Ah, the grand spectacle of institutional demand, as Ethereum approaches the illustrious $4,000 resistance level! It is as if the very heavens conspired to ignite a fervor among traders, who now watch with bated breath, hoping for a breakout that might propel our dear ETH into the stratosphere of multi-year highs. One can almost hear the collective gasps of anticipation! 😮

Ethereum Price Today: The Bullish Tango Near $4,000

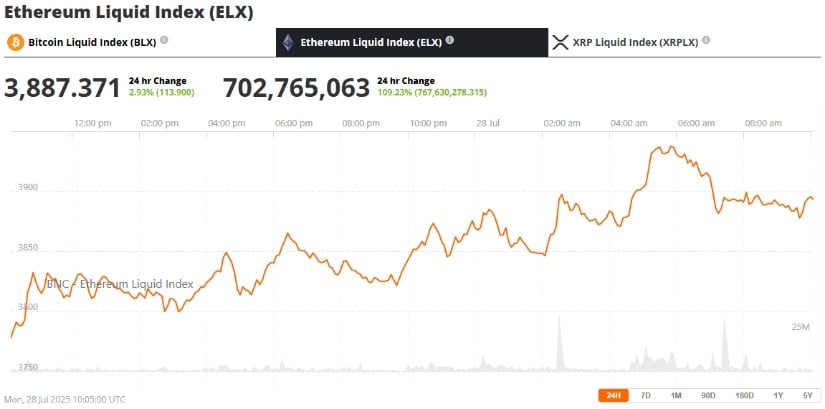

Today, Ethereum (ETH) has gallantly surpassed the $3,900 mark, fueled by the insatiable appetite for institutional staking and the ever-escalating demand for ETFs. It now finds itself in a delicate dance just below a crucial resistance zone, as analysts squint through their crystal balls, predicting a breakout that could send Ethereum soaring toward $4,500 or even $4,800. Oh, the drama! 🎭

In the past 24 hours, ETH trading volume has spiked nearly 60%, while open interest has risen by a modest 6–7%, reaching over $59 billion. Such numbers suggest a rising tide of institutional conviction, as ETH now trades above all major exponential moving averages (EMA), reflecting a bullish alignment of trend structure and momentum. Who knew numbers could be so romantic? 💕

Technical Landscape: Resistance, Liquidity, and Trend Strength

Ethereum has decisively broken free from a multimonth downtrend, entering a bullish structure near the $3,920–$3,950 zone. Technical indicators reveal ETH riding the upper Bollinger Band, while bouncing off VWAP support near $3,883, indicating sustained upward pressure. The RSI, having cooled slightly from 66 to 62, suggests a controlled strength rather than the fatigue of overindulgence. A fine balance, indeed! ⚖️

If ETH manages to break above the $4,089 swing-high — the upper boundary of a key liquidity zone — analysts predict the trend will continue toward $4,300, with further aspirations toward $4,500. This zone has previously served as a distribution territory, and surpassing it would mark a major structural breakout. But beware! A failure here may lead to a re-test of support between $3,754 and $3,680, a zone reminiscent of prior breakout levels and EMA support clusters. The suspense is palpable! 🎢

Ethereum ETF Inflows Raise Supply Shock Concerns

One of the most potent catalysts behind Ethereum’s rally is the relentless inflow into spot Ethereum ETFs. Over the past 17 consecutive trading days, these ETFs have recorded historic net inflows, with a staggering $453 million on Friday alone. This brings the total ETF assets under management to a princely sum of $20.66 billion. Who knew finance could be so thrilling? 💸

Leading this charge, BlackRock’s ETHA ETF attracted a jaw-dropping $440 million in a single day, placing it among the top-performing U.S. ETFs for the week. This trend signals a significant rise in institutional demand for Ethereum-based financial products. Analysts estimate that, at this pace, ETF demand could reach $20 billion in the coming year, equivalent to approximately 5.33 million ETH. Meanwhile, Ethereum is expected to issue only 0.8 million ETH during the same period. A mismatch of epic proportions, indeed! 📉

This supply-demand imbalance is further supported by technical data. A diamond pattern formation on Ethereum’s 3-day chart is nearing completion around $2,832, typically a sign of a powerful reversal pattern. The breakout from this structure has reinforced bullish expectations, with measured projections pointing to price targets of $4,000 to $6,000. Diamonds are a trader’s best friend! 💎

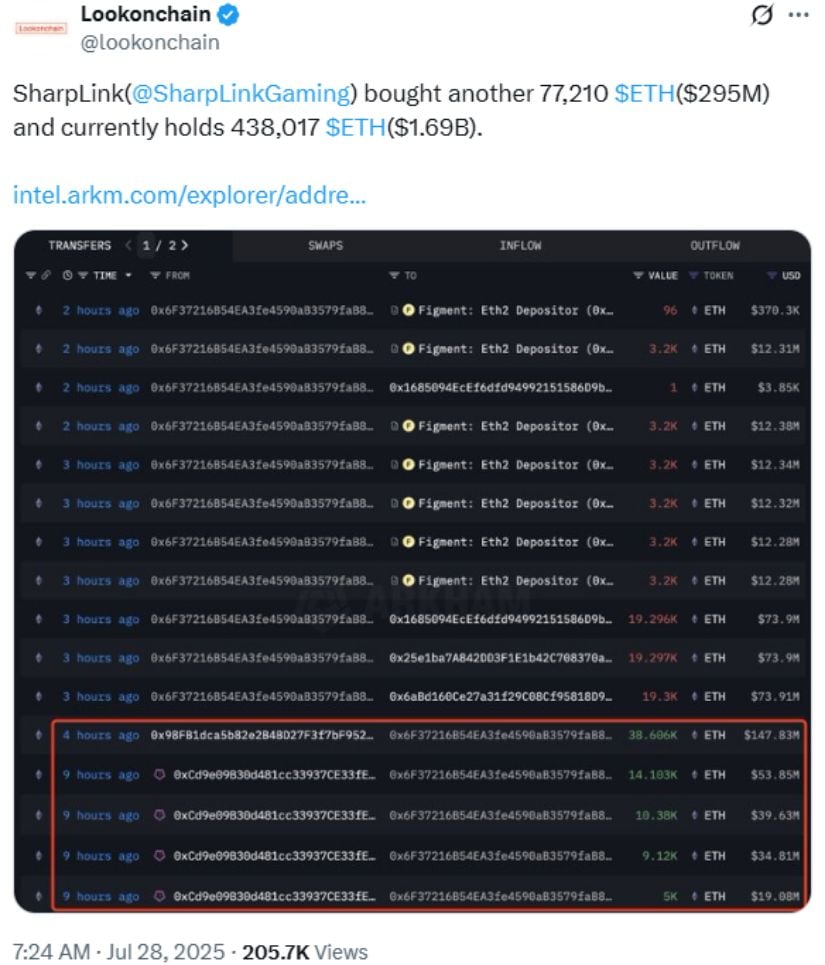

Institutional Accumulation Deepens: SharpLink Buys $295M ETH

SharpLink Gaming, a notable player in the gaming sector, recently expanded its Ethereum holdings by purchasing 77,210 ETH over the weekend, worth approximately $295 million. This brings the company’s total ETH holdings to a staggering 438,017 ETH, valued at around $1.69 billion, with more than 95% of these assets either staked or deployed on liquid staking platforms. Talk about commitment! 💍

SharpLink coordinated with Galaxy Digital for the transaction, with on-chain data revealing $148 million worth of ETH transferred from Binance as part of the deal. The company emphasized the operational advantage of Ethereum’s 24/7 functionality compared to traditional banking hours, highlighting its strategic interest in long-term ETH exposure and staking rewards. A savvy move, indeed! 🧠

This massive purchase also positions SharpLink ahead of firms like Coinbase and Bitmine in terms of Ethereum holdings, signaling an emerging trend where corporate treasuries are increasingly leaning into ETH for long-term yield and network participation. The corporate world is certainly waking up to the charms of Ethereum! 🌍

Ecosystem Tailwinds: Seasonality & Layer 2 Expansion

Ethereum’s impressive 50% price surge in July sets the stage for its historically strongest month — August. In previous post-halving cycles, Ethereum has delivered average August gains of 64.2%, often pushing the asset into key breakout levels like the $4,000 to $6,000 range. The anticipation is almost unbearable! ⏳

Simultaneously, Ethereum’s Layer 2 ecosystem — led by platforms like Arbitrum, Optimism, and zkSync — continues to expand. Increasing Layer 2 transaction volume and reduced gas fees are driving higher user engagement across decentralized applications. As these scaling solutions mature, they reinforce Ethereum’s core utility by channeling more transactions, value, and activity back to the Ethereum mainnet. A harmonious symphony of progress! 🎶

Ethereum Outlook: What Comes Next?

Looking ahead, Ethereum’s price movement will likely depend on whether it can break and sustain levels above $4,089. Should this happen, ETH could enter a new leg of price discovery with minimal overhead resistance until $4,800. The thrill of the chase! 🏃♂️

However, even if the breakout momentarily stalls, the technical and fundamental backdrop remains bullish. As long as Ethereum holds above its support range of $3,680 to $3,754, the broader uptrend remains intact. With institutional inflows accelerating, ETF demand outpacing new ETH issuance, and seasonal patterns aligning in Ethereum’s favor, market sentiment leans bullish. Some traders, ever the optimists, are already preparing for the possibility of $6,000 ETH in the coming months — especially if August delivers another historic rally. The stage is set, dear friends! 🎉

Read More

- Gold Rate Forecast

- USD HUF PREDICTION

- Doge Doomed?! 😱🐳

- PLUME: 60% Down?! 😱

- Traders Rush Back to XRP: The Silent Storm Brewing in the Crypto World! 😱🚀

- Mysterious Moves: Crypto Titans’ Bold Bet or Folly? 🤔

- When Will the Long Traders Finally Give Up? 🤔

- Bitcoin’s Price Madness: A Comedy of Bulls and Bears 🎭💰

- Brent Oil Forecast

- Bitcoin’s $90K Standoff: Is It Playing Hard to Get or Just Confused? 🤔💸

2025-07-29 01:31