The road to riches in the land of silicon and algorithms has turned to dust, friends. IREN’s stock slid down like a tired mule in July heat, shedding over half its value since the year’s peak, as the AI bubble swells like a rattlesnake ready to strike.

CoreWeave, Nebius, Bitfarms-same dance, different partners.

The slump? It got thirsty last week when Oracle and Broadcom poured their earnings reports. Turns out Oracle’s “free cash flow” is as mythical as a desert mirage. Now its stock’s a carcass, down 50% from its peak. 🐻🔥

And the funding? Oh, they raised $2 billion-because nothing says “stability” like selling your soul to the equity devil. All to chase Microsoft’s $9.7 billion order, which might as well be a pot of gold guarded by dragons.

The land rush of the digital age? Bitcoin miners are swapping picks for keyboards, staking claims in AI. Hut 8 just struck gold with a $10 billion deal-courtesy of Anthropic, the new kid with a silver spoon. Lambda Labs, Nebius, CoreWeave? They’re the wolves at the door, grinning with AWS envy. 😈

Buyers now hold the cards, folks. Prices might drop faster than a bucket in a dry well. And Bitcoin? That old warhorse? Down from $126K to $87K. IREN may call itself a “neocloud” company, but its bread’s still baked in Bitcoin ovens. 🍞🔥

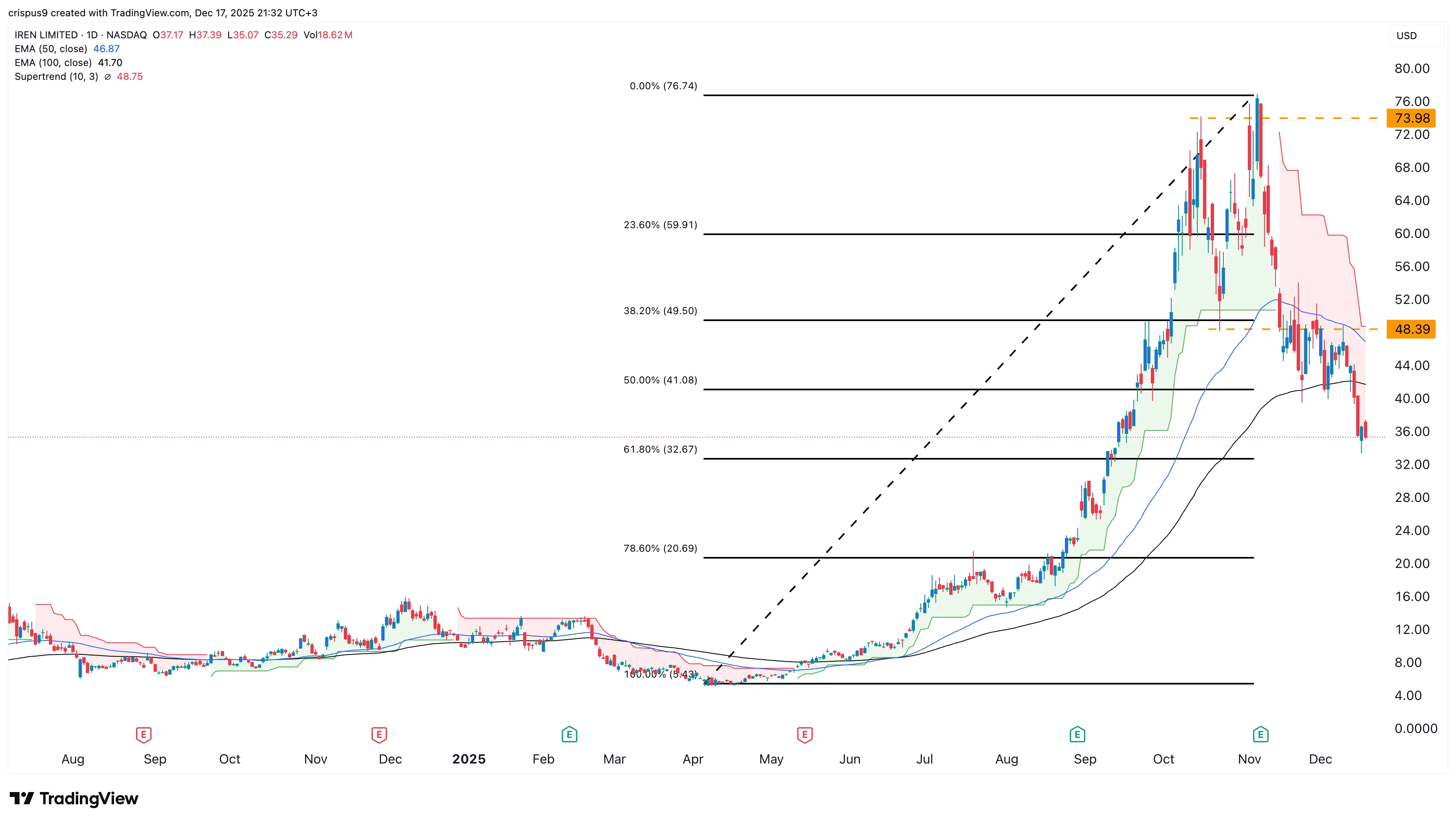

IREN stock price technical analysis

Take a gander at the daily chart-it’s a cliff dive from $77 to $35, slicing through Fibonacci levels like a dull knife through butter. Bears are dancing on the grave of the 50-day and 100-day EMAs, with Supertrend screaming “abandon ship!”

The $48 support? Shattered like grandma’s china. Sellers eye $20 with the patience of a snake. Only a rally above $48 might spare this shipwreck. But let’s be honest-hope’s a rare commodity in these parts. 🌵💨

Read More

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- 11,000 Wallets Fight for NIGHT Tokens in Cardano Airdrop-And It’s a Disaster 🤦♂️

- Is Onyxcoin’s Rocket Losing Steam or Just Fueling Up? 🚀🧐

- 🚨 Senate Drops Crypto Bill: CFTC to the Rescue? 🚨

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- 🚨 Bitcoin Plunge Alert: $93k Floor or Financial Farce? 🚨

- Crypto Drama: Coinbase Ditches MOVE—Scandal, Swoon & a $100M Hangover 🍸

- Crypto Cowboy Fights Back: CZ Tells WSJ to Take a Hike! 🚀😏

2025-12-17 22:32