Well, darling, it seems that our dear BlackRock CEO, Larry Fink, has chosen to play the role of the harbinger of doom as he declares that the gallant US economy is likely already in a recession. Since the start of April 2025—dreadful month for many—the S&P 500 has taken a 10.11% nosedive, now languishing at a mere $5,062.24. And hold onto your monocles, for Fink predicts an additional 20% plunge. Truly riveting commentary, wouldn’t you agree? 📉

Bitcoin‘s Not-So-Gentle Downward Spiral: The ‘Death Cross’ Has Arrived

Yesterday, the 50-day Simple Moving Average of Bitcoin decided to get cheeky and fell below its 200-day counterpart, creating what we now must call the ‘Death Cross’—as if Bitcoin’s social life couldn’t get any drearier. This catastrophic cross is about as bearish as a grizzly in a suit. 🐻

April hasn’t been particularly generous to our friend BTC, either—over a 4.13% decline thus far, with a spectacular drop of nearly 6.10% just before the Death Cross took center stage. And what was the cause of yesterday’s modest excitement, you ask? Oh, just a fabricated news report about Trump potentially pausing tariffs against China for 90 days. It appears false hope can be just as potent as a strong cocktail—too bad our dear Bitcoin is still nursing a hangover. 🥴

Currently, Bitcoin prices are floundering at $79,060—how charming! 😏

Experts, bless their hearts, believe that the cryptocurrency world is merely echoing the tragic opera of the US economy, particularly the tech sector’s best efforts to imitate a rollercoaster ride.

The US stock market, darling, is in a veritable tizzy. President Trump’s aggressive tariff escapades have unleashed global chaos, giving the market a right old shake. Since the beginning of this month alone, our S&P 500 has gracefully dipped by approximately 9.56%, so let’s raise a toast to volatility! 🍸

Fink’s Cheery Prognosis: “We’re Probably in a Recession Already”

In a delightful tête-à-tête, Fink suggests we may already be knee-deep in a recession. Isn’t that just dandy? He’s not shy about his predictions that stock markets might fall a further 20% due to the fears festering from those pesky tariffs, which he insists lead to inflation and unmanageable shenanigans.

Rate Cuts? Don’t Hold Your Breath, Says Fink

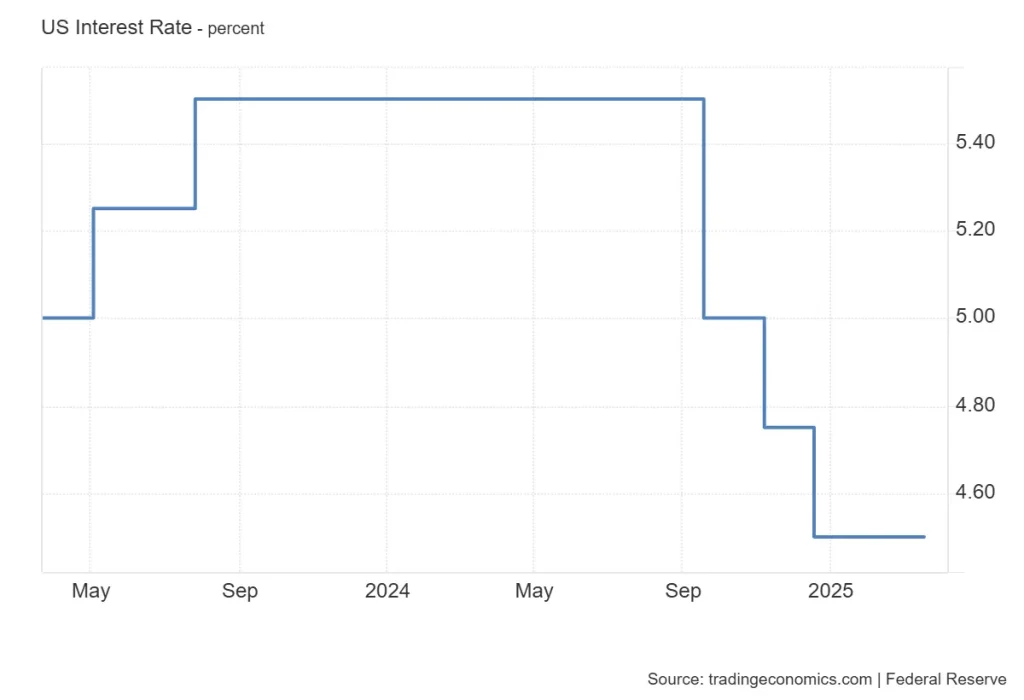

In the most recent soirée of the US Federal Reserve, the interest rate was merrily left unchanged at 4.25% to 4.5%. So much for that exciting rumor of imminent rate cuts! Last year, they slashed rates at least three times, and now they appear to be engaging in a riveting game of “let’s leave it as is.”

While chitchatting about potential rate cuts, Fink has denounced any whispered notions of four or five rate reductions this year—how scandalous! He advises the government to abandon its inhibitions and embrace pro-growth policies and deregulation, as if we’re at a party discussing which hors d’oeuvre pairs best with the collapse of capitalism. 🍴

The Crystal Ball of Bitcoin: What Awaits?

In a truly surprising twist, Fink suggests that the recent stock market’s theatrics might just serve as a prime opportunity for long-term investors. Isn’t that scrumptious? 🍭

Many crypto enthusiasts, particularly the ever-enthusiastic Michael Saylor, seem to be on the same wavelength. He has quipped that this delightful volatility will expel the short-term players faster than a bad actor in a West End production, while opening the stage for those with stamina. Bravo, I say! 🎭

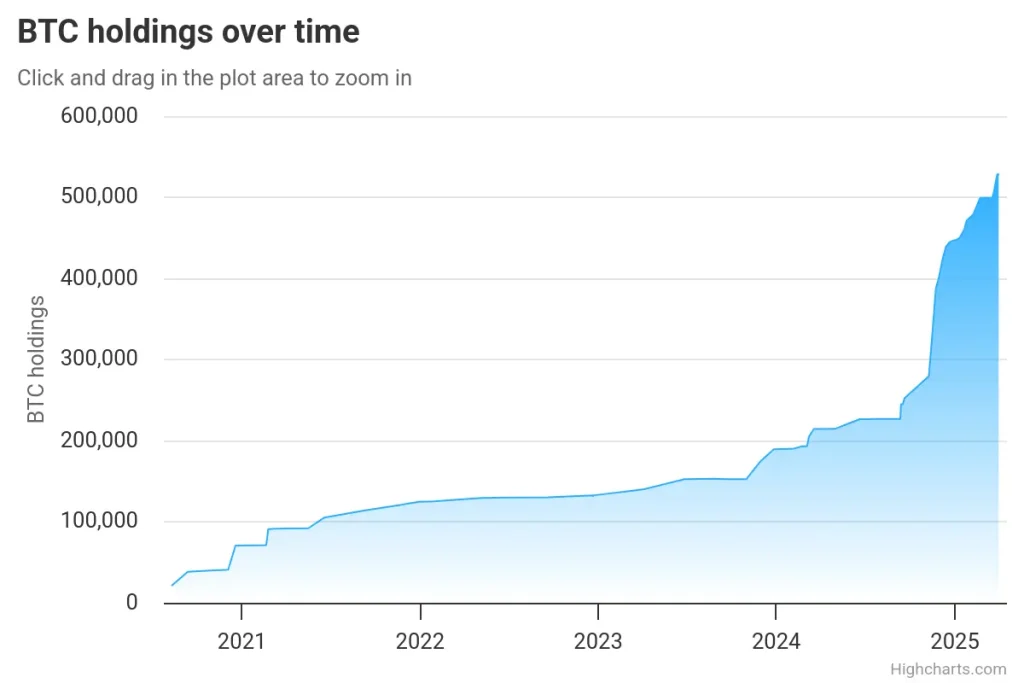

Saylor’s strategy holds an impressive 528,185 BTC, valued at approximately $41,786,194,268—truly decadent amounts for what may just be the digital equivalent of tulip bulbs! 🌷

Meanwhile, BlackRock’s iShare Bitcoin Trust ETF reigns as the largest BTC Spot ETF by market cap, boasting a market cap of $44.82B. If that’s not enough, its turnover rate shines at 10.647% with a price tag of $44.27. What a world! 💰

Stay Informed, Darlings!

Keep your ear to the ground with breaking news, expert insights, and all sorts of fabulous updates on Bitcoin, altcoins, DeFi, NFTs, and the amusing circus that is crypto.

FAQs

Is the U.S. already in a recession in 2025?

Indeed, Fink has opined that the U.S. may very well be gallivanting in a recession thanks to tariffs and instability. How riveting!

What happens to crypto in a recession?

Well, crypto can often have its own set of dramatics during a recession, with investors flocking to safer assets, but for those holding steadfastly? Oh, the futures do appear promising!

What happens to crypto if the stock market crashes?

Rest assured, crypto usually dances to the same tune when the stock market crashes, leading to panic selling and a joint plunge into the depths of despair. Ah, the charm of market psychology! 🎭

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- FTX’s Billion-Dollar Circus: When Crypto Goes Rogue and Everyone’s Suing

- Discover the Hidden Gems: Altcoins Under $1 That Could Make You Rich! 💰

- When Crypto Meets Geopolitics: A Week of Drama, Deals, and Ripple Rumors 🚀💰

- Brent Oil Forecast

- Crypto Drama: Sui’s Price Soars Like a Pigeon in a Storm! 🐦💸

- Uniswap Explodes: $1B TVL Surge – Buy or Bail? 🚀

- Pi Network Flashback: Did the Founder Reveal When Pi Coin Will Actually Start Rising?

- SOL’s October Drama: ETFs, Upgrades, and $350 Dreams? 😱💸

2025-04-08 13:09