Imagine this: Ethereum drops by nearly 4%, slipping from the shimmering heights of $2,800 to a humble $2,492. It’s like watching a soap opera where the hero just fumbled his coffee, but plot twist—whales are secretly stocking up on 16.793 million ETH. Yes, while the rest of us panic sold at the first sign of trouble, they’re quietly adding to their stacks, probably planning something sneaky or just really bad at timing. 🐋

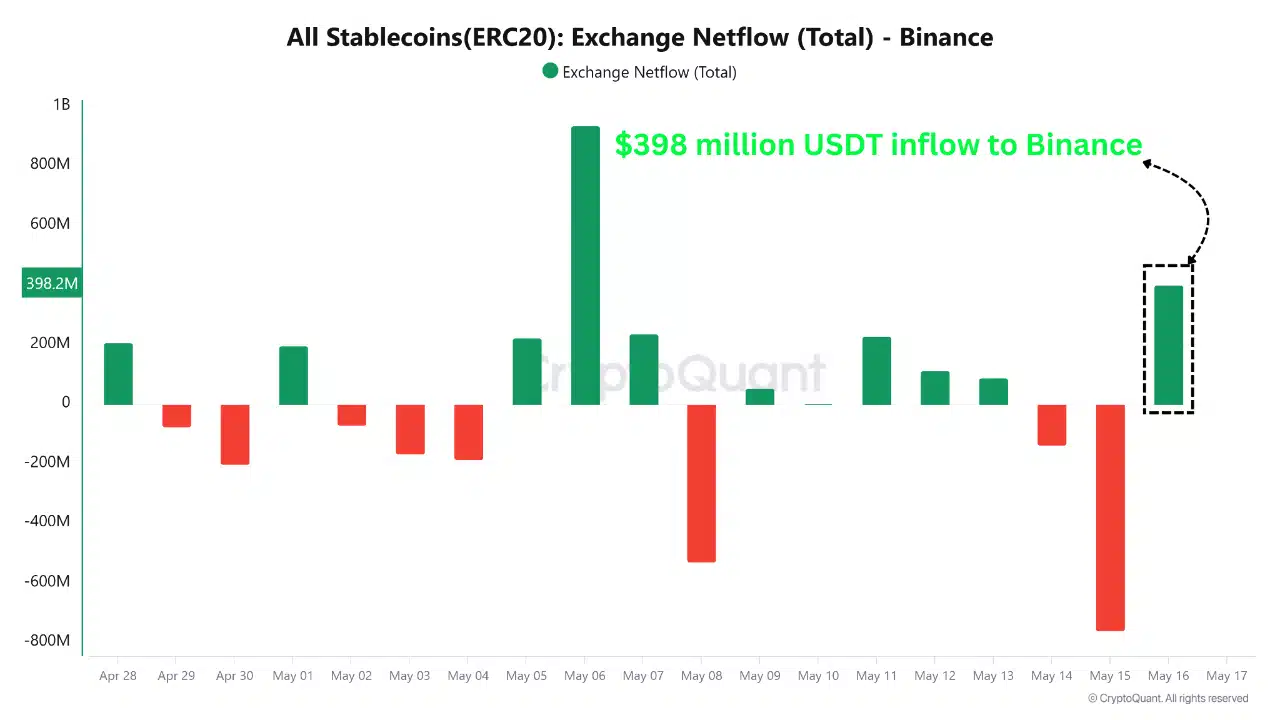

Meanwhile, on the shiny surface, the outflow gods are busy—an outflow of $540 million worth of ETH while USDT—those reliable stablecoins—poured in to the tune of $398 million. It’s the kind of financial ballet that makes you wonder: Are the whales exiting stage left, or are they just being dramatic for the cameras? Either way, it’s chaos masked as strategy, and we’re all invited to the show. 🎭

//ambcrypto.com/wp-content/uploads/2025/05/Ethereum-Exchange-Netflow-Total-All-Exchanges-4.png” alt=”Ethereum Exchange Netflow Chart” />

$398M USDT & $540M ETH: A Sophisticated Pas de Deux

Now for the pièce de résistance: on a day when USDT—yes, that digital piggy bank—flooded into Binance with $398 million, the same day, a cool $540 million worth of ETH was quietly withdrawn from centralized exchanges. It’s as if whales are saying, “We’re going into hibernation for a while, folks.” 💤

This isn’t just a coincidence; it’s strategic—like greasing a wheel or hiding your snacks before the diet buddy arrives. The USDT inflow? That’s the whales arming themselves—probably getting ready for their next big move while playing the long game in the shadows.

Bottom line? The whales are circling, whispering, or just showing off. Who knows?

Ethereum’s Newcomers & Old Guard: The Silent Shuffle

Surprisingly, Ethereum gained 18.73% new addresses in just a week. Welcome, new kids! But don’t get too comfortable—the number of active addresses did a disappearing act, dropping 3.18%. It’s like a party where everyone shows up, then promptly spends the night in their pajamas, peeking out only to check if the coast’s clear. 💃🛋️

This dance suggests that while new users are eager to join, the old-timers are on pause, maybe waiting for a sign—like a market rebound or a new meme coin to jump on.

The open interest? Down by 3.29%, sitting at $16.02 billion, probably taking a breather after the recent rollercoaster. Traders are closing bets, perhaps scared off by the $2,800 rejection—think of it as the market’s way of saying, “Relax, breathe, and maybe have some popcorn.”

Support or Stall? The Fib Level Showdown

Ethereum flirted with $2,629, around the 2.618 Fibonacci extension, then pulled back. Now it’s lounging near $2,492, between support and resistance and showing no clear winner—much like me debating whether to exercise or order pizza. The stochastic RSI? Neutral, like that indifferent friend who just shrugs. 🤷♂️

Hold above $2,292, and ETH might just wake up and dance higher. Or it could sleep through the weekend—market’s unpredictability, right?

despite today’s stumble, whales seem supportive, stablecoins are flowing, and there’s a whiff of hope that maybe, just maybe, ETH will bounce back. Or it won’t. But hey, that’s the fun of crypto—suspense, surprises, and plenty of coffee.

Read More

- Silver Rate Forecast

- SPEC PREDICTION. SPEC cryptocurrency

- USD PHP PREDICTION

- OM PREDICTION. OM cryptocurrency

- ETHFI PREDICTION. ETHFI cryptocurrency

- RUNE PREDICTION. RUNE cryptocurrency

- DOT PREDICTION. DOT cryptocurrency

- Solana’s Meltdown: $111M Longs Liquidate Like It’s Going Out of Style! 💸🔥

- ILV PREDICTION. ILV cryptocurrency

- GBP AED PREDICTION

2025-05-17 16:10