Ah, Ethereum! A majestic beast, rising to unimaginable heights! Up more than 58% in the last 30 days, and a whopping 40% of that just in the last 10 days! What a glorious sprint, but… oh, what’s that I see? Some ominous clouds gathering on the horizon. Yes, Ethereum’s momentum is cooling, my friends, and there are whispers of a storm coming. 😱

BBTrend has decided to play the villain, turning negative, while whale accumulation is… well, barely swimming. The short-term EMA momentum? Let’s just say it’s taking a nap. These aren’t the kind of signals you want if you’re hoping for a sustained bull run. Could we be staring at the beginning of a reversal? Let’s dive in, shall we? 🤔

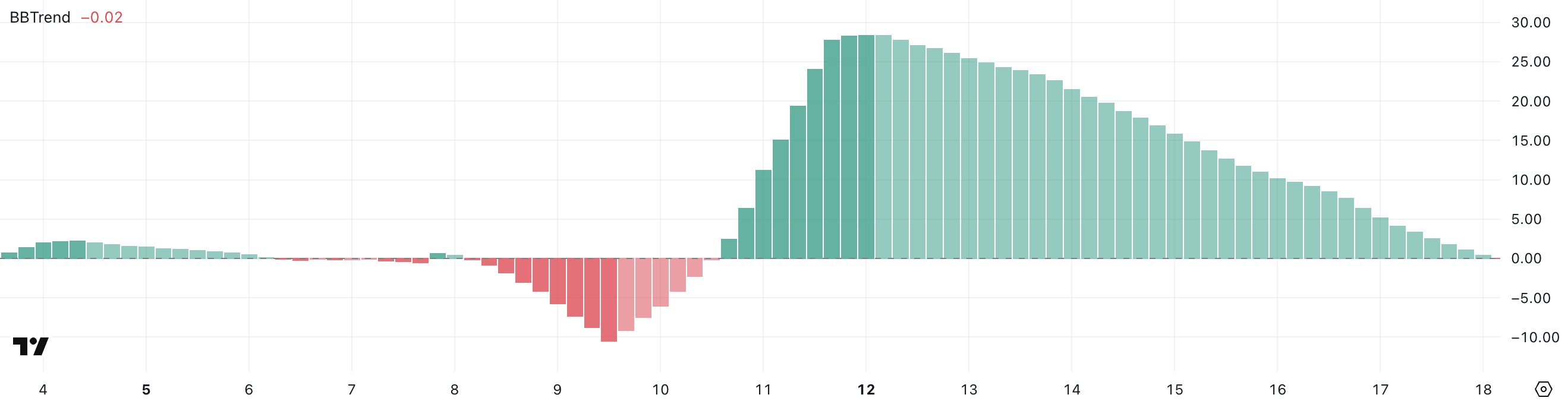

Ethereum BBTrend Has a Little Identity Crisis – Turns Negative After a Wild Month

And just like that—Ethereum’s BBTrend, the very symbol of its bullish bravado, dips into the negative, now sitting at a humble -0.02 after a glorious seven-day positive streak.

May 12 was the peak—a euphoric 28.39, only to plummet back to Earth. The end of the party? Quite possibly.

With a meteoric 58.5% rise over the past month, many are left wondering: is Ethereum gearing up for some kind of cooling-off period or just a case of buyer’s remorse? 🤷♂️

Let’s break this down: the BBTrend, which measures the price momentum relative to volatility, essentially says, “Hey, I’m either a party animal or a wallflower.” When it’s positive, Ethereum is dancing; when it’s negative, it’s time to call a cab. With a slight dip into the negative, one can’t help but wonder if the party’s coming to an end. ⏳

Unless, of course, the bulls decide to get their act together and bring some fresh buying pressure. If not? Well, we might see Ethereum stall—or worse, retrace into the abyss.

Ethereum Whale Count Takes a Dive—Bigger Fish, Smaller Numbers

Once upon a time, Ethereum whales ruled the deep waters, holding 1,000 to 10,000 ETH like it was nothing. For weeks, their numbers hovered around 5,440, never wavering, steadfast in their aquatic majesty. But in the last 10 days? A slow, almost imperceptible decline. 🦈

Currently, these majestic creatures number 5,393. Yes, that’s right—below 5,400 for the first time since April 9. The significance? Well, that’s a psychological support level that Ethereum whales hold dear. Think of it as a line in the sand, and right now, it’s looking a little… blurry.

So why does this matter? Well, whales are like the central banks of the crypto world. When they accumulate, it’s like they’re making a bold statement: “We’re in this for the long haul, baby!” But when they dip out, well, it’s like the party’s winding down, and you’re left holding an empty bottle of champagne. 🥂

Could this decline be a sign of caution, or perhaps a tactical retreat? Is Ethereum on the brink of a ‘sell-off’ or just… pondering its next move? Stay tuned—this could get interesting.

ETH Tries to Break the $2,700 Ceiling—But Will It Crash Through $3,000?

Now, let’s talk about ETH’s price action. The short-term EMAs are still in bullish formation, with the short-term lines above the long-term ones. But… and this is a big “but,” the gap is narrowing. And when the gap narrows, you know what that means? Yes, you guessed it: momentum is slowing. 😬

The market’s structure is still technically positive, but this lack of upward momentum raises some eyebrows. Could the bulls be losing steam? Could the price struggle to break the psychological $3,000 barrier? That’s the question, my dear reader. 💸

In recent days, Ethereum has repeatedly failed to break through resistance levels at $2,741 and $2,646. Without a fresh burst of buying energy, it may struggle to reclaim the glorious $3,000 mark—something it hasn’t sniffed since February 1. 😅

If the selling pressure picks up, Ethereum might just revisit its comfort zone at $2,408. And if it falls through that? We’re looking at $2,272 and $2,112 as the next potential support levels. So, buckle up. The rollercoaster ride is far from over! 🎢

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- ETH PREDICTION. ETH cryptocurrency

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- One Weird Trick: Billionaires Flock to Crypto-Ready Trump Tower in Dubai! 🏦🏙️

- Silver Rate Forecast

- Unbelievable XRP Futures Volume: What You Didn’t See Coming! 😲💰

- Fed’s Data Blackout: Chaos Ensues! 🚨

- ZK Price: A Comedy of Errors 📉💰

2025-05-18 14:28