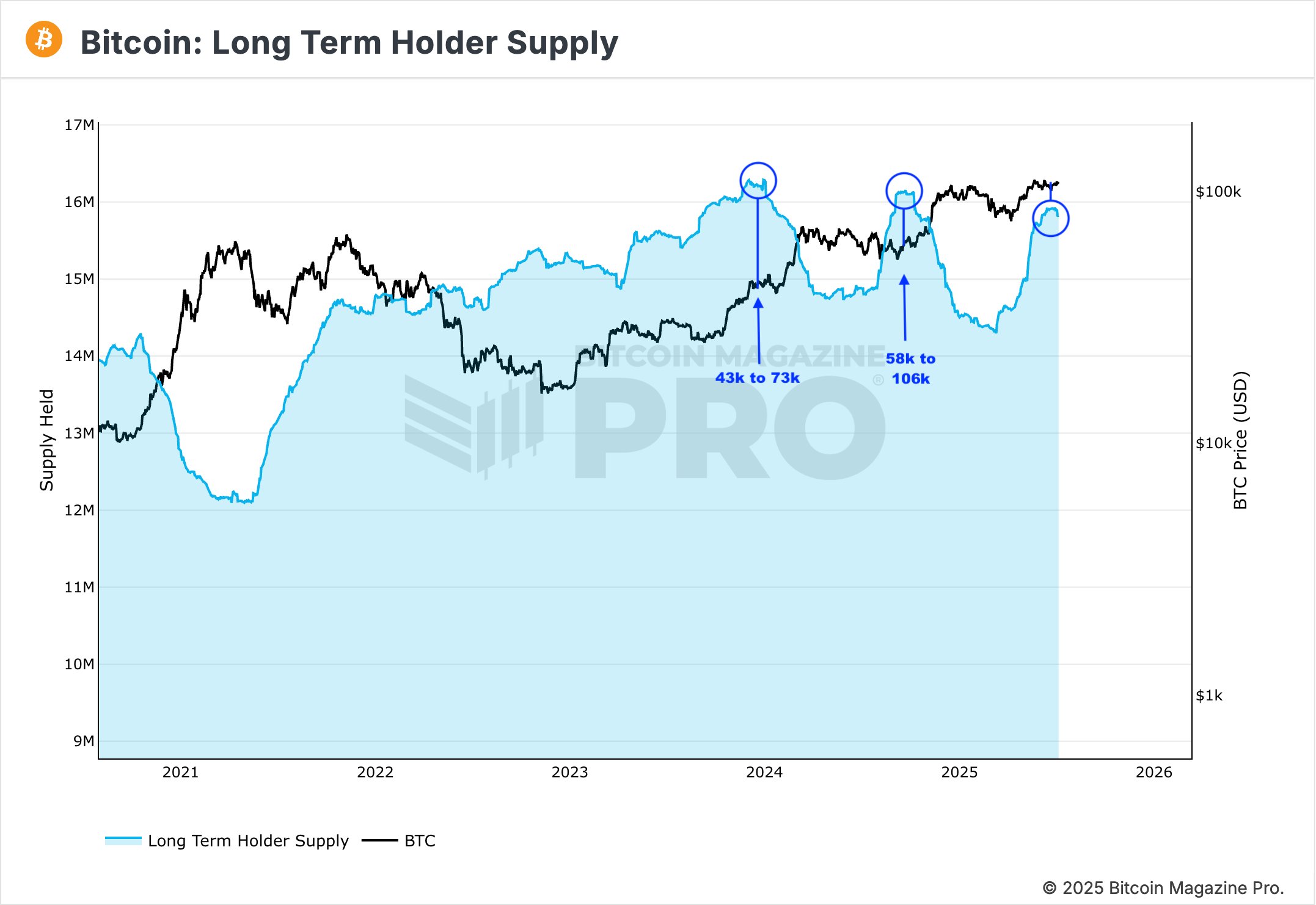

The Bitcoin market is practically *shaking* with anticipation, according to expert crypto analyst CrediBull Crypto (@CredibleCrypto). He posted on X today that over 80% of all Bitcoin in existence is now locked up by long-term investors. And let’s be real, that’s like a crypto hoarder’s dream come true, only it’s not a bunch of cat memes—it’s actual valuable stuff!

Why No One’s Selling Bitcoin

CrediBull points out that the last two times this happened—when more than 80% of Bitcoin was hoarded—huge price hikes followed. We’re talking a jump from $43k to $73k and another from $58k to $105k+. So, yeah, he’s basically saying, “When the ‘diamond hands’ are gripping the market like a toddler clutching a cookie jar, you bet your Bitcoin the price is gonna skyrocket.”

Now, with all the “extra” supply gone and long-term holders and institutional players (looking at you, Bitcoin treasury companies) in control, CrediBull is convinced: the next surge is coming. “Get ready for Bitcoin to break $150k,” he says. Yeah, that’s a bold statement, but we all know the crypto market loves making bold statements—and even bolder moves.

It’s not all just fluff though. CrediBull has done some math (don’t worry, it’s not calculus) and looked at the current market structure with his Elliott Wave forecast. Basically, he sees Bitcoin rejecting any prices above $110k, pulling back to $102k-ish, and then going sideways for a while. But here’s the kicker: there’s a *small chance* the surge has already started, and the bulls are just too busy to realize it. Guess we’ll just have to wait and see.

Of course, no one really knows. But based on price action and structure, CrediBull says it’s no longer wise to bet against Bitcoin. Why? “It’s illegal to short Bitcoin now,” he quips. Well, maybe not *illegal*, but it certainly feels like it when you see the price climbing faster than your internet browser can load.

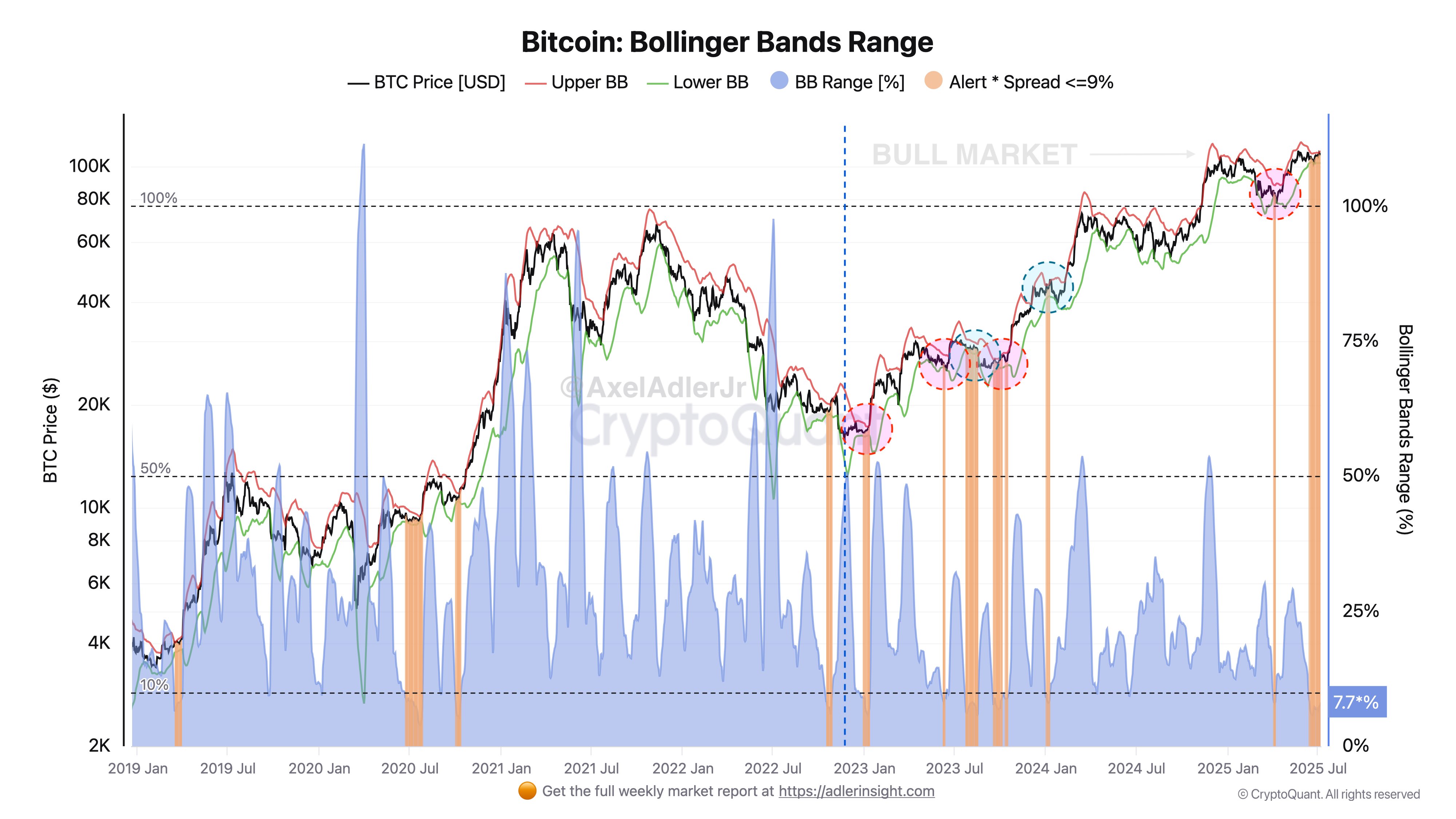

Meanwhile, analyst Axel Adler Jr is throwing his two cents in, saying there’s a *big* squeeze happening with Bitcoin’s volatility. Apparently, the difference between the high and low boundaries of the Bollinger Bands is tighter than your jeans after Thanksgiving dinner (ouch!). According to Axel, such low volatility means the market is like a pressure cooker ready to blow—and the chances of Bitcoin popping to the moon are higher than ever.

In fact, Adler has tracked six similar squeezes before. Four of them led to explosive price jumps, while the other two saw a little dip before soaring again. So, if you’re sitting there holding your breath, just know that this volatility squeeze might just be your cue to keep your hands off the panic button. The rally is coming… probably.

With long-term holders snatching up supply like it’s a Black Friday deal, technical indicators showing all the right signs, and institutions hoarding Bitcoin like it’s going out of style, the situation is screaming “bullish!” So, while nothing is certain in the crypto world, the odds are pointing to Bitcoin’s next big leap—and it might already be starting quietly in the background.

At press time, BTC was chilling at $108,738.

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Gold Rate Forecast

- USD RUB PREDICTION

- EUR UAH PREDICTION

- USD TRY PREDICTION

- Brent Oil Forecast

- Is Jack Ma’s Alibaba Secretly Betting Big on Ethereum? Find Out! 🚀

- XRP’s Comedy of Errors: Still Falling or Just Taking a Break? 😂

- Wallet Wars! TRON, $100 Million, and the Blockchain Blacklist Brouhaha 🤡

2025-07-09 00:05