid rising U.S.-Venezuela tensions. A modern-day Iliad, with crypto and crude oil as its tragic heroes.

- What are the current odds of Maduro leaving office? Bettors assign a 21% chance of an exit before Jan. 31, 2026, rising to 56% by the end of 2026. A glacial pace, yet a thaw is inevitable.

- Why are U.S.-Venezuela tensions affecting prediction markets? U.S. sanctions, maritime actions, and military threats have made Maduro’s political future a tradable outcome. Capitalism, even in its most cynical form, cannot resist a spectacle.

- Is Polymarket pricing in a military conflict? Markets give a 57% chance of military engagement by March 31, 2026, while a full U.S. invasion remains a low-probability scenario. A war, it seems, is more likely to be fought in spreadsheets than in trenches. 📊

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- USD TRY PREDICTION

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- SEI’s Suicide Dive to $0.20! 🚀😱 Or the Greatest Trick Since Woland Came to Moscow?

- Crypto Drama: Sui’s Price Soars Like a Pigeon in a Storm! 🐦💸

- Brent Oil Forecast

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

2025-12-13 21:29