What to know:

- CME bitcoin futures open interest has dropped from over 212,000 BTC to 130,000 BTC this year, while the annualized basis has stayed below 10%.

- A Fed rate cut in September could boost liquidity and risk appetite, setting the stage for a rebound in the basis trade.

In this article

BTCBTC$110.410,11◢1,68%

BTCBTC$110.410,11◢1,68%Will the potential strategy of basing trades, which aims to generate profits from the disparity between the current bitcoin price and the futures market prices, yield results if the Federal Reserve reduces interest rates on September 17?

It’s likely that the Federal Open Markets Committee will decrease the federal funds target rate by 0.25% from its present range of 4.25% to 4.50%, according to the CME FedWatch tool. This move towards a more accommodating policy might rekindle interest in leveraged investments, potentially causing futures prices to rise and revitalizing a trade that has been relatively quiet in 2025.

A basic strategy involves purchasing bitcoin directly or through a Bitcoin ETF, while simultaneously selling futures contracts (or doing the opposite) in order to profit from the gap between the current and future prices. The aim is to seize the diminishing spread before expiration, all while reducing risk associated with bitcoin’s market fluctuations.

When federal funds remain slightly over 4%, a yearly return of 8% on the basis trade might not seem enticing until the pace of interest rate reductions increases significantly. Typically, investors will prefer lower rates as an inducement to participate in the basis trade instead of simply keeping their money in cash.

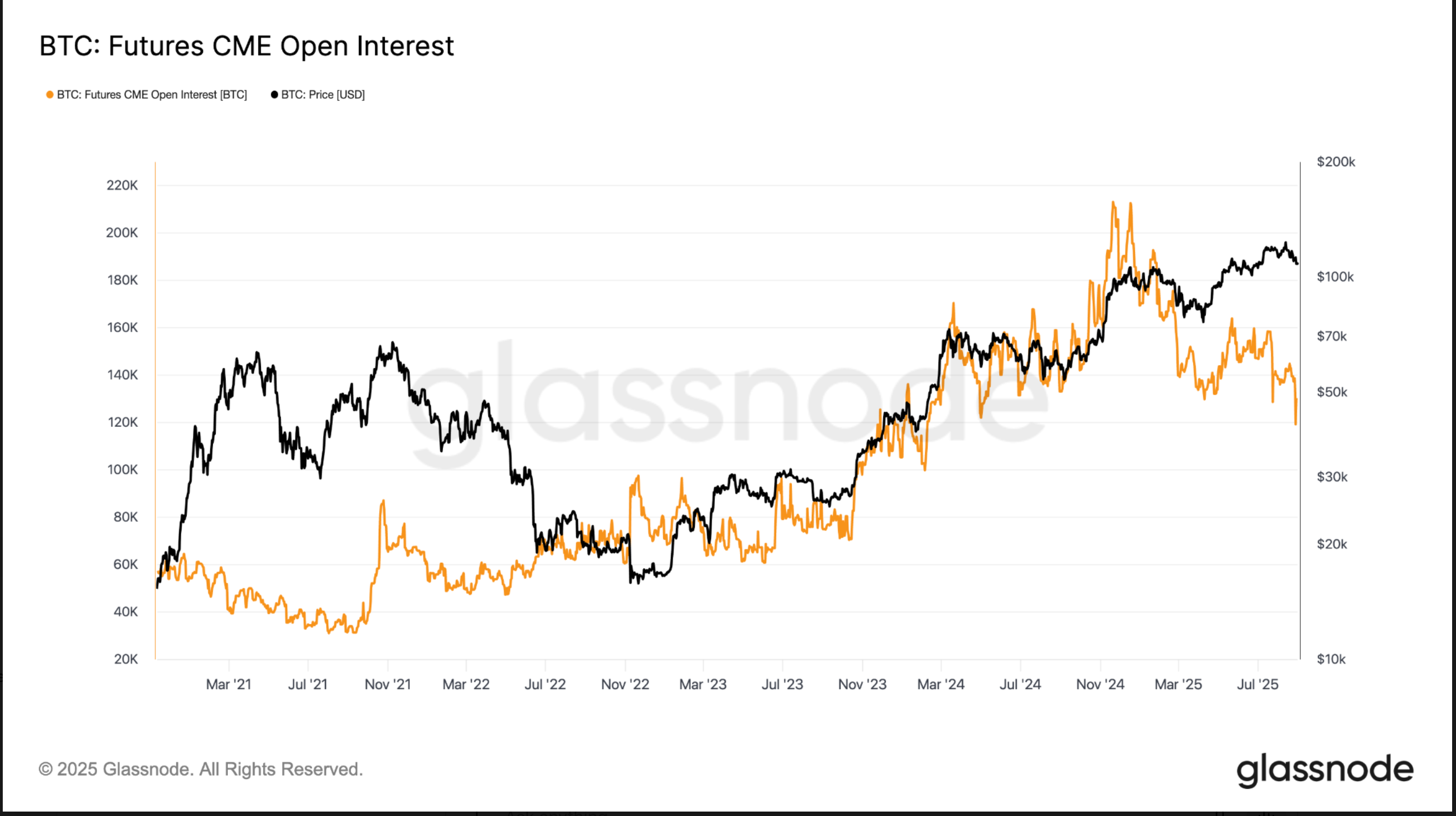

On the Chicago Mercantile Exchange (CME), the amount of Bitcoin futures contracts that are still open has significantly decreased from over 212,000 Bitcoins at the start of the year to approximately 130,000 Bitcoins, as shown by data from Glassnode. This level of open interest is similar to what was observed when spot Bitcoin ETFs were launched in January 2024.

For the entire year, as per Velo data, the annualized rate has consistently been less than 10%. This is significantly different from the 20% observed near the end of last year. This decline can be attributed to both market-specific and broader economic factors. These include tightening funding conditions, a slowdown in ETF inflows following the boom in 2024, and a shift in risk appetite away from bitcoin.

As a crypto investor, I’ve noticed that Bitcoin’s trading range has become more compact recently, which seems to suggest the continuation of its current trend. Interestingly, the implied volatility, a measure indicating potential price fluctuations, is currently at 40, having dropped from a record low of 35 last week, according to Glassnode data. This indicates that the market’s volatility is suppressed, and with institutional leverage being light, the premiums for futures contracts have been kept in check.

If the Federal Reserve lowers interest rates, it could make it easier for funds to circulate, potentially increasing the appeal of high-risk investments. This increase in demand might cause an uptick in the number of contracts held on Chicago Mercantile Exchange (CME) futures, rekindling the basis trade which has been dormant for a year.

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Gold Rate Forecast

- Brent Oil Forecast

- Bitcoin’s Wild Ride: $85K or Bust! 🚀📉

- EUR PHP PREDICTION

- SHIB PREDICTION. SHIB cryptocurrency

- Bitcoin’s Next Move Will SHOCK You! $85K or $83K?

- Crypto Chaos: Powell Holds the Keys! 🔑

- Crypto’s Dandy Escape: Band-Aids and Banter for the Currency Conundrum 😏

2025-09-02 13:59