The crypto market, as always, is a tempestuous sea, unpredictable and merciless. Investors, like passengers on a ship with no compass, are anxiously awaiting the Federal Reserve’s decision on interest rates. Recently, the price of SOL surged, nearly touching the $150 mark. But, alas, it could not breach the celestial barrier and was cast back down, a victim of the cruel whims of market forces. This failure caused a sharp drop in key on-chain metrics, prompting many to divert their investments elsewhere. Experts, ever hopeful, argue that should the Fed decide to lower interest rates, the market may find some respite, and the relentless selling pressure on SOL might ease. But who knows? It’s a roll of the dice. 🎲

Solana’s Network Activity Falls Off a Cliff

In the recent hours, Solana has experienced such wild price swings that one might think the network is having a nervous breakdown. After failing to stay above $150, an enormous wave of liquidations swept through the market. Coinglass reports that in the last 24 hours, over $7 million worth of Solana positions were wiped out. Of that, about $1.61 million came from those who were foolish enough to bet on rising prices (long positions), while the sellers closed around $5.42 million worth of positions. A truly spectacular show of financial carnage. 🤑

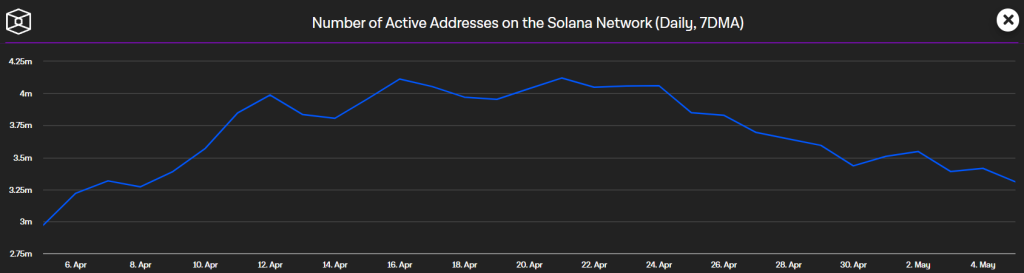

One of the main reasons for Solana’s struggle is its plummeting network activity. The Block’s data reveals that the number of active addresses on Solana has dropped sharply in recent weeks – from a high of 4.12 million to a mere 3.31 million. Even the number of new addresses has taken a hit, falling from 4.11 million to 3.2 million. It’s almost as if the network has become a ghost town, and Solana is finding it increasingly difficult to break through its stubborn price resistance. Ghosts aren’t known for their financial prowess, after all. 👻

The market is holding its breath as it watches today’s U.S. Federal Reserve meeting, which could bring about even more volatility. While some of Trump’s recent comments have sparked a faint glimmer of hope, the CME FedWatch Tool shows a mere 2.3% chance of a rate cut happening today. Most experts expect the Fed to maintain the status quo, keeping interest rates steady between 4.25% and 4.50%. But one can never be too certain in this game of financial roulette. 🎰

If the Fed does cut rates, it might just give Solana the boost it needs to break above $150. However, if the rates stay the same, SOL is likely to continue its sideways drift within its current range. Just another day in the crypto carnival. 🎪

What’s Next for SOL Price?

Solana is currently getting support around the 20-day EMA, a lifeline for the beleaguered cryptocurrency. Buyers are stepping in during price dips, but the bears, those tenacious creatures, are fiercely defending the $150-$160 resistance. As of now, the price sits at $145.8, a modest 1.4% gain in the past 24 hours. A small victory in a grand battle. 🦸♀️

Buyers, with the optimism of a gambler who’s lost it all, are likely to attempt once again to break above the $150 resistance. If they succeed, the price could climb to $180. This would create a wide trading range between $110 and $215, where the crypto circus could continue for a while. 🏹

However, if the sellers manage to push the price below the 20-day EMA, we could be in for a long, dreary winter. SOL might tumble to the $133 level, and stay trapped within the range of $105 to $150 for the foreseeable future. And so, the saga continues. 🕳️

The long/short chart for Solana reveals a noticeable drop in the ratio, now sitting at 0.5122. This means that approximately 66% of traders are betting that SOL’s price will continue its downward spiral. The odds are stacked against the crypto hopefuls. 🎯

Read More

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Gold Rate Forecast

- XRP’s Comedy of Errors: Still Falling or Just Taking a Break? 😂

- Whale of a Time! BTC Bags Billions!

- FTX’s Billion-Dollar Circus: When Crypto Goes Rogue and Everyone’s Suing

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

- Stripe’s Latest Acquisition: A Crypto Wallet Adventure Awaits! 🚀💰

2025-05-07 19:48