Ah, Ethereum, that ever-elusive specter of digital currency, has managed to reclaim a nascent 10% increase over the past 24 hours. This miraculous feat seems to correlate perfectly with the US government’s benevolent gesture of postponing trade tariffs for a staggering 90 days, impacting more than 75 nations. What a world we live in, where crypto movements hinge on bureaucratic indulgences!

Ethereum Takes a Polite Leap to $1,600

Of course, the joy is tempered by the recent grim history—Ethereum plummeted to a two-year low of $1,385 just this week, invoking moans and groans from weary investors. It seems our dear cryptocurrency lost its footing below the once-safe range of $2,100 to $3,900 on March 9, dragging its reputation down by around 16% over the last month. Who knew that numbers could evoke such pain?

In its quest for redemption, Ethereum has been eying the historical demand zones—like a lost puppy searching for its master—hitting lows beneath the $1,640 barrier. Analysts, ever optimistic at their own expense, warn that ETH‘s troubles may not be over, whispering the possibility of a dip to the $1,000-$1,200 range if the king of altcoins doesn’t reclaim its lost glory. Let’s pop the champagne when that happens, shall we?

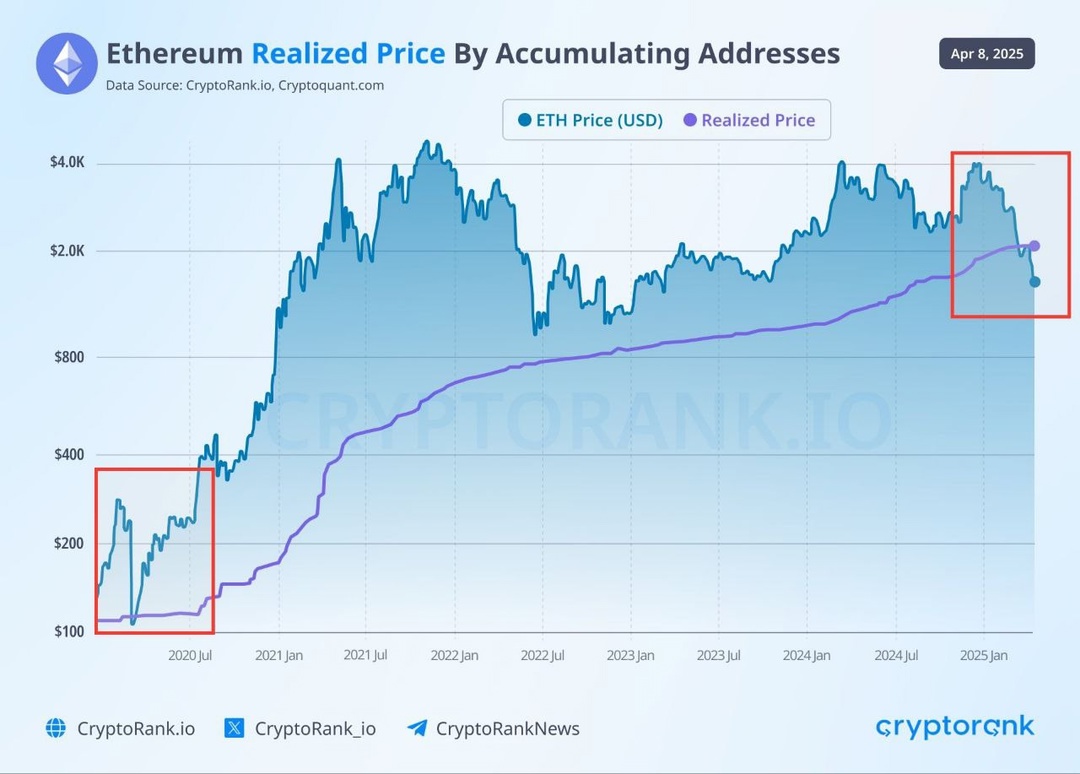

As the saga unfolds, ETH found itself slumping below its realized price of $2,000—an indicator of desperation, or perhaps, a glimmer of hope depending on which analyst you ask. Funnily enough, the last time it flirted with the depths of despair was back in March 2020, when it dropped from $283 to $109 before mounting a grand comeback. Oh, the audacity of hope!

In perhaps the greatest plot twist of the week, President Trump’s 90-day tariff timeout (for almost everyone, save for good old China) has propelled crypto and stock prices alike, with Ethereum jumping 10% in a mere hour. Timing, it seems, is everything.

Is the Miracle of a Breakout Approaching? 🥳

Enter stage right, Analyst Titan of Crypto, who suggests that Ethereum may be on the cusp of a resurgence. According to some arcane trading pair patterns, the ETH/BTC relationship is showing a familiar rhythm, echoing moments from the past when momentum suddenly shifted. Let us not hold our breath!

Historical charts reveal that the pair has danced along the trendline thrice before surging towards glorious heights. And here we are, testing it again like some cosmic cosmic game of limbo—how low can Ethereum go? Rumor has it that a weekly closing above $1,550 could reinvigorate bullish sentiment, but until then, we remain in suspense.

Amid these wild oscillations, ETH attempted a valiant leap from $1,480 to $1,600 yesterday, tantalizingly close to the $1,700 point before finding solace somewhere between $1,580 and $1,640. Someone pass the smelling salts!

Many are convinced that a bullish reversal is looming like a thunderstorm in the distance, with Ethereum forming a charming falling wedge. If it manages to break through that upper trendline around $1,840, we may witness significant gains—though we’ve been disappointed before, haven’t we?

As we muse on our fortunes, Ethereum currently hovers at $1,566, marking an 11% decline in the weekly knit of fate. What a dramatic decline indeed!

Read More

- Gold Rate Forecast

- EUR ZAR PREDICTION

- CNY RUB PREDICTION

- USD INR PREDICTION

- Mine BTC at Home? 🏡💰 LOL!

- Shocking News: IREN’s $450M Debt Offering Will Leave You Speechless! 💰😱

- Shocking Revelation: BNB Price Soars as Investors Line Up for Gold! 💰🚀

- How TRON’s Recent Stunt Could Turn a Meme to a Million: The Epic Tale of $1 Billion and Soon $1.20?

- USD AUD PREDICTION

- ICP PREDICTION. ICP cryptocurrency

2025-04-11 08:33