Peter Brandt, a trader so seasoned he probably dreams in candlesticks, is waving his magic bearish wand over the S&P 500, Bitcoin, and Ethereum, forecasting a nosedive that would make even a rollercoaster jealous. Apparently, by year-end, these shiny risk assets might be looking a lot less shiny—and a lot more like the clearance rack at a liquidation sale.

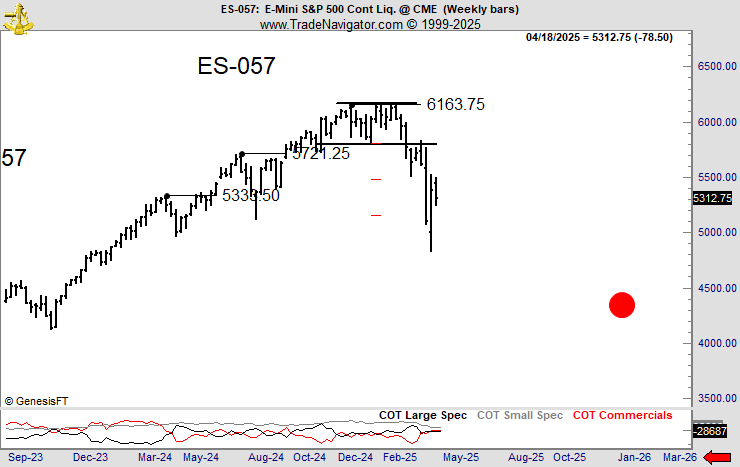

First stop: US stocks. Brandt, who has amassed an audience bigger than some small countries (792,500 followers on X, formerly known as Twitter, for the uninitiated), is calling the S&P 500 bearish after it threw a tantrum below the 5,800 mark and then, like a rejected suitor, couldn’t get back up past that level.

His bold prediction? The S&P 500 will be hobbling just below 4,500 points by the end of the year. That’s a drop that could make your portfolio cry, but hey, at least it’ll be consistent.

“The Red Dots are where I think we end the year in 2025.”—translation: expect a cliff dive.

Friday’s close had the S&P 500 lounging at 5,282, blissfully unaware of the doom looming ahead.

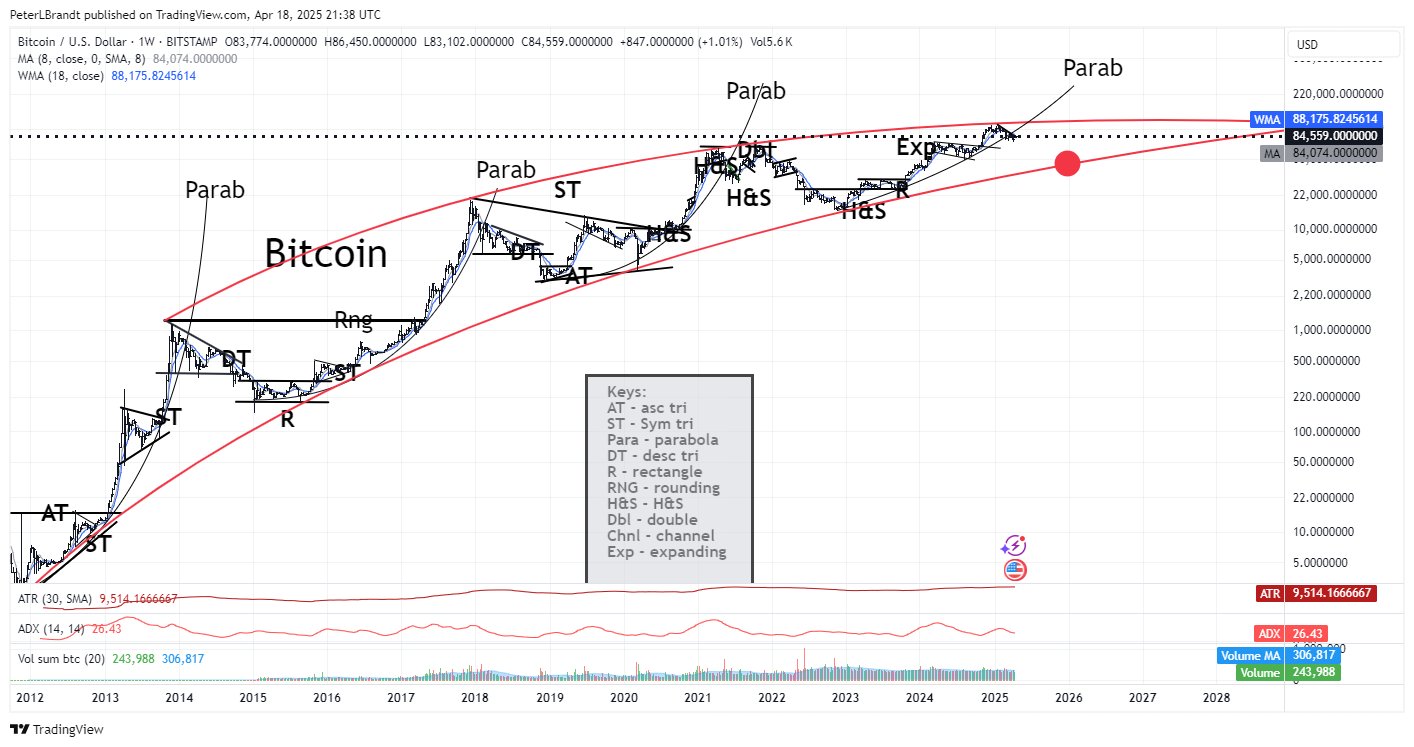

Over in crypto-land, Brandt’s crystal ball sees Bitcoin spiraling down to around $50,000—quite the nosedive considering it’s currently flirting with $85,280. Apparently, Bitcoin broke free from a parabola that’s been politely keeping it positive since 2023. Nature abhors a parabola, it seems.

“Not my opinion, but it is what the chart suggests as possible.” Sounds like a responsible disclaimer or a sneaky way to say, “I might be right… or not.”

At the time of writing, Bitcoin is still living large at $85,280, but don’t get too comfortable.

Ethereum isn’t escaping the grim forecast either. Brandt predicts ETH will nosedive to around $600—talk about a rough year for crypto fans who aren’t exactly swimming in digital gold right now.

//pbs.twimg.com/media/Go2T2vHboAAVsjs?format=jpg&name=large”/>

Currently, Ethereum enjoys a somewhat cushy $1,616, but Brandt’s chart suggests a trip to the basement.

Now, for the one bright spot: gold. Yes, the same ancient metal that’s been shiny since forever is expected to continue its golden reign. Brandt shows us nifty charts with an “ascending channel pattern”—financial mumbo jumbo that basically means gold’s been climbing like it’s got somewhere really important to be, and now it’s breaking free, potentially soaring up to around $3,600.

Think of the ascending channel as gold’s personal StairMaster, making it fitter and stronger, and the breakout as it finally sprinting out the door.

“Gold Finger, the market with the magic touch.” Sounds like a James Bond villain, but it’s just gold being gold.

Gold currently shines at $3,327 as of Friday’s close. Not too shabby if you’d rather stuff bars in your mattress than anxiously watch charts breathe.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Is Onyxcoin’s Rocket Losing Steam or Just Fueling Up? 🚀🧐

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Coinbase’s Meme Coin Frenzy: A Tale of Farts and Fortunes 🚀💰

- Ethereum’s Wild Ride: Is It Just Getting Started? 🚀

- XRP ETF: Will Crenshaw’s Stubborn Soul Crush Crypto Dreams? 😱

2025-04-20 10:26