Ethereum—once just a shiny ledger—now moonlights as the carnival clown of finance. Over the past three months, ETH has doubled, tripled, or perhaps even quadrupled—who’s counting? July alone sent it soaring nearly 50%, probably to make up for lost time—or just to show off. And on its 10th birthday, what do people do? Not just stare at charts like spellbound zombies; they’re diving headfirst into the treasure chest of yields! 🎉

Yes, ETH’s pump has awakened a frenzy—staking, restaking, synthetic yield hubs, funding rate farming—you name it. Basically, everyone’s trying to squeeze more juice out of the old blockchain orange, and trust me, the data is screaming, “More, please!” 🍊

Staking Demand Skyrockets — Because Who Doesn’t Love Locking Up Coins?

While everyone’s busy cheering, a legion of coins is getting locked up like valuables in a bank vault—staking, the new hot romance. Beacon Chain’s latest gossip reveals over 35 million ETH are now staked—more than a summer blockbuster! And the trend? Trembling, growing, like a teenager’s awkward beard.

So, staking—imagine locking your ETH in a digital safe. You help run the network and, in return, get some shiny rewards—like a thank you note with a cash bonus. On June 2, the influx hit a massive spike—more ETH than a flock of geese on a migration. The rewards? Oh, just enough to make you think you’re earning a small fortune—$15,358 a year, assuming ETH keeps doing its party trick at $3,795 each. 🎩

Validators—those clever computers—make sure all the transactions are squeaky clean. Basically, they’re the hall monitors of the crypto schoolyard, earning rewards for their vigilant work.

Liquid Staking—Because Who Likes Banning Liquidity?

For the little guys, platforms like Lido, Frax, and Rocket Pool have opened the floodgates. These clever platforms let you stake a tiny fraction of ETH and still keep a tradable receipt—like a digital IOU—earning a modest yield of 2.5% to 3.3%. And wouldn’t you believe it? Deposits in these pools doubled faster than rabbits in a hutch. 🐇

But here’s the twist—yields on these platforms are actually shrinking. Back in late 2022, APY was a spicy 8.16%. Now? About 2.7%. Why? Because the more ETH you stake, the more rewards are shared—like slicing a cake that keeps getting bigger, but everyone gets a smaller piece. And network activity? Less wild parties, more quiet libraries. 🎓

But don’t cry for yields—they’re still positive, and the total ETH staked is over 36 million—resembling a blockchain version of “Everyone’s a Stakeholder.”

Restaking: Like Inception, But for ETH

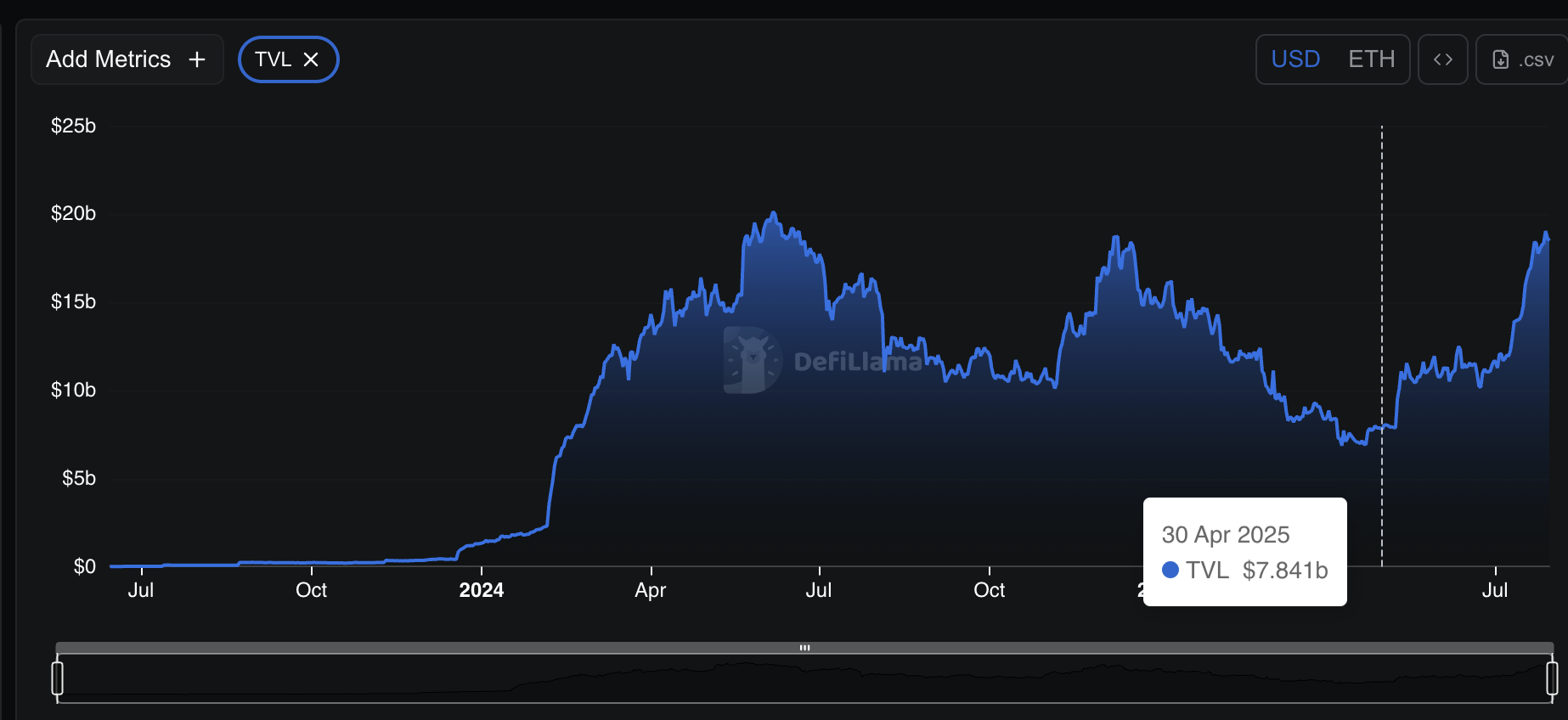

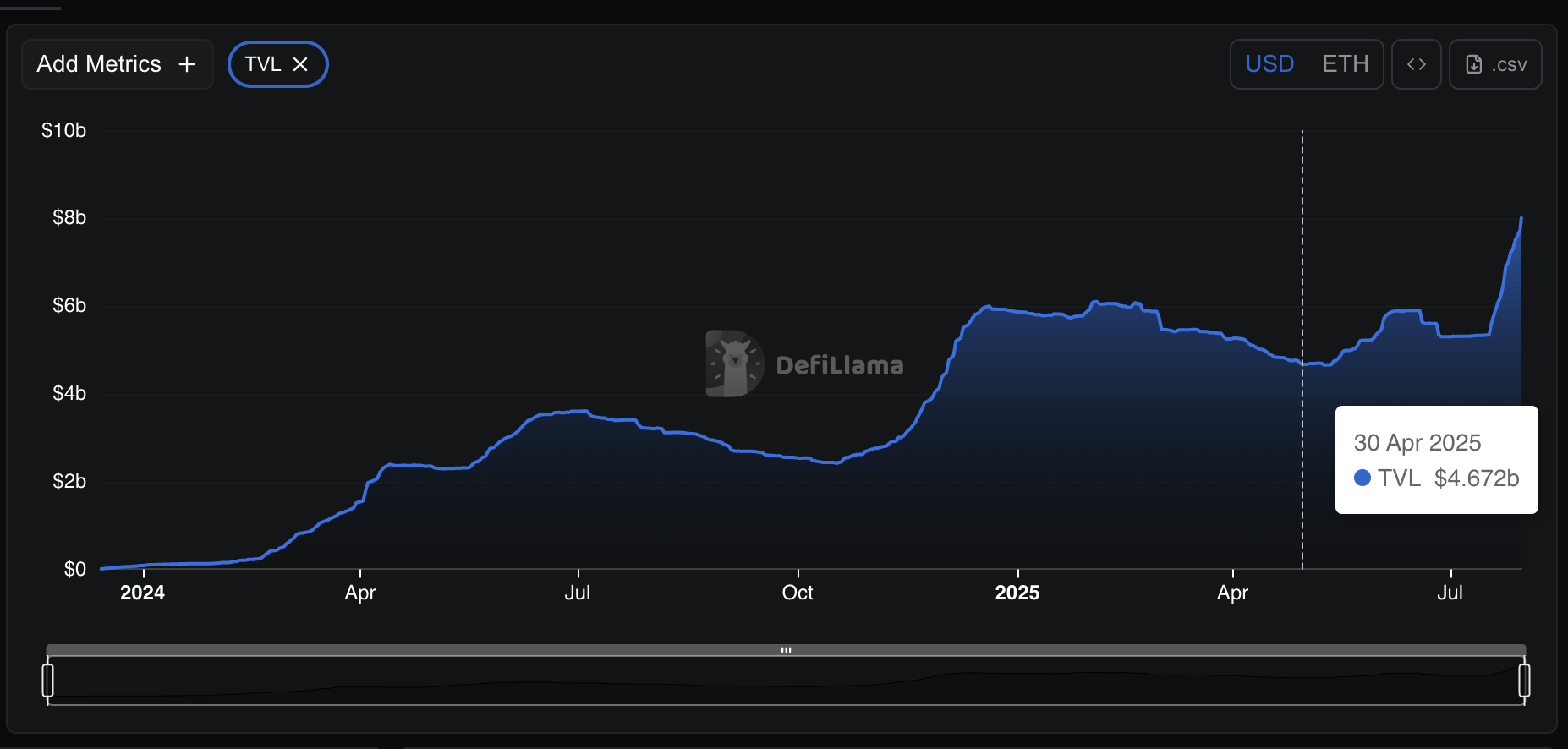

ETH is not just locked; it’s getting a second life—like a Bollywood soap opera! Restaking lets holders redeploy their staked tokens (stETH or eETH) into new platforms like EigenLayer, stacking yields faster than a poker player folds. This multi-layered approach? It’s the financial equivalent of stacking books—except these books pay you interest. The numbers? A near doubling of TVL on platforms like EtherFi, from $5.5 billion to over 10 billion—smart money loves a good sequel. 📈

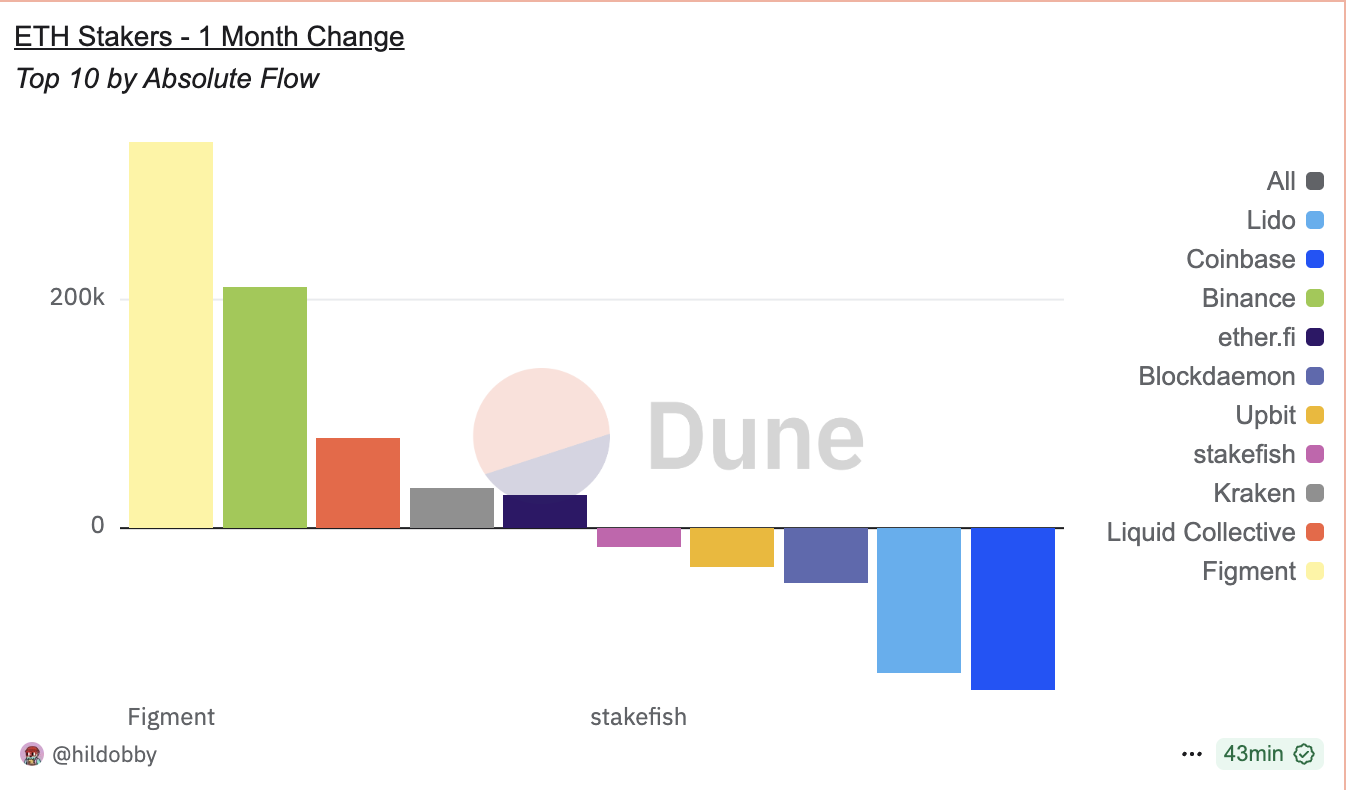

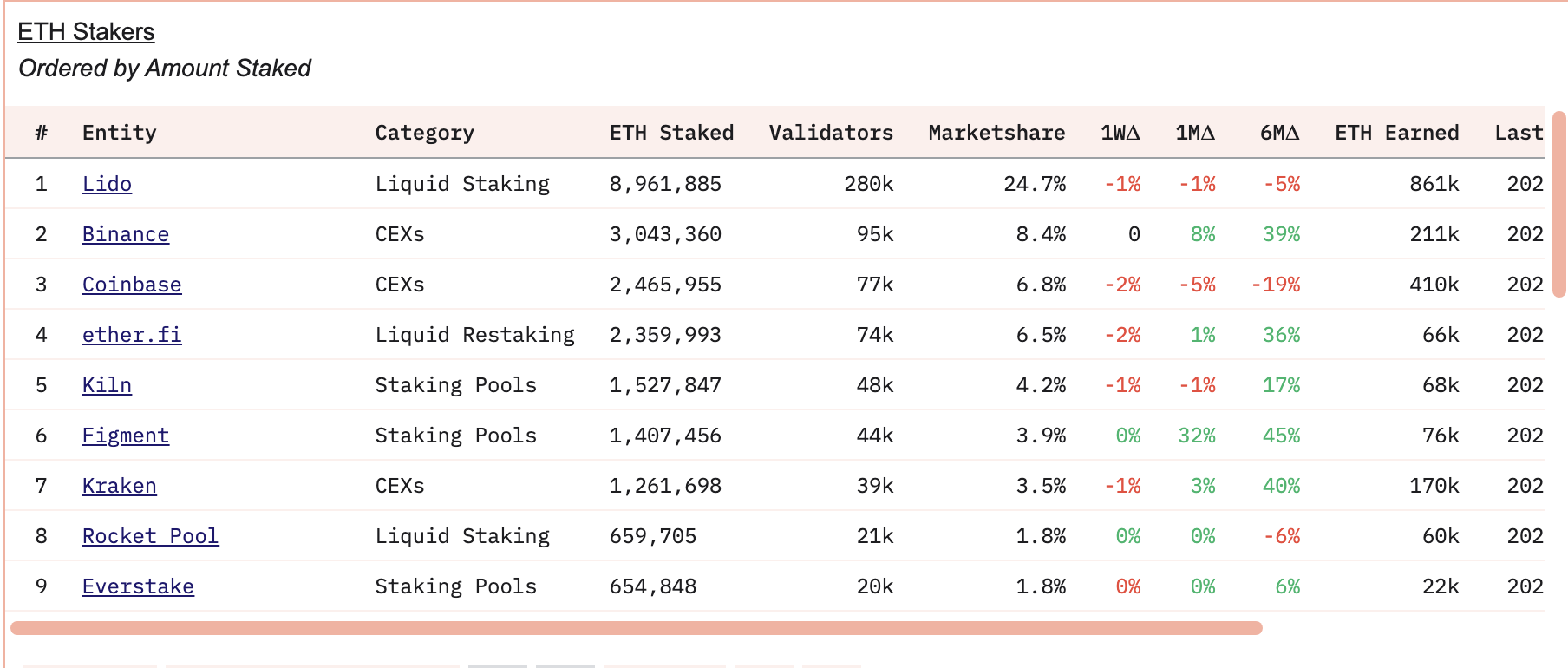

EigenLayer—think of it as the Swiss Army knife of ETH—lets you restake for even more rewards, like earning interest on interest. Big institutions? Figment alone pulled in 250k ETH last month, proving that big players are in the game, perhaps just to look cool at parties. 🎉

And platform EtherFi now commands 6.5% of all staked ETH—seriously, they’re the cool kids at the staking lunch table, rivaling Binance and Coinbase. Seems that big exchanges are not just about trading anymore—they’re eyeing the yield buffet.

Synthetic Yields: Because Reality is Too Boring

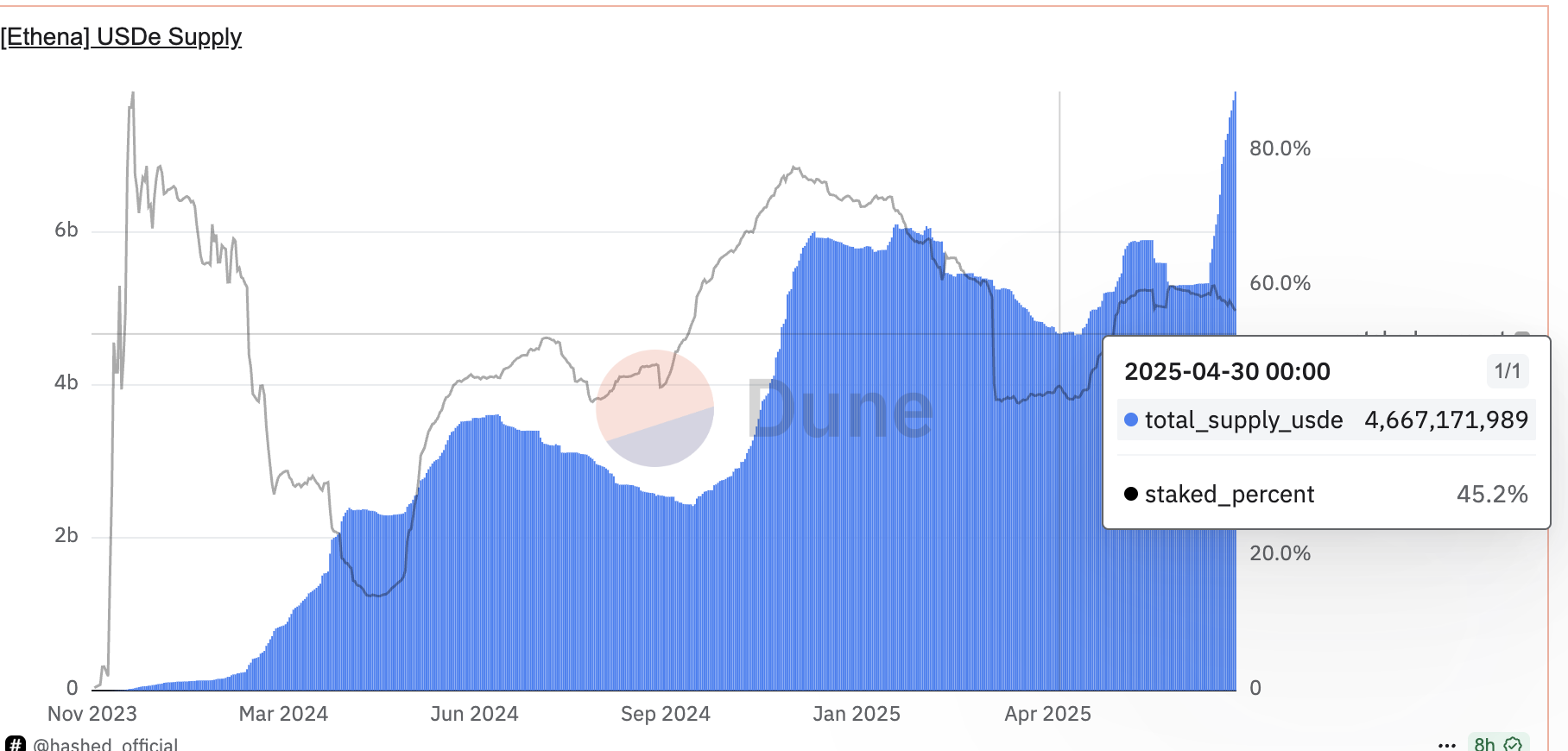

Meanwhile, in the land of fantasy—oops, I mean finance—synthetic yield platforms such as Ethena have sprung up like mushrooms after rain. They create “synthetic dollars” backed by ETH or stETH—because who doesn’t want more digital candy? 🍭

USDe has grown almost 80% since April—imagine that! And these stablecoins aren’t just floating around—they’re earning, with yields around 8.47%. Layer on the USDe minting, staking, and re-staking? That’s a yield buffet with no napkins required. 🥳

Funding Rate—The Hidden Casino

Next sportsbook: funding rate farming. Sound boring? Think again! It’s like part of a secret society—longs dominate, bets are inflated, and big money just waits for the funding payments to roll in. Picture a giant game of whack-a-mole, but instead of moles, it’s traders getting paid just for overleveraging themselves. 🎯

As ETH approaches new heights, funding fees go haywire, making shorts look like the smart reluctant hero—wait, I mean, villain—collecting steady income as longs race to the moon like lunatics.

Low-Key Investment: Lending & Liquidity Pools

Finally, not everyone is riding the rollercoaster—some are quietly earning tiny, safe yields through lending or liquidity pools. Think of it as the mild-mannered cousin of crypto—sensible, steady, yet oddly profitable. Pools like Morpho Aave or Uniswap offer yields of 1.2% to 50%, which sounds like a diet menu—”for the risk-taker” edition. And yes, some riskier pools are tempting enough to make your palms sweat. 🎢

In the vast universe of ETH yield hunting, many have chosen to sit back, relax, and let the smart contracts do their magic—like a financial spa day, minus the cucumber slices. 🧖♂️

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- Silver Rate Forecast

- Brent Oil Forecast

- Crypto Whirlwind: How DeepBook’s Wild Ride Might Just Make You Smile 😏💸

- Bitcoin’s $90K Standoff: Is It Playing Hard to Get or Just Confused? 🤔💸

- Bitcoin Beats Amazon! 🍕 The Day Crypto Took Over the World

2025-07-31 13:29