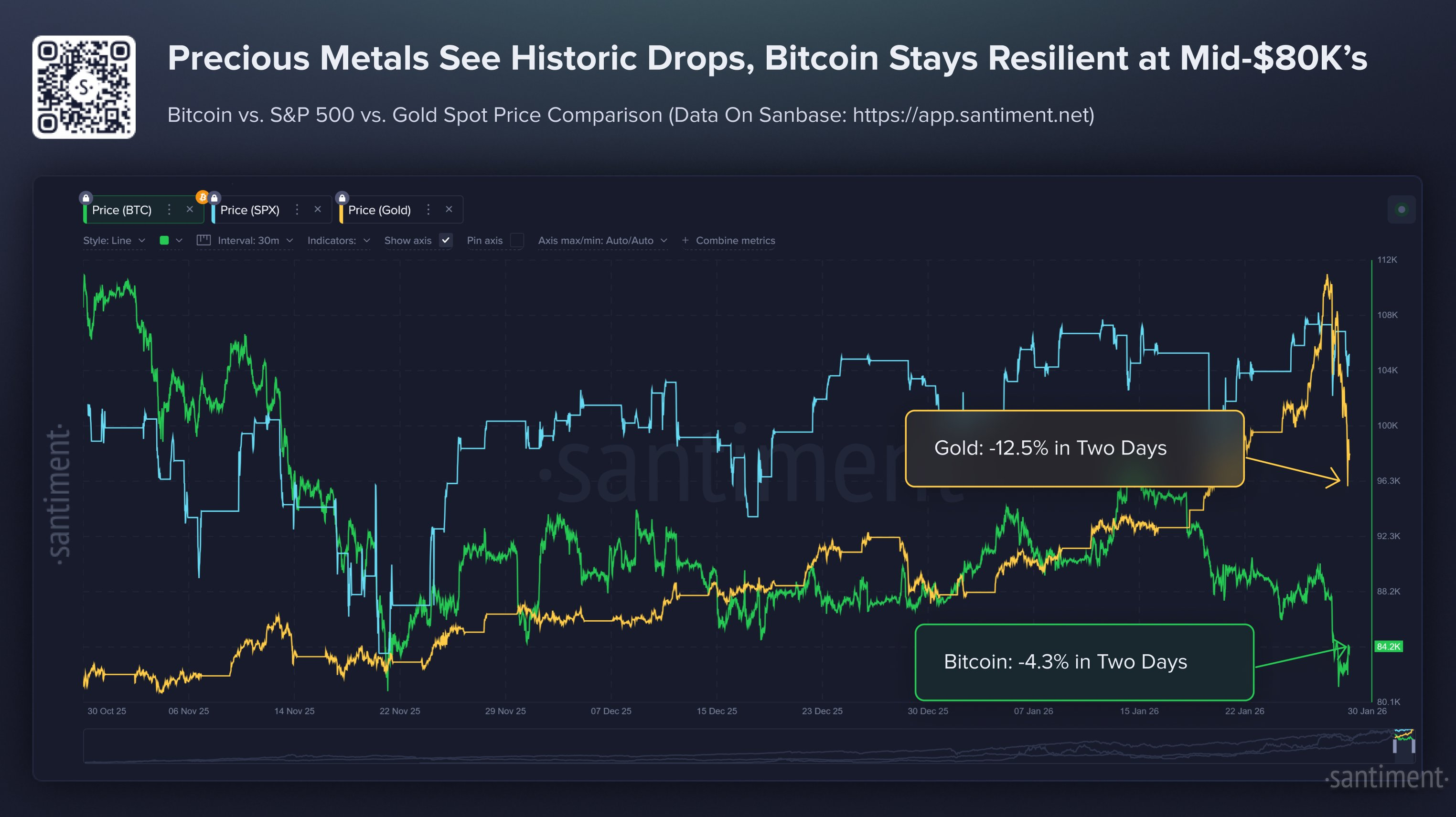

A catastrophic exodus of investors has battered the gold and silver markets, stamping out roughly seven trillion dollars of value in the last two days. Bitcoin, for its part, dropped a fragile seven percent, yet it continues to hang on like the last desperate member of a regime facing revolution.

Bitcoin pundit Joe Consorti warned that the collapse of the precious‑metals market cap barely scratches the weight of Bitcoin’s own entire valuation-a painfully ironic reversal of fortunes.

Gold and silver have shed a further $6.52 trillion in the last 48 hours.

That figure matches Bitcoin’s market cap not once but nearly four times over.

Wild.

– Joe Consorti (@JoeConsorti) January 30, 2026

BTC Evades the Unholy Liquidity Avalanche that Devoured Gold and Silver

Analysts from Santiment highlighted the anomaly: while Bitcoin and its ilk held steady, gold fell more than eight percent and silver plunged over a quarter. It’s as if the metals were hit by a plague of nausea, while Bitcoin sat stoically tasting none of it.

Gold slumped from a zenith of $5,600 an ounce to a near‑derelict $4,700, while silver dribbled down from $121 to $77 in a descent that would make even the most hardened trader shiver.

Observers traced the melt‑up to President Donald Trump’s decision to appoint Kevin Warsh to succeed Jerome Powell as Federal Reserve chief-a move that signals a hardening of monetary policy, and the swathe of hot‑money traders who had batted in on rate‑cut fantasies suddenly found their positions rippled out.

Warsh, a staunch hawk in the eyes of the inflationary parade, threatened to flip the depreciation narrative, causing a violent unwinding of speculative bets.

“The violent move in the metals is a symptom of a lot of hot money chasing price recently which are now being stopped out, leverage being unwound, and profit taking among many players,” Bob Coleman, CEO of Idaho Armored Vaults, explains.

Others noted that gold had been overheating under a wave of genteel enthusiasm, ready for a correction hotter than a Siberian winter.

“While parabolic moves often elevate asset prices beyond most investors’ slender imagination, the out‑of‑this‑world spikes tend to erupt at the end of a cycle. In our view, the bubble today is not in AI, but in gold. An upturn in the dollar could pop that bubble, a la 1980 to 2000, when the gold price dropped more than 60%,” Cathie Wood, founder of Ark Invest, says.

What’s Next for Bitcoin?

The pressing query for Bitcoin’s devotees is whether its steadfast climb near eighty‑two thousand dollars symbolizes a newfound detachment from the common commodities, or simply a lagged reaction to a tumbling economic narrative.

Unlike the metals, Bitcoin did not pour into the final, euphoric crescendo of the “debasement trade,” which may leave some speculative froth to shed and a broader runway to recover.

Some analysts swear that as liquidity drains the oversaturated metals market, capital may howl towards digital assets. This perspective treats Bitcoin’s scarcity as a different theater from the industrial dynamics that haunt gold and silver.

Nonetheless, should Warsh enforce a rigorous tightening of global liquidity, risk assets-including cryptocurrencies-might once again feel the squeeze in the coming weeks.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Is Onyxcoin’s Rocket Losing Steam or Just Fueling Up? 🚀🧐

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- XRP ETF: Will Crenshaw’s Stubborn Soul Crush Crypto Dreams? 😱

- Ethereum’s Wild Ride: Is It Just Getting Started? 🚀

- Crypto Dinner: Where Politics Meets Meme Coins and Laughter! 😂🍽️

2026-02-01 00:21