What to know:

- In its first earnings report since going public in July, Figma revealed it now holds $91 million in bitcoin, part of its $1.6 billion cash reserves.

- The company CEO framed the move as a modest part of a broader treasury strategy, not a pivot to crypto speculation.

- Despite beating earnings expectations, Figma’s stock fell 18% Thursday, continuing a post-IPO slide.

In this article

BTCBTC$109,796.66◢2.26%

BTCBTC$109,796.66◢2.26%In the second quarter of this year, Figma – a firm specializing in collaborative design software – announced an increase in their Bitcoin investments to a total value of approximately $91 million, as revealed during their recent earnings call on Wednesday.

The announcement made by Chief Financial Officer Praveer Melwani is part of a broader strategy that involves a significant cash reserve of around $1.6 billion. In this amount, the company had approximately $91 million invested in its Bitcoin exchange-traded fund. Translated: The CFO’s disclosure is related to a $1.6 billion cash reserve situation, where about $91 million was held in the company’s Bitcoin ETF.

Figma, a company that recently went public on the New York Stock Exchange in July, has experienced quite a journey in recent years. An anticipated $20 billion takeover by Adobe fell through in 2023 due to regulatory antitrust concerns. However, since then, the company has persistently expanded its customer base, now boasting 95% of the Fortune 500 companies as part of it.

As a crypto investor, I prefer a steady and thoughtful strategy like Figma’s over those who jump on the bandwagon of bitcoin for quick gains or a desperate attempt to regain investor interest in their struggling businesses. Figma seems to be taking a measured approach that prioritizes long-term stability over short-term hype.

CEO Dylan Field told CNBC, “We’re not aiming to be just like Michael Saylor.” As the co-founder of MicroStrategy, Sayor is known for transforming his former software company into a significant bitcoin owner. However, unlike him, “we’re not a Bitcoin-focused company.” Rather, we are a design firm. Yet, there is a role for it in our financial reserves and as part of a broad treasury diversification strategy.

The surge in bitcoin investments and the unexpectedly high revenue didn’t improve investor confidence immediately, as seen in the short term. Contrary to expectations, Figma shares plummeted by 18% on Thursday, ending at $55.96. Despite this, the share price is still above its initial public offering (IPO) value, but it has fallen approximately 50% from its peak during the IPO day frenzy.

Figma, subtly incorporating Bitcoin into its treasury, joins a growing number of publicly traded companies exploring digital currencies within their financial frameworks – an innovation that’s notable yet devoid of the usual fanfare and fervor typically attached to such decisions.

For now, bitcoin remains a small slice of Figma’s balance sheet.

Crypto Treasury Names Hammered Further as Nasdaq Reportedly Ups Scrutiny

Fireblocks Dives Further Into Stablecoins With Intro of In-House Payments Network

HBAR Slumps 4% as Technical Breakdown Triggers Heavy Selling

Bitcoin Slips Below $110K as Analysts Weigh Risk of Deeper Pullback

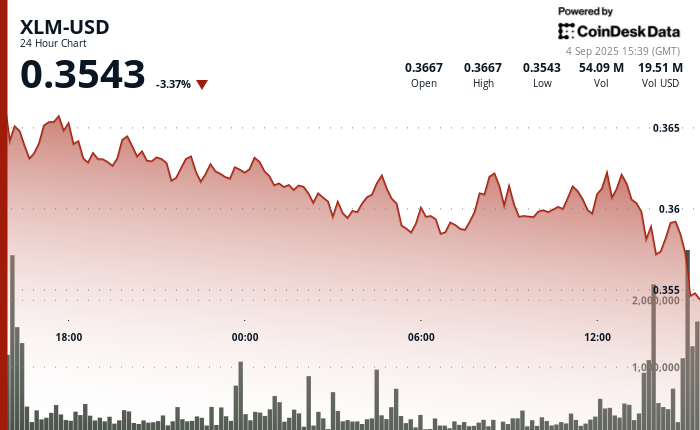

Stellar Plunges 3% as Protocol 23 Upgrade Fails to Spark Rally

Trump-Linked American Bitcoin Stock Falls Below IPO Price After 15% Plunge

Crypto Treasury Names Hammered Further as Nasdaq Reportedly Ups Scrutiny

Bitcoin Slips Below $110K as Analysts Weigh Risk of Deeper Pullback

NFL Opener Draws $600K on Polymarket as Platform Targets $107B Sports Betting Industry

Bitcoin Traders Brace for NFP Shock With Hedging Plays

Public Firm Bitcoin Holdings Top 1 Million BTC

Gold Outshines in 2025 as Bitcoin-Gold Ratio Eyes Q4 Breakout

In this article

BTCBTC$109,796.66◢2.26%

BTCBTC$109,796.66◢2.26%Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Schumer’s Secret Stablecoin Standoff—What They Don’t Want You To Know 🪙🤐

- Unmasking the Whale: Ethereum’s Shocking, Witty Crypto Power Move Revealed 😎

- Silver Rate Forecast

- Brent Oil Forecast

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- 🚀 Ants Gone Wild: $1.24B Korean Crypto Frenzy During Chuseok! 🤑

- Bitcoin Investors Are Making Bank and Changing Their Minds. What’s Going on? 🤔

2025-09-04 21:31