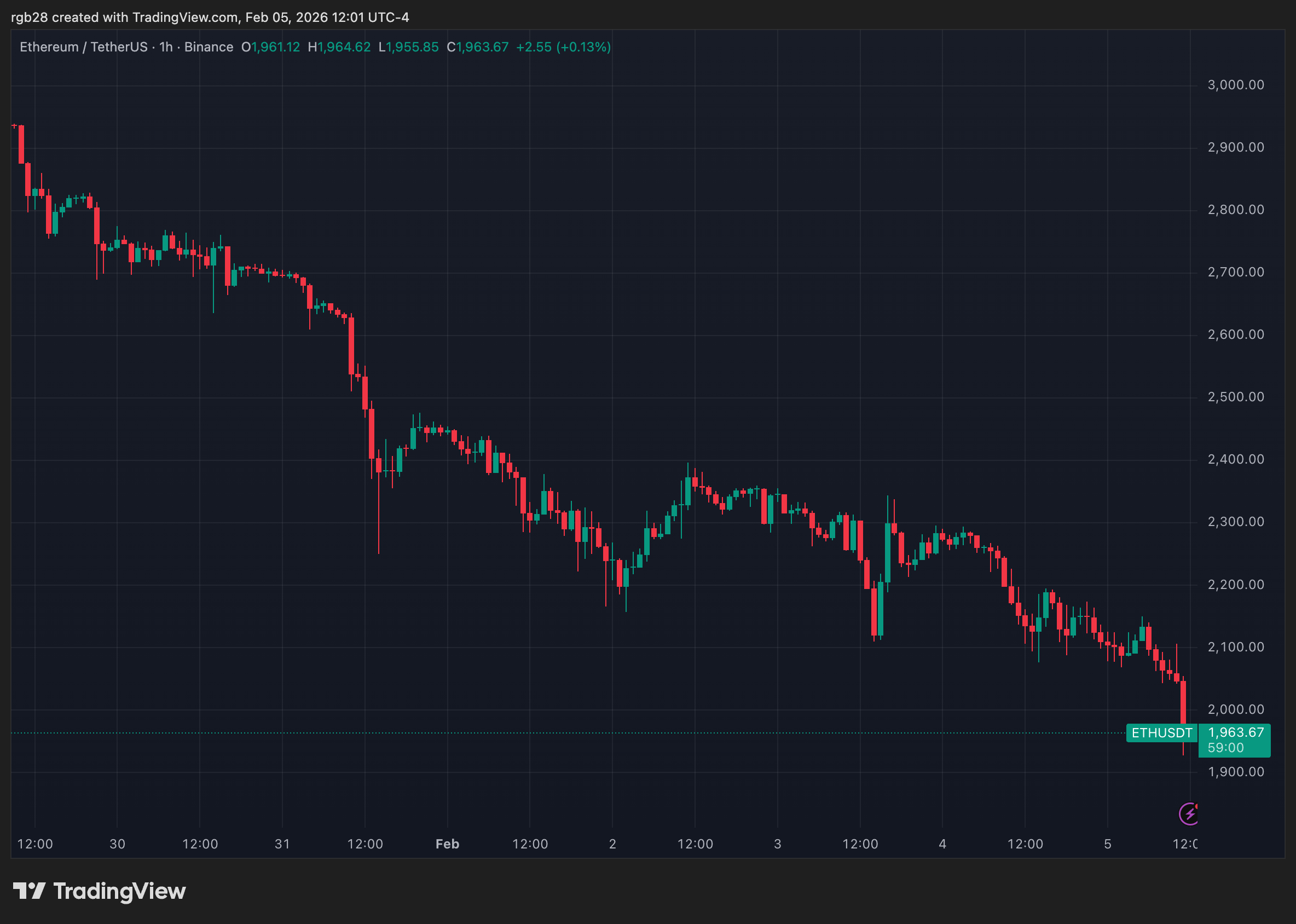

In the grand theater of the crypto market, where fortunes rise and fall with the whims of unseen forces, Ethereum (ETH) has taken center stage in a performance both tragic and absurd. Like a protagonist in one of life’s lesser comedies, it has stumbled, dropping over 9% in a single act, reaching depths not seen in eight months. The once-proud $2,000 mark, a psychological barrier as fragile as a Chekhovian dream, has been breached, leaving analysts to whisper of “do-or-die” moments with the gravity of a village doctor diagnosing a common cold.

The Correction Waltz: A Dance to $1,500

On a Thursday that felt as interminable as a Russian winter, Ethereum, the second fiddle in the crypto orchestra, hit a low of $1,934. Its macro range, a tightrope between $2,100 and $4,400, has become a noose, swinging wildly in the winds of market correction. Since its August zenith of $4,956, ETH has shed over 60% of its value, a decline as dramatic as a nobleman’s fall from grace in a provincial estate.

Daan Crypto Trades, a modern-day soothsayer, observed with wry detachment that the price action has been “awful this cycle, but the levels have been very clean.” Horizontal areas, he claims, are all one needs to watch-a simplistic wisdom that belies the chaos of the market. “Break one, target the next,” he quips, as if Ethereum were a character in a farce, blindly stumbling from one mishap to another.

Should ETH fail to reclaim its lost ground, the $1,800 mark looms like a forgotten relative, ready to welcome it back to the fold. Altcoin Sherpa, another voice in this chorus of doom, declares ETH’s chart “bleak,” its 200-Week Exponential Moving Average lost like a mislaid umbrella. The April 2025 lows, a mere $1,400-$1,500, beckon with the inevitability of a Chekhovian finale.

The Fall of the House of BitMine

As Ethereum tumbles, so too do its acolytes. BitMine, the second-largest crypto treasury, has watched its unrealized losses swell to $8 billion, a figure as staggering as it is absurd. Tom Lee, its chairman, clings to optimism like a drowning man to a reed, declaring the pullback “attractive” and ETH’s fundamentals “strong.” Yet, the market, indifferent to such pleas, continues its relentless march downward.

Spot ETH ETFs, once the darlings of the financial world, have bled nearly $80 million in a single day, their outflows a testament to the fickleness of investor sentiment. Liquidations, too, have reached a fever pitch, with $326.6 million wiped out in 24 hours-a sum that would make even the most profligate aristocrat blush.

And so, as Ethereum teeters on the edge of its next act, one cannot help but wonder: is this a tragedy, a comedy, or merely the banal unfolding of life’s absurdities? Perhaps, like a Chekhov play, the answer lies not in the outcome, but in the quiet desperation of the journey itself.

Read More

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- 11,000 Wallets Fight for NIGHT Tokens in Cardano Airdrop-And It’s a Disaster 🤦♂️

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

- Jito’s Spectacular Rise: The Token That Just Won’t Quit! 🚀

- Is Onyxcoin’s Rocket Losing Steam or Just Fueling Up? 🚀🧐

- NFTs Soar to New Heights: Is the Bull Run Truly Back? 🚀💰

- Bitcoin’s Wild Ride: $2B Down the Drain and Counting! 🚀💸

2026-02-06 11:59