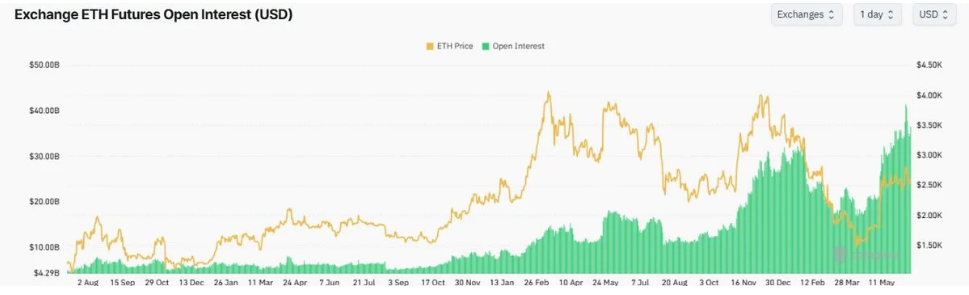

Ah, Ethereum (ETH), that capricious darling of the digital realm, seized the spotlight on June 16, as the futures open interest pirouetted to a staggering $36.56 billion—an annual high that would make even the most stoic investor raise an eyebrow. Prices, like a caffeinated squirrel, bounced back above $2,600, flirting with a resistance level that has been as stubborn as a mule for months. Traders, those intrepid adventurers, dove headfirst into new positions, setting the stage for a dramatic showdown in the market. 🎭

Futures Open Interest Hits Yearly High

According to the ever-reliable CoinGlass data, the open interest in ETH futures surged dramatically over a mere three days, reaching that eye-popping $36.56 billion on Monday. This figure, the highest since last year, suggests that traders are borrowing funds like they’re at a casino, betting on Ethereum’s next move. 🎲

Price Tests Multi‑Year Resistance

In a single session, ETH rose about 4.5%, a rally that nudged it right up against a long-standing descending trendline—an invisible line that investors have been watching like hawks for over a year. It sits tantalizingly above the 50-week moving average, while the 200-week average lurks just below, like a shadowy figure in a thriller novel. If ETH can clear and hold above these levels, it may signal a glorious run. But beware! Weak trading volume could mean the bulls need a bit more firepower before they charge. 🔥

ETF Flows Show Steady Support

On the same day, US spot funds tied to Ethereum experienced a minor outflow of $2.18 million, marking the first net withdrawal in 19 days. Yet, weekly inflows still totaled a whopping $528.12 million, pushing total assets under management in these ETFs beyond the magical $10 billion mark. 💸

Institutional Backing Expands ETH Reach

Major asset managers are getting creative with Ethereum, rolling out tokenized treasury products and stablecoin-backed funds that link directly to ETH. Companies like BlackRock and Fidelity are leading the charge, proving that Ethereum is not just a pretty face in the DeFi world but also a serious contender in real-world applications. 🏦

Meanwhile, Ethereum traded calmly at $2,630 on June 16, reflecting a 4% increase in the last 24 hours. The futures markets are heating up, with volumes rising steeply as large players pour into ETH-based contracts. Speculative positions often herald choppy waters ahead. As more money flows into leveraged positions, even the slightest price movement can trigger forced liquidations—sometimes on both sides of the trade. In other words, today’s serene chart can morph into a jagged mess faster than you can say “liquidation.” 🌊

Read More

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- USD HUF PREDICTION

- Silver Rate Forecast

- Brent Oil Forecast

- Schumer’s Secret Stablecoin Standoff—What They Don’t Want You To Know 🪙🤐

- AVAX Soars Again! Is the Crypto World Turning Tides? 🚀

- Ride the Crypto Wave or Wipe Out – $250K Up for Grabs! 🌊💸

- 🚀 Ants Gone Wild: $1.24B Korean Crypto Frenzy During Chuseok! 🤑

- SEC’s Jenga Tower: Crenshaw Calls Out Crypto Chaos! 🎲💥

2025-06-17 06:07