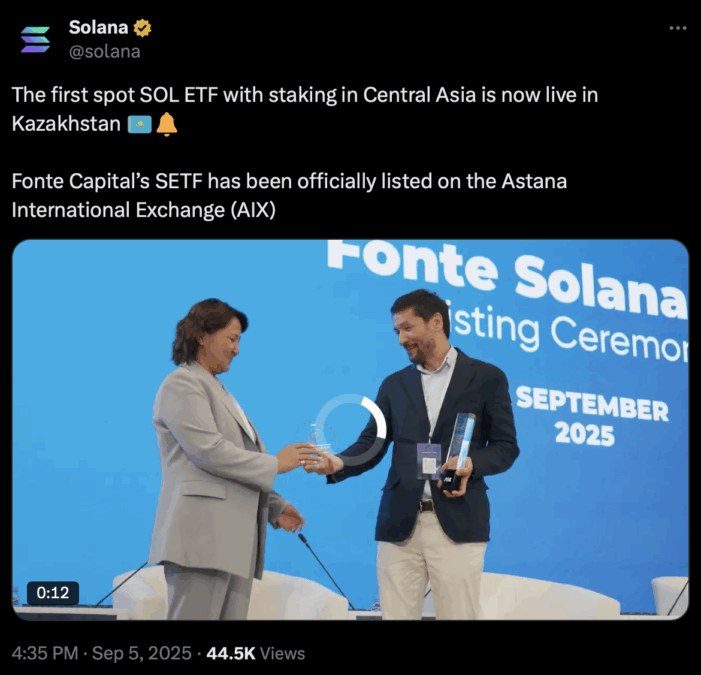

Fonte Capital Ltd, a company that somehow hasn’t gone bankrupt yet, just announced their “historic” Fonte Solana ETF OEIC Plc on the Astana International Exchange (AIX). Because nothing says “trust us” like launching an ETF in a place you have to Google Maps to find.

This is the first Solana ETF ever, but let’s be real: it’s just a fancy way to say, “Hey, invest your money while we stake it and hope the blockchain doesn’t crash. You get 5.5-7.5% returns! Or a firework. Both are exciting!” 🚀

The staking function? It’s like a loyalty program for blockchains. Lock your coins, help process transactions, and earn extra Solana tokens. Because nothing says “safe investment” like letting strangers process your transactions while you cross your fingers. 🤞

“This is a historic milestone!” said Yerzhan Mussin, CEO of Fonte Capital. By “historic,” he probably means “untested and unproven.” But hey, at least it’s not a pyramid scheme! Probably.

The ETF trades under the ticker SETF (because “Solana Eternal Trauma Fund” was taken) and is quoted in USD. The Astana International Financial Centre (AIFC) is handling regulations, because “light-touch oversight” is code for “we’re not sure what we’re doing either.”

BitGo Trust Company, the custodian, has $250 million in insurance. Good luck, right? Because nothing protects investors like a $250 million safety net… until it’s $249 million. Then it’s like, “Oops, we’re out of luck!”

Maksim Kovalev, Head of Digital Assets, said the launch “proves Solana is mature.” By “mature,” he means “hasn’t melted down yet.” Congrats, Solana! You’ve made it to adulthood… barely.

Other Solana products exist, but they’re “different structures.” Hashdex’s Brazilian ETF was so exclusive, only your Aunt Mildred could get in (and she’s not qualified). REX-Osprey’s U.S. fund isn’t even a “spot ETF,” which is like saying it’s a “diet soda ETF” – still sweet, just less guilt.

Europe’s 21Shares ASOL and Bitwise BSOL are just ETPs, not ETFs. Because nothing says “regulatory clarity” like a alphabet soup of acronyms. Enjoy!

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Brent Oil Forecast

- Bitcoin’s Epic Wait: Will It Finally Wake Up From Its Nap and Skyrocket? 🤔🚀

- Bitcoin’s Wild Ride: Brace for the $74K Liquidation Tsunami! 🚨

- Fartcoin’s Explosive Future? 🚀💨

- TRX PREDICTION. TRX cryptocurrency

- Is Pi Network the Next Big Thing or Just a Crypto Comedy? 🤔💰

- Bitcoin’s Meteoric Rise: $95K Today, $103K Tomorrow? 🚀💸

- XRP Skyrockets! ETF Incoming? 🚀

2025-09-05 23:36