Well, well, well, look what we have here! Three spot cryptocurrency exchange-traded funds (ETFs) for Solana, Hedera, and XRP from those charming folks at Fidelity Investments and Canary Capital have just snuck their way onto the Depository Trust & Clearing Corporation’s National Securities Clearing Corporation list! What does this mean? Could we be on the brink of witnessing some magic? Or is it just another bureaucratic hoop jump before the big show? 🎩✨

Hold onto your wallets, folks! These ETFs are pending regulatory approval. Yup, we’re still waiting on the green light from the SEC. But no worries, we’ve got a few juicy tidbits to keep you on the edge of your seat. 🍿

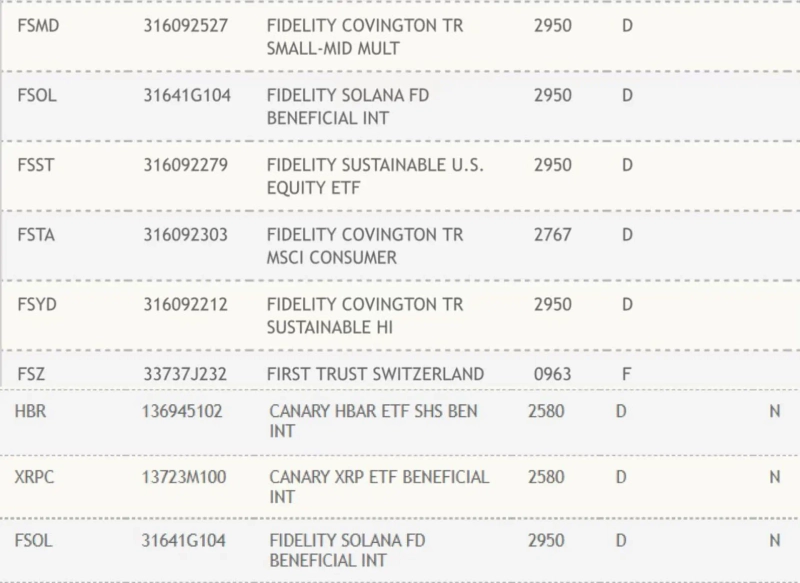

- Fidelity’s Solana ETF (FSOL) and Canary’s XRP ETF (XRPC) and Hedera ETF (HBR) have made their list debut. 🎉

- SEC is still taking its sweet time, with decisions on XRP expected in October, and Solana and Hedera in November.⏳

- Analysts are feeling pretty smug, predicting a 95% chance of approval for both Solana and XRP ETFs. 🎯

On September 11th, the DTCC updated its list with Fidelity’s Solana ETF (FSOL), Canary’s XRP ETF (XRPC), and Canary’s Hedera ETF (HBR) joining the ranks of securities eligible for clearing and settlement. It’s like a VIP club for financial products-except you still need the SEC to hand out the velvet ropes. 🕴️

Are the Solana, Hedera, and XRP ETFs Approved Yet? Spoiler: Not Quite

Now, in case you’re still wondering what this DTCC thing is all about, let me clear that up for you: it’s the big cheese of post-trade operations for U.S. securities. It handles ETF product settlements and clearings but doesn’t make the final call on whether these funds can actually be traded. That power still lies in the hands of the SEC, a body that’s as quick as a snail on a treadmill when it comes to making decisions. 🐌

Just because something gets listed on the DTCC doesn’t mean it’s ready for a party on Wall Street. No, no. The SEC has to give it the thumbs-up first, or else it’s back to square one. Been there, done that, got the rejection letter. 📬

Remember the Litecoin spot ETF? It was added to the DTCC list back in February, but it’s still waiting for the SEC to hit “approve.” Still, if you ask ETF analyst Eric Balchunas, he’s confident that most tickers listed on the DTCC eventually make it to market. After all, how many have failed? Not many, it seems. So, take a deep breath, folks. 😤

The SEC: The Ultimate Drama Queen of Approvals

Oh, and here’s a little tidbit for you: the SEC has been a real tease this year, pushing back decisions on these ETFs more times than a kid on a sugar high refusing to go to bed. The decision on Canary’s XRP ETF has been delayed until between October 18-23. Hedera’s ETF? It’s stuck waiting until November. Fidelity’s Solana ETF? Yeah, it’s also caught in the SEC’s snail-paced web. 🕷️

But don’t panic! Analysts are still betting on a high chance of approval, thanks to a little thing called “new pro-crypto leadership at the SEC.” 😏 According to Balchunas and his partner-in-crime, James Seyffart, there’s a 95% chance that Solana and XRP will get the golden ticket. Hedera’s odds are slightly lower, at 90%, but still pretty dang good. 💸

Meanwhile, back in the market, Solana (SOL) is leading the charge with gains over 7% in the last 24 hours, followed by Hedera (HBAR) and XRP with smaller but still respectable gains of 3.63% and 1.88%, respectively. 📈

And just to wrap it all up, Nate Geraci, the ETF analyst who can predict the future (or at least pretend to), believes that once these ETFs get the SEC’s stamp of approval, the demand will be off the charts. “People are severely underestimating investor demand for spot XRP & SOL ETFs,” he declared in a recent post. So, get ready for some serious wallet action! 💥

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Brent Oil Forecast

- Crypto Riches or Fool’s Gold? 🤑

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

2025-09-12 11:21