In an unprecedented move, Greece’s Hellenic Anti-Money Laundering Authority has, for the first time, chosen to freeze crypto assets linked to the infamous $1.46 billion hack of the Bybit exchange in February 2025.

Ah, a moment to pause and reflect. A turning point, some would say, in the perpetual battle against the elusive phantoms of financial cybercrime. And yet, one must ask, will it be enough? In the vast ocean of global crypto, is this a mere ripple or a wave of significant change? Only time will tell.

The Remarkable (And Somewhat Inevitable) Tracing of Lazarus’ $1.46 Billion Hack

Let us not forget, the blame for this breach rests squarely on the shoulders of Lazarus, a notorious North Korean hacking group. Known for their subtle grace in the art of cyberattack, their latest orchestration against Bybit has left the crypto world reeling.

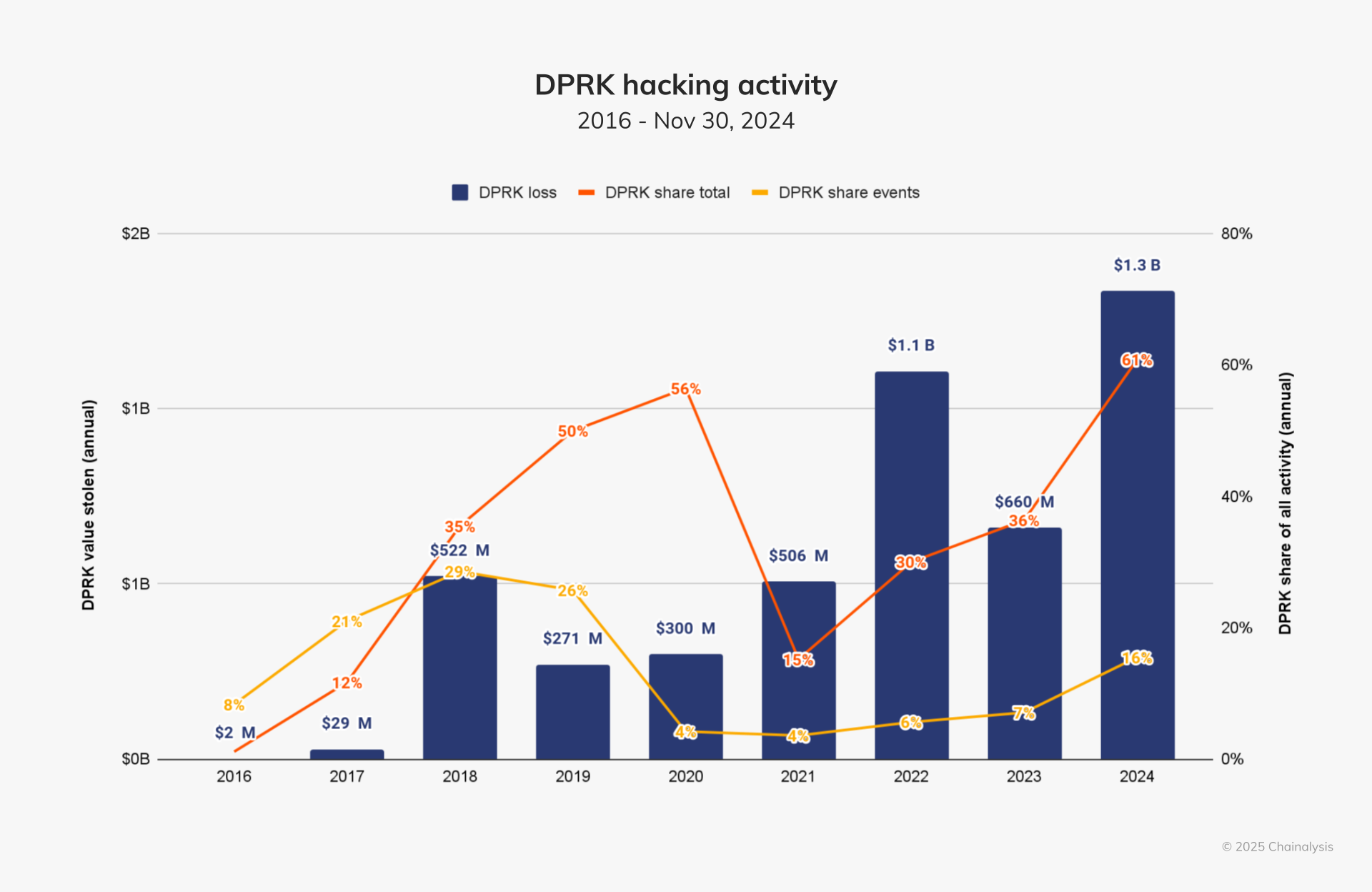

Let’s put things into perspective, shall we? The Bybit hack, ominously dubbed “TraderTraitor” by the FBI, resulted in the theft of approximately $1.46 billion worth of Ethereum. And here’s the kicker: it exceeded the total value of crypto stolen by North Korean-linked hackers in all of 2024, a sum that barely reached $1.34 billion, according to Chainalysis. Hooray for progress!

As the industry scrambled, the experts at Chainalysis worked with the Hellenic AML Authority, tracing the stolen funds. They found a wallet, a most convenient one, tied to a local exchange platform in Greece. Imagine the surprise when they froze the assets!

Now, let’s take a moment to appreciate this victory. Greece’s National Economy and Finance Minister, Kyriakos Pierrakakis, gave a speech (we presume, rather smugly) extolling the virtues of blockchain technology and international cooperation in tackling financial crimes. A fine effort, though the question remains—how long will this cooperation last before another hack shakes the very foundation of global crypto?

This marks a key moment in the ongoing saga of crypto regulation, highlighting both the potential for success and the constant, nagging fear of cybercriminals lurking just beneath the surface.

Ah, Lazarus. One would think that after their antics in the 2022 Axie Infinity hack, they might rest on their laurels for a moment. But no. They were at it again, less than 48 hours after Bybit’s breach, rapidly laundering the stolen funds. How quaint!

TRM Labs described their method as a “flood the zone” tactic—throwing rapid, multi-directional transactions into the ether, overwhelming compliance and surveillance systems. Truly a sight to behold, if you appreciate chaos and destruction in equal measure.

“The Bybit exploit shows that Lazarus continues to refine its ‘flood the zone’ strategy—overwhelming compliance teams, blockchain analysts, and law enforcement with high-speed transactions, leaving them to scramble and chase shadows,” noted TRM.

the situation grows more complicated by the day, and the need for tighter cooperation between regulators and blockchain analysts has never been more urgent. But will it work? Will we ever catch up?

Of course, the pressure now mounts on exchanges like Bybit to step up their security measures. After all, with the total value locked (TVL) in DeFi and CeFi platforms reaching a staggering $121 billion by July 2025 (according to DeFiLlama), the stakes have never been higher. But who are we kidding? This is crypto—there’s always a bigger fish waiting to pounce.

Greece’s success might serve as a beacon of hope for other countries—South Korea, the United States, you’re next on the list. But the truth remains: tracing and seizing crypto assets is a Sisyphean task, an ever-elusive goal with blockchain’s delightful anonymity standing firmly in the way.

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Brent Oil Forecast

- Bitcoin’s Wild Ride: Will You Laugh or Cry? 🤔💸

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- Schumer’s Secret Stablecoin Standoff—What They Don’t Want You To Know 🪙🤐

- Silver Rate Forecast

- XRP Hits $100? This Redditor’s Dream Might Just Make You Rich–Or Laugh! 😂🤑

2025-07-10 11:07