If you’ve ever wondered what happens when a cryptocurrency decides to play hide-and-seek with the $0.24 mark, you’re not alone. After a 100% rebound from its “blue entry level” (whatever that means-maybe it’s a color-coded retirement plan?), Hedera is now doing the cha-cha in a tight consolidation range. Imagine a toddler who just learned to walk, determined to stay upright but still needing a handrail. That’s this token.

Analysts, bless their overcaffeinated hearts, are claiming this is the “decisive wave structure” we’ve all been waiting for. Hov and Steph Is Crypto (yes, that’s their real name) have apparently spent the last week diagramming this on cocktail napkins and spreadsheets. The market, they say, is mirroring past bullish cycles-like a bad rom-com that refuses to end. With a $10 billion market cap and trading activity that makes my morning coffee habit look lazy, this altcoin is liquid enough to drown a goldfish in.

HBAR’s Recovery: Because 100% Isn’t Enough

Hedera Hashgraph recently retested its blue entry level like it was a long-lost ex who always texts at 2 a.m. According to Hov, the token surged 100% from that point-because doubling your money is just the polite thing to do. The analyst claims this confirms “renewed market strength,” which sounds impressive until you realize “renewed” just means it didn’t crash yesterday.

Hov also noted that the token has completed three waves from the low, which he describes as “early in broader market cycles.” For context, I once watched a seagull eat a hot dog in three bites. That’s about how complex this analysis is. But hey, if you want to call it a “fourth wave within a larger third-wave framework,” more power to you. Just don’t expect me to trade my Netflix stock for it.

Resistance Levels: The Wall That Won’t Die

Hov’s latest advice? Don’t buy at resistance levels unless you enjoy losing money and then blaming the moon phase. He insists the token needs to “push decisively above immediate resistance” to avoid becoming the crypto equivalent of a TikTok trend that lasted three days. A breakout would be “stronger case for upside momentum,” which is just a fancy way of saying “maybe it’ll go up, but probably not.”

Caution is key, folks. If you’re the type to buy at the top, consider retesting lower levels instead. It’s like shopping during a sale, but with less fabric and more volatility.

The Final Wave: 2021 All Over Again?

Steph Is Crypto (yes, they’re still here) claims Hedera might be entering its “final wave of the cycle.” This sounds exciting until you remember that 2021’s rally was basically crypto’s version of a viral dance challenge-everyone joined, and most people lost money. If 2025 becomes the year of the breakout, I’ll be the one in the corner yelling, “I told you Bitcoin would be $1!”

The analyst’s comparison to 2021’s accumulation phase is as comforting as a toaster oven fire. If this setup pans out, early investors might benefit-assuming they don’t sell in panic when the price dips to $0.23.87.

Consolidation: The Art of Doing Nothing

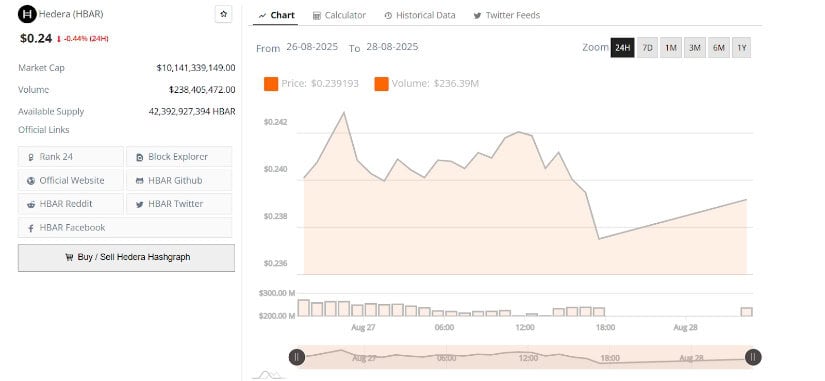

Hedera has spent the last 24 hours trading between $0.238 and $0.242, which is about as thrilling as watching paint dry in slow motion. The price touched $0.242 before retreating like it remembered it forgot the stove was on. Selling pressure spiked briefly, but honestly, I’m more surprised this hasn’t been turned into a Broadway musical.

Trading volumes are steady, which is the crypto equivalent of “meh.” Buyers are accumulating at lower levels, but breaking through resistance feels like convincing my cat to use the litter box. It’s possible, but not guaranteed.

Technical Setup: A Love Letter to Optimism

The market dipped 0.44% recently, which is just enough to make you question your life choices. For sustained upside, buyers need to cling to the $0.24 support like it’s the last life raft on a sinking ship. If they fail, we’ll all be back at $0.23, sipping chamomile tea and wondering what went wrong.

Analysts are bullish because, well, they’re analysts. If you align wave structures with historical patterns, you’ll find a scenario “closely monitored by traders.” That’s just code for “we’re all guessing, but at least we sound confident.” If Hedera breaks through resistance, it’ll confirm the projected final wave-a phrase that makes me want to invest in a time machine and tell my 2017 self to buy Dogecoin.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- EUR UAH PREDICTION

- USD RUB PREDICTION

- USD TRY PREDICTION

- Brent Oil Forecast

- USD IDR PREDICTION

- Cardano’s ADA: $60M Whale Shopping Spree! Is $1 in Sight? 🐋💰

- TRX PREDICTION. TRX cryptocurrency

- Bitcoin’s Cosmic Dance: $97K or the Void of $92K?

2025-08-28 23:52