The central bank, in its infinite wisdom, lowered its target rate on Wednesday afternoon, an event some are calling a “hawkish cut.”

Interest Rates Drop: What’s Next for Bitcoin?

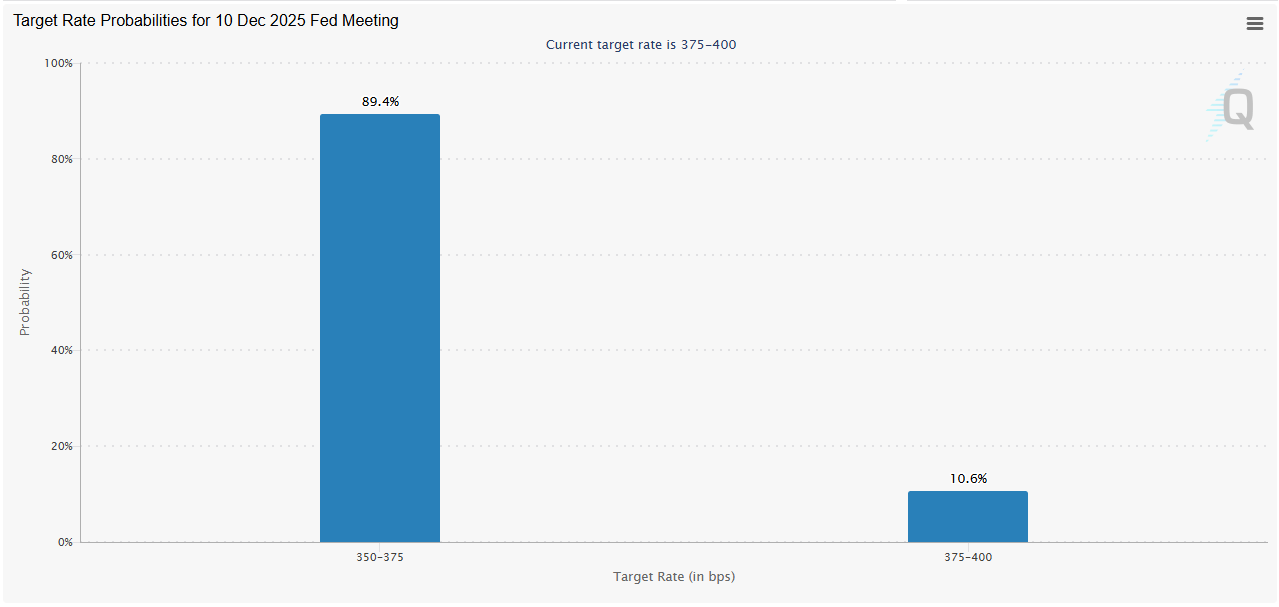

Even before Jerome Powell graced the stage on Wednesday afternoon, the verdict was in; the cut was coming. The CME Fedwatch Tool, which predicts such things with the authority of a prophet, had already foreseen it-90% chance of a 25-basis-point reduction. Lo and behold, Powell didn’t disappoint. But the real question is: will Bitcoin surge in excitement, or was the cut already baked into the price?

Bitcoin, ever the rebel, has a history of defying expectations. When ADP reported a surprise uptick in private-sector job cuts, the cryptocurrency rose by a cheeky 2%. In fact, BTC’s behavior lately is so unpredictable that even seasoned pros like Custodia Bank CEO Caitlin Long are speculating about price manipulation. I mean, who needs logic, right?

Now, despite a cut, Bitcoin barely twitched post-announcement. A bit anticlimactic, but let’s be fair to our digital friend. The Fed’s decision came amidst a divided panel, with nine out of twelve Federal Open Market Committee (FOMC) members voting for the reduction, though the future direction of rates remains shrouded in uncertainty. Some, naturally, are calling it a “hawkish cut.”

The Fed, struggling with its dual mandate of stable prices and maximum employment, has taken to proposing all kinds of solutions, each more bewildering than the last. Perhaps that’s why Bitcoin’s future seems as foggy as the Fed’s own outlook.

“It’s very unusual to have persistent tension between the two parts of the mandate, and when you do, this is what you see,” Powell explained, clearly delighted by the chaos. “I think it’s actually what you would expect to see.” Oh, of course. It’s all part of the plan, isn’t it?

Overview of Market Metrics

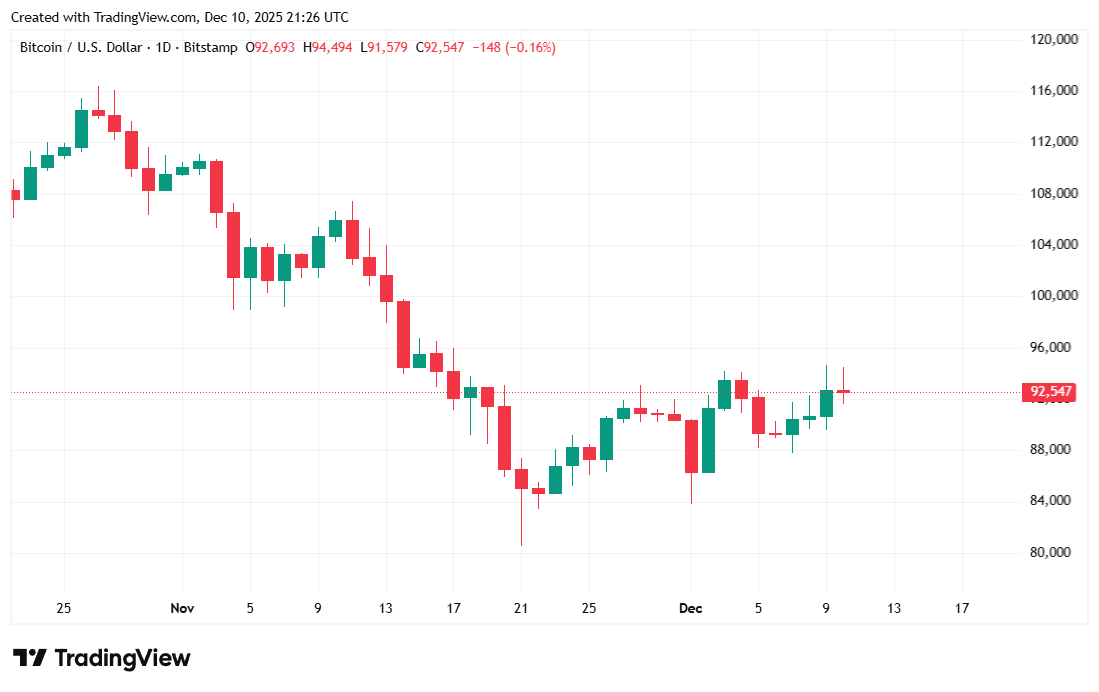

Bitcoin was trading at $92,506.84 at the time of reporting, down by a modest 0.57% over the last 24 hours and dipping 0.81% for the week, according to Coinmarketcap data. The digital asset hit a low of $91,640.13 on Wednesday before bouncing to $94,477.16. A wild ride, but that’s just another day for BTC.

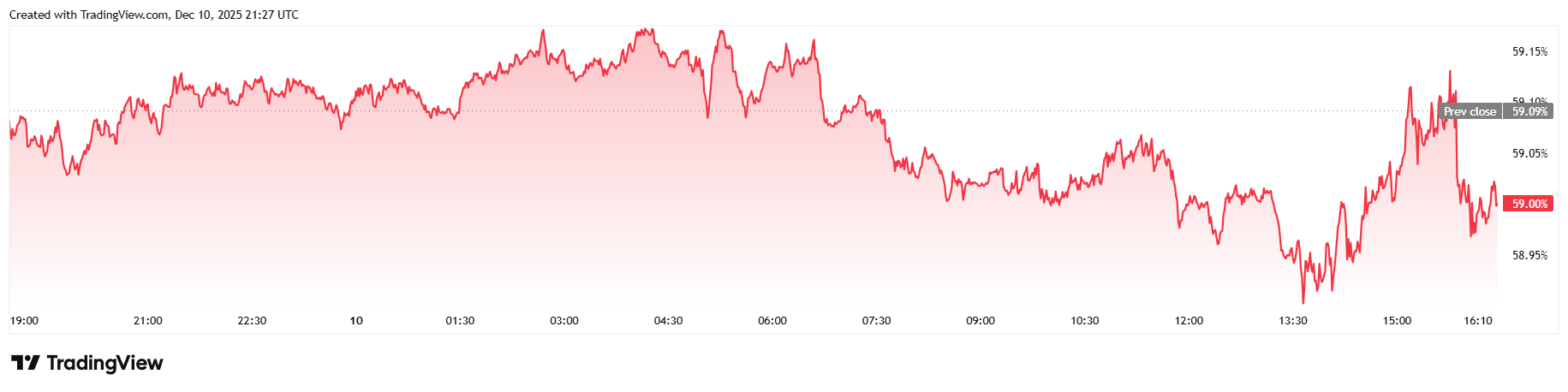

Daily trading volume? Flat, like a pancake, dipping slightly by 1.17% to $65.64 billion. Bitcoin’s market capitalization is a hefty $1.84 trillion, while its dominance is slipping-down 0.16% to 59.01%. Is the king losing its crown? Only time will tell.

Total Bitcoin futures open interest was practically unchanged, edging up by 0.40% to $59.14 billion, according to Coinglass. Liquidations were lower than Tuesday’s, coming in at a measly $102.56 million. The bulk of these losses? Long investors-who, bless their hearts, lost a cool $65.46 million. Short sellers? They lost about half of that. Oh, the joys of margin trading.

FAQ ⚡

- Why did the Fed cut rates today?

The central bank, with all the subtlety of a wrecking ball, lowered its target rate by 25 basis points due to slowing growth and rising pressure from both sides of its dual mandate. Who knew running an economy was so hard? - Was the Bitcoin market expecting this cut?

Oh, you bet it was. The CME FedWatch Tool pegged the likelihood at 90%, so the market had this one priced in before Powell even opened his mouth. - Why didn’t Bitcoin rally after the announcement?

Because it was already priced in, and let’s be honest-Bitcoin’s been in a mood lately. The Fed’s mixed signals didn’t exactly help. Who can blame it for sitting this one out? - How could divided views within the Fed affect Bitcoin?

A divided Fed equals chaos, and chaos equals volatility. That’s the recipe for Bitcoin’s price to swing in ways we can’t predict, even if we try. Spoiler alert: we try.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- EUR UAH PREDICTION

- USD RUB PREDICTION

- USD TRY PREDICTION

- Brent Oil Forecast

- USD IDR PREDICTION

- GBP JPY PREDICTION

- Nigeria’s Crypto Crackdown: ₦2 Billion or Bust?

- Privacy Alert: Ireland’s Encryption Law Sparks Outrage 🔐💔

2025-12-11 01:38