Now, listen here. Bitcoin’s been shuffling its feet, holding steady like an old mule stubbornly refusing to budge from the dusty trail. After the Federal Reserve pulled their usual trick, a little interest rate cut to stir the pot, Bitcoin didn’t panic. No, sir. It stayed above its key support, like a stubborn oak weathering a California drought. The folks watching the market are squinting, biting their nails, seeing how tricky options expiries, big money players, and all that fancy macroeconomic mumbo jumbo might steer the next rodeo.

Bitcoin Price Holds Key Support

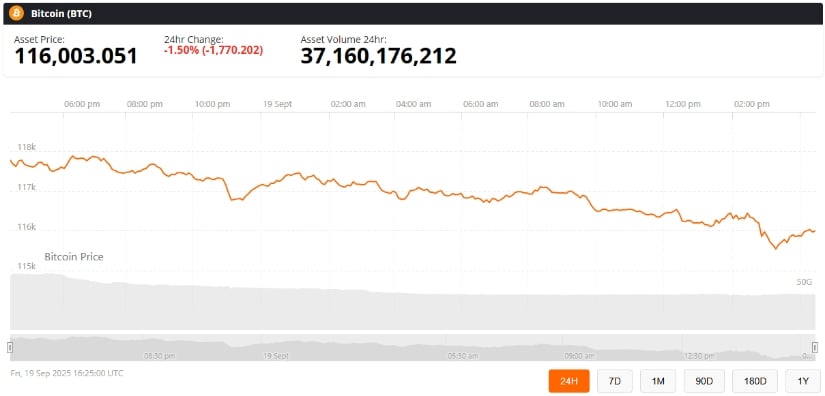

Bitcoin’s been dancing in a narrow creek, flowing between $115,500 and $117,900-nothing wild, just biding its time after it had a good kick up post-Fed. That $116,900 spot? Like a rattlesnake in the grass, it gave some traders a nasty “fakeout” and wiped out a few futures positions. The herd is hanging close to that line, watching for the telltale twitch that means it’s ready to charge forward or maybe just turn tail.

Kamran Asghar, that clever crypto guy, says Bitcoin’s standing ready to carve a new path, that support’s as solid as a barn door nailed tight. He reckons the movement inside this parallel channel is like a colt getting ready to break loose, maybe just maybe setting the stage for that mythical Super Cycle folks like the Chiefy fella keep yammering about.

Fed Rate Cut and Market Sentiment

The Fed dropped a 25 basis point stone in the pond, causing ripples of “risk-on” cheer. But Bitcoin’s been as jumpy as a cat in a room full of rocking chairs around $117,200-can’t seem to hold that ground. The market’s mood? Tepid at best. If Bitcoin trips up here, we might just see a quick shuffle back to $105,000, and folks better keep their boots laced tight because losing that support is like losing your last bottle of whiskey during a long night.

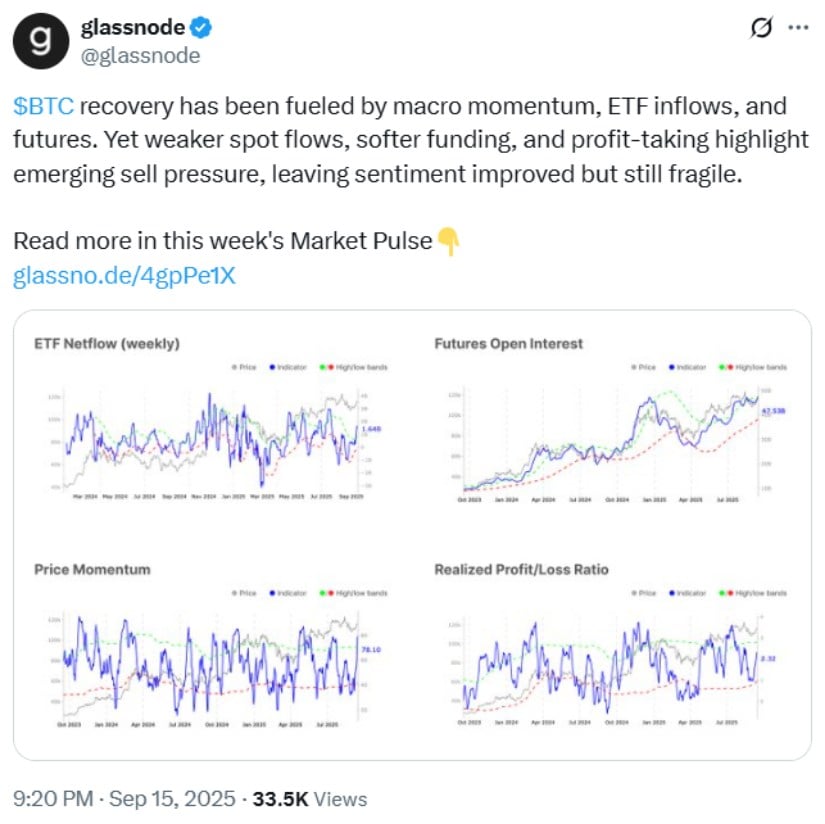

Glassnode, that numbers whisperer, tells us 95% of the Bitcoin out there is sitting pretty in the green, pockets full of profit. But hold your horses-some of that profit-taking and weak spot flows have the market as fragile as a soap bubble in a dust storm. That dance of hope and doubt is the tightrope on which Bitcoin balances before it might finally muscle its way toward that $350K Super Cycle dream, if the buyers come back hungry enough.

Bitcoin Options Expiry and Trading Dynamics

Here comes one of the biggest Bitcoin options expiries you ever did see. Thirty thousand BTC options, worth $3.53 billion, ready to be shuffled on Deribit like a poker hand gone wild. The put-call ratio’s sitting at 1.23-bearish, if you like that kind of thing-but it dropped to 0.77 in the last day, meaning the calls got a bit feistier. Traders eye the “max pain” price of $114,000, knowing these expiries stir up more drama than a soap opera on payday.

Analyst Super Cycle Predictions

Then there’s Chiefy (you know, the crypto influencer). The man’s predicting a Super Cycle come September 20, with Bitcoin potentially shooting up to $350,000. And those altcoins? Well, they might just sprint 200-fold, like a jackrabbit on a hot skillet. Sounds mighty optimistic, maybe even a sprinkle of gambler’s folly, but it’s got the crypto crowd buzzing louder than a beehive in July.

Sure, it’s a pie in the sky forecast, but these fiery speeches keep the crowd roped in, dreaming and scheming. If Bitcoin holds above $116,000 and busts through resistance, some reckon this might be the start of a real rodeo toward $350K. Just don’t forget, crypto can turn on you faster than a rattlesnake in a boot.

Looking Ahead: Consolidation Amid Optimism

For now, Bitcoin’s content to sit tight, chewing its cud between hopeful eyes and wary shakes from the Fed’s rate cut and creeping interest from the big city money folks. Analysts say if it closes above $117,200, that’s the green light for a new hustle upward, the path to that dazzling Super Cycle dream wide open.

Folks would do well to watch the liquidity, those options expiry antics, and the grand stage of macroeconomics. With Bitcoin’s all-time high lingering just over $124,000, the mood’s cautiously hopeful. The charts whisper quietly that if these support levels stand firm, this old wild horse might yet break out, galloping straight toward a future only a few enough of us dare believe in.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Crypto Riches or Fool’s Gold? 🤑

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Bitcoin Miners’ Revenue Tumbles 11% – Will They Surrender? 🤯

- Silver Rate Forecast

2025-09-19 23:09