Picture, if you will, a poor wretch trying to navigate the shadowy bazaar of digital monies — as if it were some Kafkaesque labyrinth. You’ve heard of the mighty US dollar‘s minions, those stablecoins USDC and USDT, flaunting their peg with all the pomp of a czar’s procession. But what if you find yourself dreaming not of dollars but of Euros, in polite Europe, or the feisty Brazilian Real, basking under tropical disgrace? And heaven forbid you want to own tokenized gold, yet can’t exactly stash it under your mattress, can you? 🧐

Until now, swapping your sacred USD stablecoins for their more exotic brethren or shiny RWAs was akin to bargaining in a market run by cats: unpredictable, expensive, and you’d need a proper sorcerer’s guide to understand the ritual.

Enter Stabull Finance — our digital messiah, a Decentralized Exchange (DEX) much like a mystical currency booth run by invisible automatons, designed to swap stablecoins across the globe with the elegance of a dance and the speed of a vodka-fueled hare.

Let’s dive, like plunging into the deep Volga, into the mess Stabull cleans up and how it does so without breaking a sweat (or your digital wallet).

The Problem: Stablecoins Scattered Like Lost Souls

Before Stabull, imagine a world where stablecoins were swimming in countless puddles rather than rallying in one great pond — fragmented liquidity, if you will:

- Money in Pieces: Think dozens of tiny ponds where goldfish (stablecoins) swim alone. EURS, GYEN, BRZ—each in their own delicate ecosystem spread thin across exotic blockchains like Ethereum and Polygon. Trying to find a decent crossing from USDC to NZDS was a quest fit for a Dostoevskian antihero, fraught with wild price swings and scarce comrades.

- Hunting for the Right Coin: Ah, the joy of KYC forms thicker than a Russian novel! Buying certain stablecoins sometimes meant signing your soul away or having bags full of cash suitable only for a local oligarch. Regular citizens were left scavenging exchanges, hoping to stumble upon the right token in the right amount. Spoiler alert: they probably didn’t.

- The Wallet-Killing Fees: Switching coins on usual DEXs led you through a ritual of multiple swaps (USDC to ETH to TRYB, anyone?), paying fees like tribute to the blockchain gods and losing precious value (slippage). Ethereum’s gas fees? Like buying a ticket on the Trans-Siberian Express but only having the funds for a potato.

- Issuer: The Gatekeepers of Coinland: The creators of stablecoins acted like wary gatekeepers, wary of handing out keys to the kingdom. Draconian rules, 1:1 reserves, minting only for the elite — an exclusive club where your handshake wasn’t good enough.

In sum, the realm was desperate for a bridge—something more solid than a paper chain, connecting USD loyalists with the rest of the world’s coin clans.

Stabull’s Grand Plan: The Glorious Market Opera

Stabull emerges like a conjurer orchestrating a grand symphony, a hub uniting stablecoins and RWAs under one digital roof. Witness its magic:

1. Pooling Together the Coin Choir (Aggregated Liquidity)

Why wander endlessly when all the coins can party in one ballroom? Stabull pairs most non-USD stablecoins with the ever-so-popular USDC as the venerable host. Imagine USDC as the charismatic dance partner who shuffles everyone from TRYB to EURS with grace. A swap is but a flick—TRYB to USDC to EURS—no awkward steps, no missed beats.

- The Marvel: By gathering liquidity into USDC pools, Stabull deepens the financial waters, making trades smoother than a Shostakovich sonata.

- Easy to Spot: The shiny, clickable tokens—EURS, GYEN, NZDS, TRYB, XSGD, BRZ, PHPC, COPM—and even gold (oh yes, that glittering old chestnut, PAXG) await your command with but a click or two, no passport or secret handshake required.

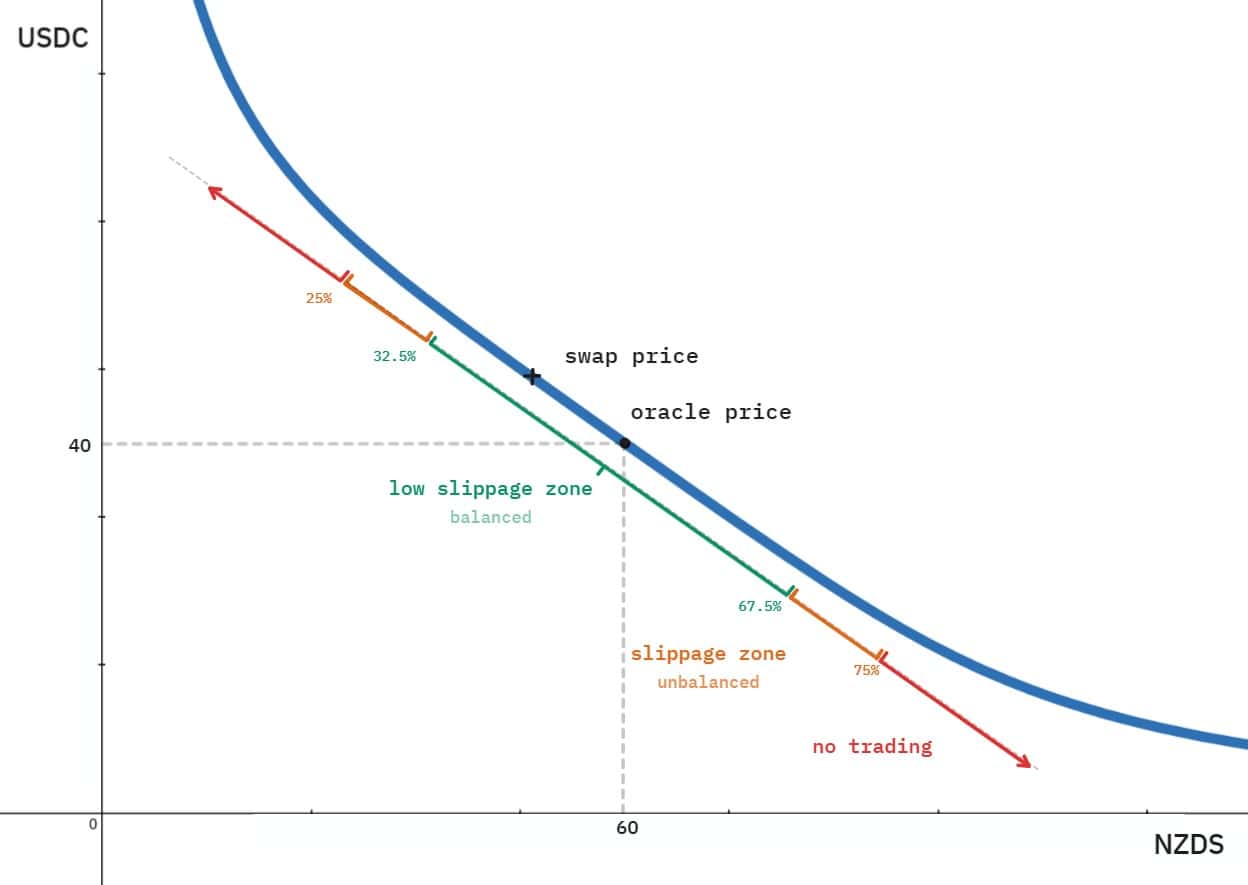

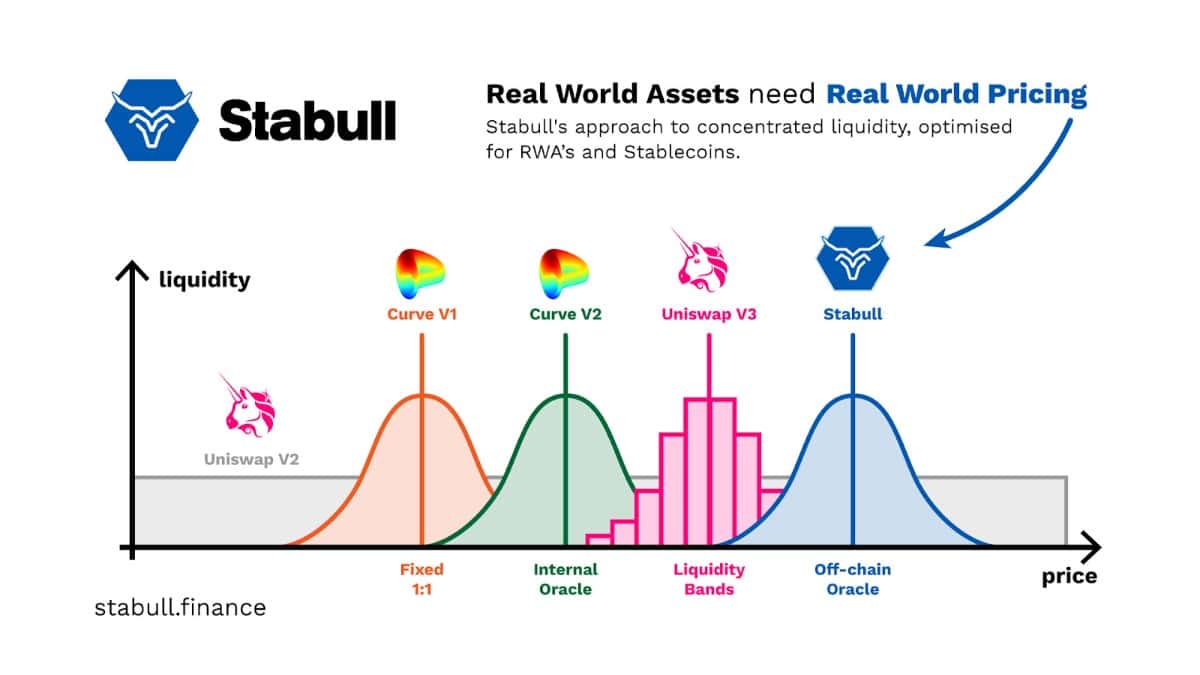

2. Smart Wizards at Work (Oracle-Powered AMM)

Beyond a mere bazaar, Stabull employs a 4th generation AMM (Automated Market Maker), a sort of mathematical seer mixing tokens with elegant formulas and oracle whispers from Chainlink, feeding in real-world exchange rates as if by sorcery.

- The Genius: By anchoring prices to oracles, trades snap to the true FX rates—no wild surprises, no drunken price shenanigans.

- Benefits? Glad you asked:

- Low Slippage: Your swap price clings to the market price like a Siberian husky to the frozen snowbank.

- Price Integrity: No illusions here, just cold hard numbers, stable as a Volga winter.

- Stability Preservation: Stablecoins stay, well, stable—no drunken moonwalks off their pegs.

3. Wallet-Friendly Fees & The Multi-Chain Dance

- Fee Cheer: Swapping cost? A modest 0.15% per pool used. Two hops for cross-stablecoin swaps? 0.30%. It’s so inexpensive even an impecunious poet could participate.

- Multi-Chain Acrobatics: Stabull plays on Ethereum’s grand stage but also dances cheaply on Polygon and the upcoming Base chain—Layer 2 wonders that don’t bleed your wallet dry with exorbitant gas fees.

4. Making Stablecoins Earn Their Keep

- Liquidity Providers Rejoice! Deposit your stablecoins and collect a share of swap fees plus the sweet melody of $STABUL tokens. Idle coins now pull their weight like diligent comrades, bringing income instead of gathering dust.

- Forex Market à la Blockchain 24/7 trading, instant swaps, cross-border payment magic, multi-currency payrolls—Stabull weaves all this with cunning wizardry.

5. No Bureaucratic Goblins (No KYC, Easy Peasy)

- Permissionless Entry: Just connect your wallet, no need to share your mother’s maiden name or your deepest secrets.

- Hold the Reins: You keep the keys to your treasure chest. Stabull merely facilitates the dance; your coins never leave your wallet’s warm embrace.

- Interface as Simple as Vodka and Pickles: Clear terms, clear fees, and transparent slippage—all laid out so even a confused poet can make sense of it.

How The Swap Waltz Goes on Stabull

- Connect your MetaMask, set it to Polygon: Like tuning your balalaika before the ballad.

- Pick your stablecoin partners: USDC to NZDS? Easy as borscht.

- Check the price and fees: Stabull shows you the lay of the land—how many NZDS will grace your digital purse, the tiny fee, and negligible gas costs.

- Approve contract if a first-timer: A small bow to the blockchain lords (one-time gas fee), then hit Swap!

- Coins arrive: Your NZDS waltzes into your wallet while the fees make their rounds to liquidity providers and the protocol, all as smooth as a Moscow snowball rolling downhill.

Two non-USD coins? That’s two hops, one graceful dance, and a 0.30% twirl fee. Bravo!

The Grand Comparison: Stabull Outshines the Rest

- Versus General DEXs: While Uniswap and Curve stumble over slippage and dull pricing, Stabull’s oracle wizardry makes prices behave like well-trained circus bears.

- Versus Centralized Exchanges: No endless KYC, no locked vaults, no whimsical regional bans. Stabull is the open bazaar, day and night.

- Versus Synthetic FX: Real, backed coins here, none of those algorithmic spiritual possessions that vanish at the first sneeze.

The $STABUL Token — Your Ticket to the Inner Circle

The $STABUL token governs this kingdom. Holders vote on adding pools, tweaking fees, and enjoy rewards via liquidity mining. An Initial Exchange Offering spins up in spring 2025 on ProBit for those keen to join the dance early.

Stabull: The Bridge Over Turbulent Stablecoin Waters

As the digital realm bursts beyond Bitcoin’s boldy shouted name, the world needs a calm harbour where Euros, Reals, Yen, and even tokenized gold can mingle without chaos. Stabull strides in, a grand conductor uniting disparate currencies into one fluid market, always open, always honest.

This is no mere exchange. It’s the stage for a new act in the global digital economy, where stablecoins are no longer hermits but citizens of a lively, interconnected world. As Bulgakov might ponder—if he dealt in crypto—“Why simply exist in chaos when you can dance through it with Stabull?” 💃🕺

Read More

- Gold Rate Forecast

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Brent Oil Forecast

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- When Crypto Flows Turn into a Billion-Dollar Flood 🌊💰

- Tron Surpasses Ethereum with a $23.4 Billion USDT Victory – Shocking New Stats

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- Whale of a Time! BTC Bags Billions!

- Silver Rate Forecast

- When Crypto Meets Geopolitics: A Week of Drama, Deals, and Ripple Rumors 🚀💰

2025-04-25 05:02