In a most curious turn of events, cryptocurrency investors, those intrepid souls, are clinging to their digital treasures with the fervor of a cat to a sunbeam, even as prices flirt with the heavens. A report from the ever-reliable Cryptoquant reveals that exchange inflows have taken a nosedive, while stablecoin liquidity is positively bursting at the seams. Who knew holding on could be so fashionable? 😏

Exchange Inflows: A Dramatic Decline at the Pinnacle of Prosperity

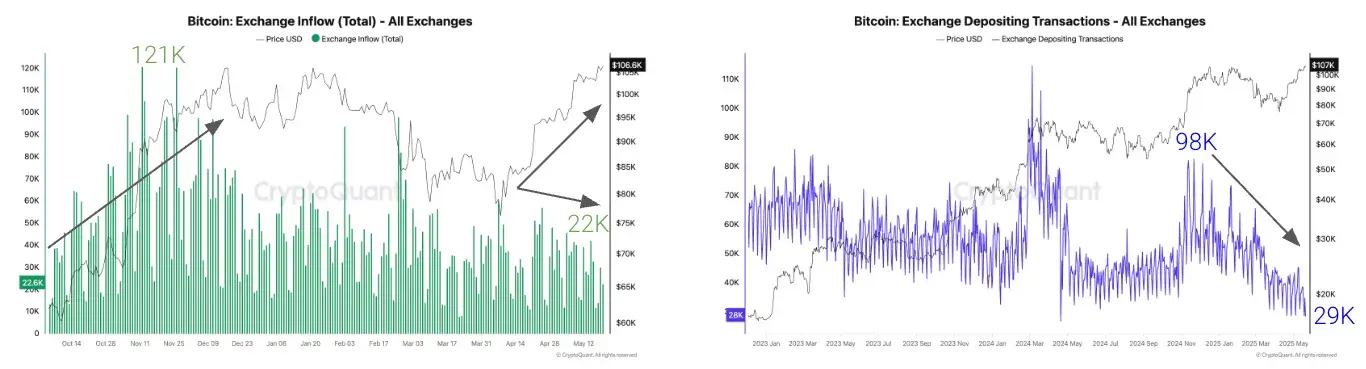

According to the esteemed Cryptoquant, the selling pressure across Bitcoin, Ethereum, and XRP has plummeted, much like a soufflé in a drafty room. With Bitcoin exchange inflows now languishing at a mere 22,000 BTC daily—an 82% drop from the dizzying heights of 121,000 BTC in November 2024—one must wonder if investors have taken a vow of silence regarding their assets.

Individual deposits have also tumbled from 98,000 to a paltry 29,000, suggesting that the desire to sell has evaporated faster than a mirage in the desert. Historically, such low inflows are a bullish sign, but who can keep track of these trends when the market is as unpredictable as a cat on a hot tin roof? Ethereum is not immune, with daily inflows plunging 70% to 1 million ETH from 3.2 million ETH in November.

Individual ETH deposits have cratered by a staggering 89%, plummeting from 135,000 in early April to a mere 15,000. It appears that investors are loath to part with their holdings, even in the face of market conditions that could make a banker weep with joy. Meanwhile, XRP has experienced a veritable rollercoaster, with daily inflows collapsing from 4 billion tokens in March to a mere 46 million after Ripple’s legal tango with the U.S. SEC.

Deposits have plummeted by 99.5%, from 2.1 million in December to a mere 9,000, reflecting a newfound optimism among investors, as noted by the diligent researchers at Cryptoquant. In a delightful twist, tether ( USDT) reserves on exchanges have soared to a record $46.9 billion, showcasing liquidity that would make even the most seasoned trader blush. Cryptoquant has pointed out that rising stablecoin balances typically provide a cushion for asset prices, much like a well-placed pillow on a fainting couch.

In conclusion, the report suggests that the crypto markets are facing low near-term selling risks amid robust liquidity—a combination that Cryptoquant analysts have dubbed “structurally bullish” for Bitcoin and its merry band of altcoins. So, dear investors, hold on tight; the ride is far from over! 🎢💸

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- ETH PREDICTION. ETH cryptocurrency

- Silver Rate Forecast

- One Weird Trick: Billionaires Flock to Crypto-Ready Trump Tower in Dubai! 🏦🏙️

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- 🚀 Worldcoin: $1.50 or Bust? Analysts Predict Crypto Chaos! 🌌

2025-05-22 19:27