Ah, the NFT lending frenzy, once a roaring fire of excitement, has now dwindled to a mere flicker, much like the hopes of a man who forgot his wife’s birthday. Active borrowers have plummeted by a staggering 90%, while lenders, perhaps feeling a bit shy, have retreated by 78% over the past year. It seems the allure of non-fungible tokens has faded faster than a summer romance.

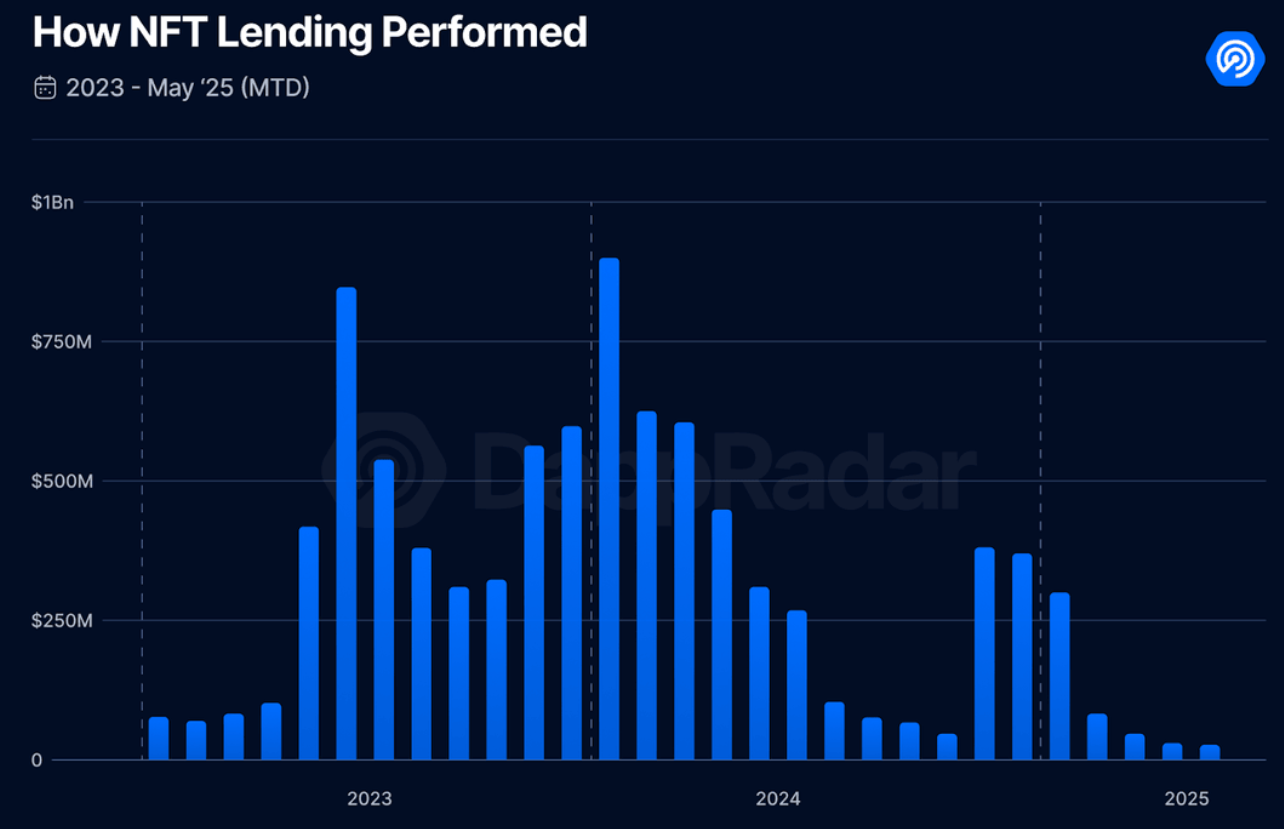

In a shocking twist of fate, the NFT lending market has collapsed, with monthly volume nosediving to a mere $50 million in May. This represents a jaw-dropping 97% drop from its glorious peak of $1 billion in January 2024, as revealed by the wise sages at DappRadar. Their research report, dated May 27, paints a grim picture: a 90% decrease in active borrowers and a 78% drop in lenders. It’s as if everyone decided to take a long vacation to a place where NFTs don’t exist!

“The sharp decline suggests that the NFT lending narrative is no longer convincing enough for users, at least not in the current market conditions.”

DappRadar’s blockchain analyst Sara Gherghelas

As if the universe conspired against them, average loan sizes have followed suit, shrinking from a lavish $22,000 during the market’s 2022 peak to a paltry $4,000 today. That’s a 71% year-over-year decline, indicating that both the demand for leverage has vanished and lenders are now more risk-averse than a cat near a dog park.

Yet, amidst this chaos, the Pudgy Penguins have waddled their way into the spotlight, standing out as one of the few NFT collections still enjoying a robust lending activity, with a whopping $203 million in loans this year. Meanwhile, the once-mighty NFT marketplace Blur’s Blend protocol, which used to command over 90% market share, now accounts for a mere 30% of outstanding loans. Smaller lending platforms like NFTfi and Arcade are still in the game, but their activity resembles a slow dance at a wedding where no one wants to be the first to leave the floor.

Weekly trading volumes have been falling like dominoes for weeks, scaring off capital and dragging the market back to levels not seen since its explosive debut in 2020. In 2024, trading volume dropped nearly 20% from the previous year, while total sales declined by 18%, as reported by crypto.news. As Gherghelas aptly put it in her 2025 research, it was “one of the worst-performing years since 2020.” Who knew that NFTs could be so… non-fungible in their success?

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Whale of a Time! BTC Bags Billions!

- Silver Rate Forecast

- Crypto Riches or Fool’s Gold? 🤑

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- Crypto Mayhem: Bears vs Bulls in a Dance of Doom 💸🔥

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

2025-05-28 10:50