Over the past month, Solana (SOL) has experienced a significant surge of 28.4%, however, its upward trajectory seems to be moderating lately. Following a brief peak at $184, it has only managed to increase by a slight 0.78% over the last seven days. Nevertheless, Solana remains at the forefront in DEX metrics, outperforming all other chains with an impressive $27.9 billion in weekly trading volume.

The system containing various apps built on Solana is still buzzing with activity, contributing significantly to fees. But some technical signs, like RSI, Ichimoku Cloud, and EMA lines, hint that the current surge might be slowing down. This could mean a phase of stability or potential adjustment may be approaching.

Solana Leads DEX Market With $27.9 Billion Weekly Volume and Surging App Activity

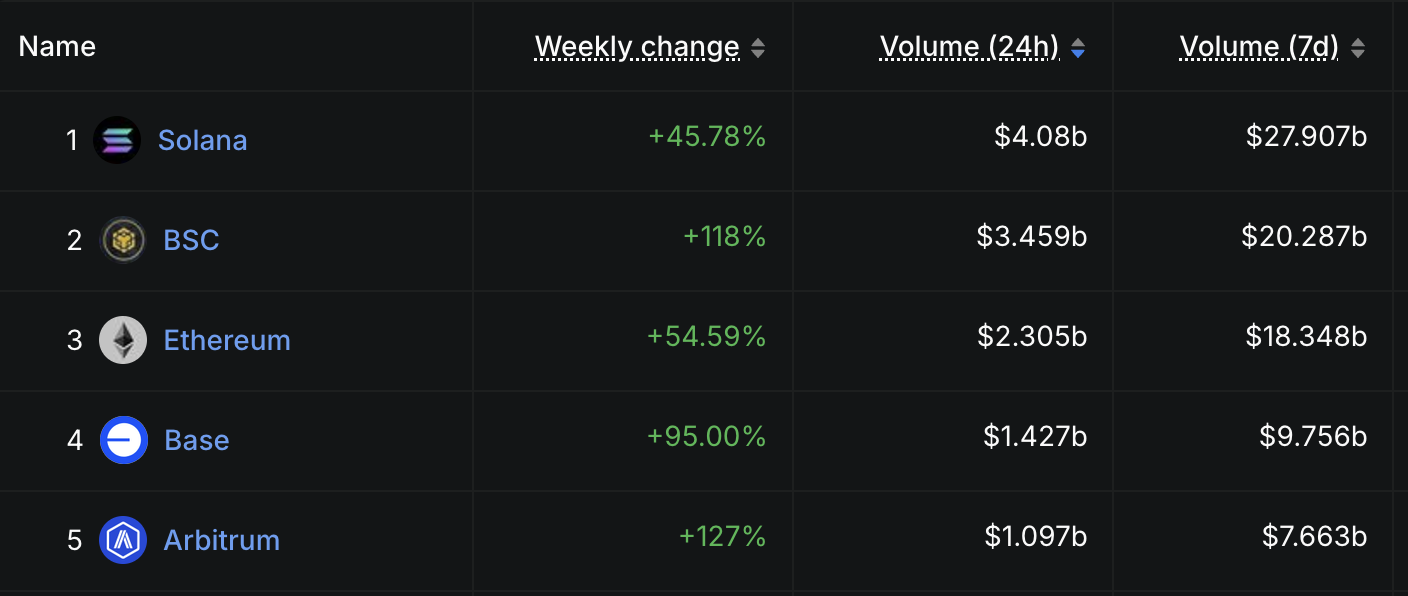

For four weeks straight, Solana is holding the top spot in the Decentralized Exchange (DEX) market in terms of trading volume, demonstrating its consistent dominance.

In just the last week, Solana’s decentralized exchange (DEX) volume reached an impressive $27.9 billion, outpacing the volumes of BNB Chain, Ethereum, Binance‘s Base, and Arbitrum.

The amount of daily transactions on the Solana Decentralized Exchange (DEX) increased by 45.78% each week, pointing towards a robust recovery in on-chain interactions, following a period of reduced activity from March to April.

Solana’s DEX trading volume went up by about 46%, showing a significant rebound in blockchain usage after a downturn in transactions between March and April.

Over the past month, I’ve noticed a significant surge that can be considered a spike in our data. Remarkably, this uptick aligns with a larger pattern, as daily volumes have persistently exceeded the $20 billion threshold.

As a researcher diving into the blockchain landscape, I’ve noticed an exciting development: over the last week, Solana has been hosting no less than four of the top ten fee-generating applications and chains. This diverse lineup encompasses both established platforms and promising newcomers, indicating a thriving ecosystem on Solana.

In the current wave of crypto projects, the Believe App, a new platform built on Solana, has caught everyone’s attention. In just the past 24 hours, it has managed to collect an impressive $3.68 million in fees, outperforming established platforms like PancakeSwap, Uniswap, and Tron.

Momentum Cools for SOL as Indicators Turn Neutral

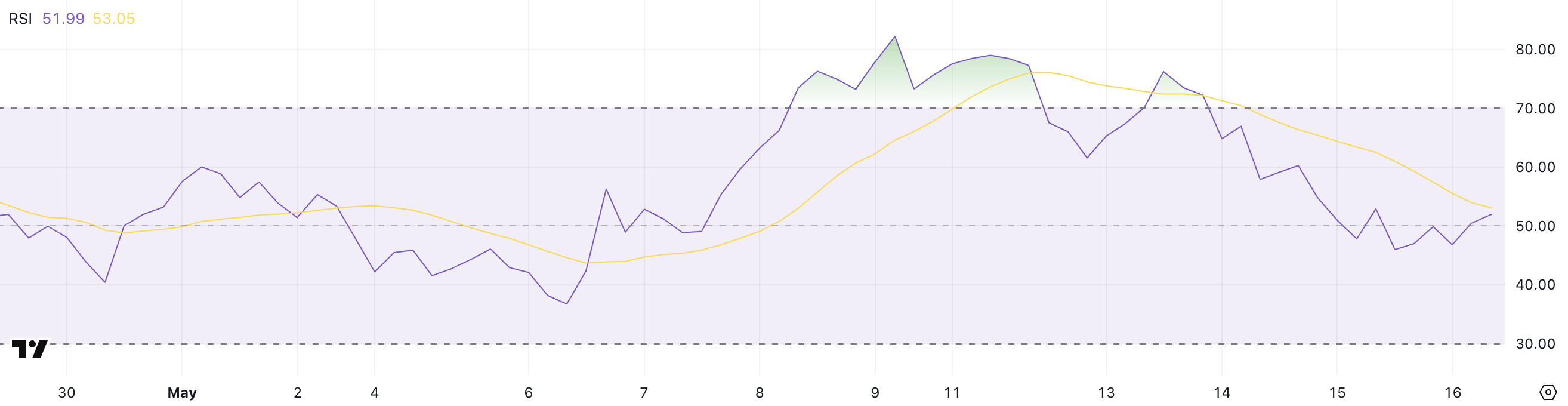

As a crypto investor, I’ve noticed that Solana’s Relative Strength Index (RSI) has taken a dip, dropping from a robust 66.5 to 51.99 in just three short days. This significant decrease suggests a clear shift in the bullish momentum we’ve been experiencing, potentially indicating a change in market direction.

For several days now, the Relative Strength Index (RSI) has been fluctuating around 44 to 50, indicating a shift towards a balanced market feeling following earlier trends that suggested an overbought market.

This shift suggests that traders are more cautious, and recent gains may be cooling off.

In simpler terms, the Relative Strength Index (RSI) is a tool that shows an asset’s price momentum, ranging from zero to one hundred. A value greater than 70 means the asset might be overbought, while less than 30 suggests it could be oversold. Currently, Solana’s RSI reading is at 51.99, placing it in a neutral zone, which often implies a phase of stability or uncertainty, possibly indicating consolidation or indecision.

Should the Relative Strength Index (RSI) climb back above 60, this might signal a resurgence of bullish power; on the other hand, if it falls beneath 45, there could be additional bearish pressure building up.

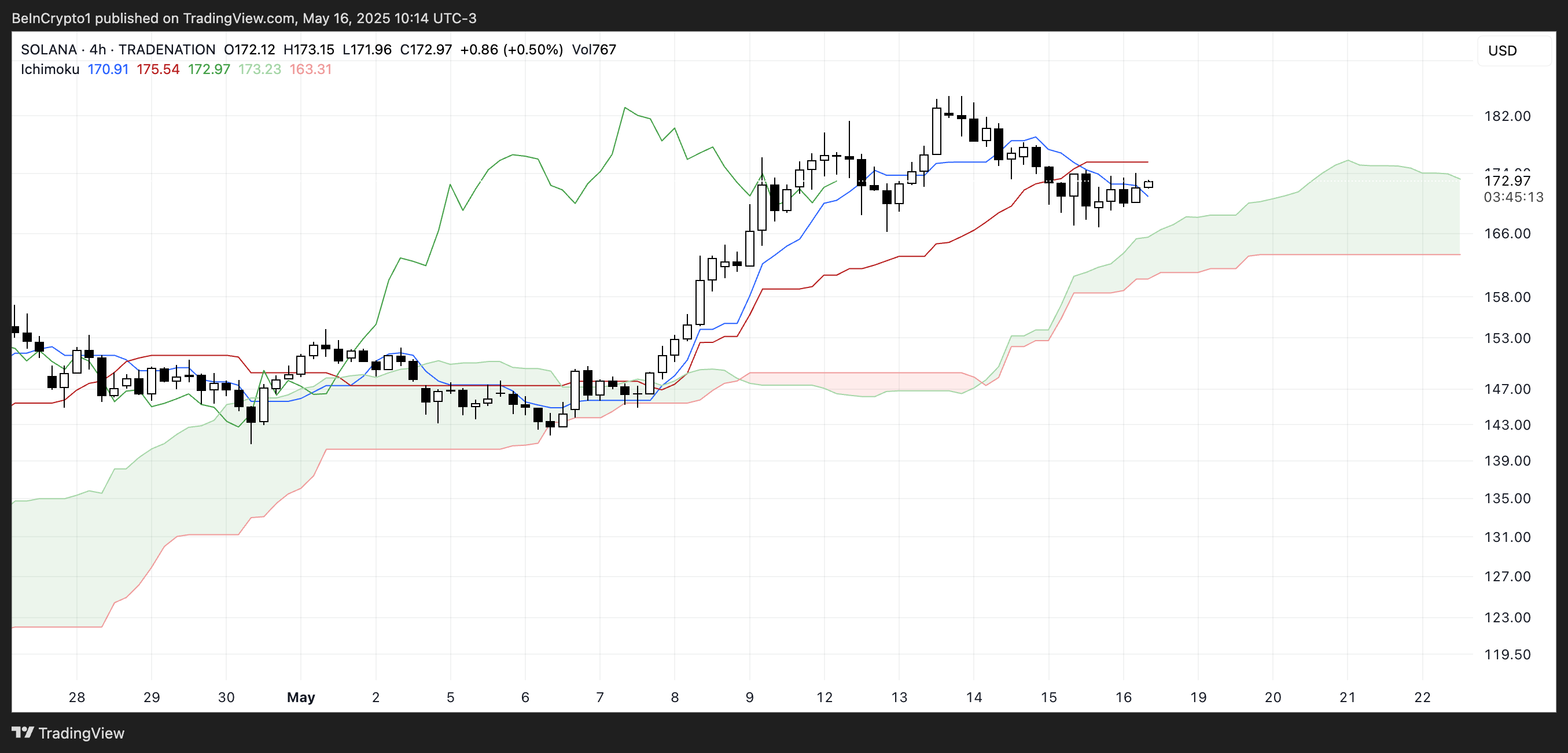

On the Ichimoku Cloud chart for Solana, we’re currently experiencing a phase of steady growth followed by a pause, indicating uncertainty or indecision based on the most recent signals.

As I analyze the current market trends, I notice that the price seems to be stabilizing around the Kijun-sen (red line) and Tenkan-sen (blue line). Interestingly, these key indicators are showing signs of flattening, which could suggest a decrease in momentum or potential market consolidation.

The Chikou Line (the green trailing line), hovering over the candles, indicates a persistent bullish tendency in the overall market trend. Yet, the minimal gap between it and the recent price movements signals a potential decrease in its underlying power.

As an analyst, I’m observing that the Kumo Cloud, marked by both green and red areas, remains optimistic in its outlook. The spreading apart of the leading span lines underneath the current price indicates a supportive stance, potentially cushioning any potential downturns.

On the other hand, since candles are now closely connected with the Kijun-sen and struggling to decisively surge beyond the Tenkan-sen, there’s a sense of caution in the short term.

If the cost manages to break significantly beyond the horizontal blue line, it might bring back momentum. However, if it starts to hover near the shaded area (the “cloud”), this could indicate the beginning of a longer period of sideways movement, or even a possible shift in the current trend.

Solana’s Bullish EMA Structure Faces Momentum Slowdown

On Solana’s chart, the Exponential Moving Averages (EMA) continue to show a bullish trend as the short-term EMAs are sitting above their long-term counterparts. But it’s worth noting that the distance between these averages is shrinking, hinting at a possible decrease in the strength of the upward movement.

Recently, the value of Solana didn’t manage to surpass a significant barrier, and even though it might revisit this level, the absence of solid continuation suggests doubts about the robustness of the upward trend.

In line with this cautious perspective, both the Ichimoku Cloud and Relative Strength Index (RSI) suggest a possible slowdown might occur. Solana has managed to stay above a significant support threshold so far, however, it still appears fragile. If this support level is breached, a potential drop could ensue.

Despite a generally optimistic overall trend, the market seems to be facing a critical juncture. Whether the buyers regain control and drive the market up again or sellers manage to break through significant resistance levels will determine the next direction.

Read More

- Gold Rate Forecast

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Brent Oil Forecast

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- Crypto Riches or Fool’s Gold? 🤑

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- Bitcoin Miners’ Revenue Tumbles 11% – Will They Surrender? 🤯

- Silver Rate Forecast

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

2025-05-17 01:46