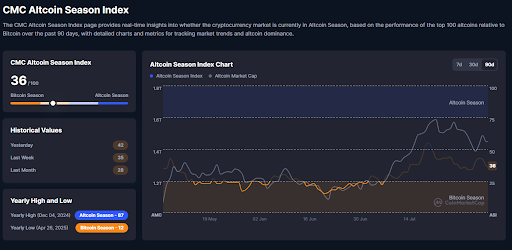

Ah, the Altcoin Season Index, that fickle mistress of the crypto realm, has plummeted to a mere 38, heralding a return to the age of Bitcoin supremacy. What, pray tell, does this portend for our beloved altcoins?

As of the sixth day of August, the Altcoin Season Index has taken a nosedive, now languishing at a paltry 38, as reported by the ever-reliable CoinMarketCap. One might say it’s akin to a summer picnic turned into a rain-soaked affair.

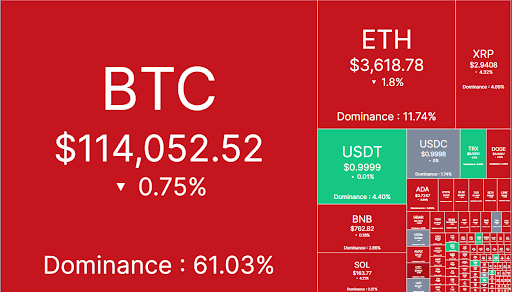

This decline signals a palpable shift in investor sentiment, as the once-mighty altcoins find themselves overshadowed by Bitcoin, which now boasts a market dominance of 60.9%. It appears that capital is once again flowing out of the altcoin pool, much like a leaky faucet in a dilapidated house.

Bitcoin’s recent tumble to $112,000 has stirred the pot of volatility across the market. Yet, instead of igniting a new altcoin rally, investors seem to be retreating, pulling their funds from the smaller-cap crypto assets as if they were fleeing a particularly bad dinner party.

Why Bitcoin Dominance Is Rising Again

The resurgence of Bitcoin dominance comes amidst a cloud of uncertainty that has settled over the market like a thick fog. In recent weeks, several major altcoins-Solana, Dogecoin, and XRP-have suffered sharp losses, as if they were the unfortunate victims of a cruel cosmic joke.

For instance, Solana (SOL) has plummeted by over 9%, Dogecoin (DOGE) has taken a dive of nearly 11%, and XRP has lost about 5.5%. One might wonder if these altcoins have been attending the same financial seminar on how to lose money.

Typically, when Bitcoin cools off after a robust rally, traders flock to altcoins like moths to a flame. However, this time, it seems they’ve opted for a more cautious approach, perhaps fearing the flame might burn them.

Bitfinex analysts have noted in a recent update that, “This capitulation in altcoins alongside Bitcoin’s weakness suggests that speculative appetite is now receding across the board.” A rather poetic way of saying, “Hold onto your wallets, folks!”

What the Altcoin Season Index Really Tells Us

The Altcoin Season Index, that trusty barometer of market sentiment, tracks how many of the top 50 altcoins have outperformed Bitcoin over the last 90 days. A score above 75 indicates a vibrant altcoin season, while a score below 25 suggests we’re firmly in Bitcoin territory.

In early July, the index stood at a respectable 55. However, by early August, it had plummeted to 38, confirming a shift away from altcoins. According to CoinMarketCap data, fewer than 38 of the top 100 altcoins have managed to outpace Bitcoin recently. It’s as if they’ve all decided to take a long vacation instead of competing.

This index has historically served as one of the most significant gauges of market sentiment. When confidence in altcoins wanes, investors tend to consolidate into Bitcoin and, on occasion, Ethereum. It’s a classic case of “if you can’t beat them, join them.”

However, while some analysts are cautious, others remain optimistic. Crypto trader Ted has proclaimed on X, “This is your best opportunity to stack utility alts before they go parabolic.” Merlijn The Trader has chimed in, “Alts are coiling for a violent breakout.” One can only hope they’re not referring to a kitchen appliance malfunction.

A Historical Pattern Repeats?

The current shift in Bitcoin’s dominance and the decline of the altcoin season index echo readings from past cycles, much like a nostalgic tune that refuses to leave your head.

For instance, during the bull runs of 2017 and 2021, similar drops in the index often preceded explosive surges in Bitcoin’s price. It’s almost as if history is playing a cruel trick on us, repeating itself with a wink and a nudge.

Bitcoin now commands over 60% of the market, while Ethereum holds around 11.77%. Despite a 0.5% price decline, Ethereum’s robust presence indicates it remains a foundational layer for many altcoin projects. It’s the sturdy ship in a sea of uncertainty.

In summary, the drop in the Altcoin Season Index to 38 suggests that the market is becoming increasingly cautious in an environment that appears to be tilting toward Bitcoin. Investors are rotating out of altcoins, particularly those lacking strong fundamentals or utility, as if they were shedding old clothes.

However, this does not spell doom for altcoins. Certain assets, especially those tied to Ethereum or DeFi, may still perform admirably. Market consolidation may be but a fleeting phase, and breakout patterns are forming in several altcoin charts, much like a flower daring to bloom in a harsh winter.

For now, traders and investors would do well to keep a vigilant eye on the Altcoin Season Index and Bitcoin dominance as their guiding stars in this tumultuous sea of cryptocurrency.

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Silver Rate Forecast

- Brent Oil Forecast

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- Bitcoin’s $90K Standoff: Is It Playing Hard to Get or Just Confused? 🤔💸

- Banks Might Actually Need XRP When Sh*t Hits the Fan—CEO Spills Tea

2025-08-06 21:27