Behold, the Ethereum price, that fickle and tormented soul, now teeters on the precipice of despair, having forsaken the sacred $2,360 threshold-a weekly support level once deemed unshakable. In its wake, a tempest of liquidations sweeps through derivatives markets, as if the very heavens weep for the folly of mankind. The probability of a deeper correction? A certainty, whispered by the winds of chaos.

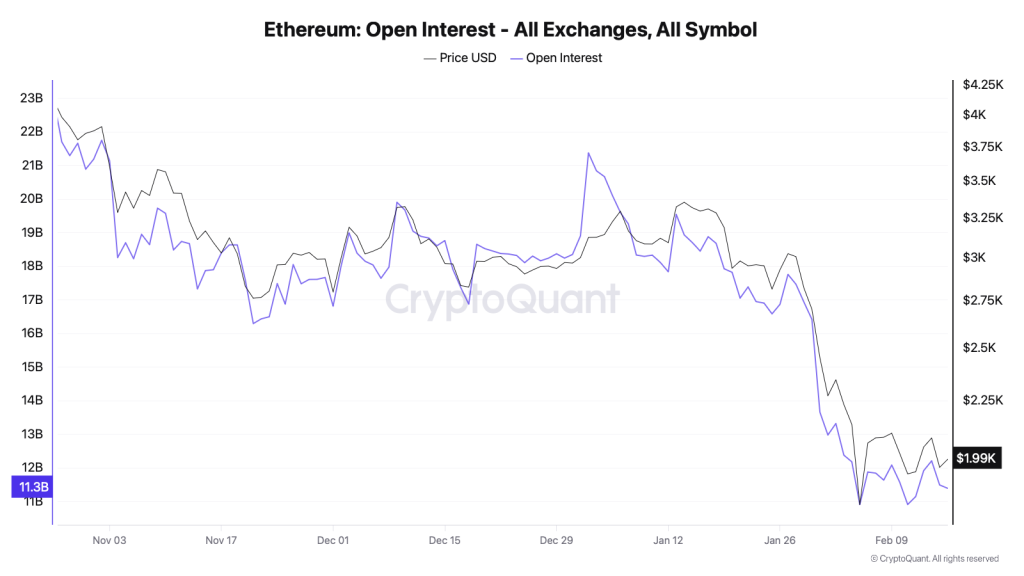

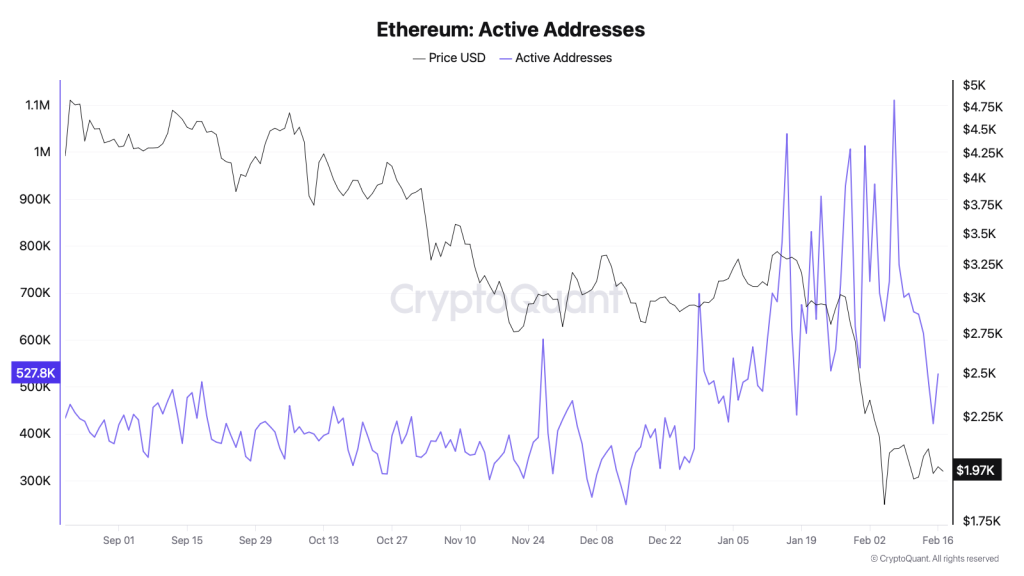

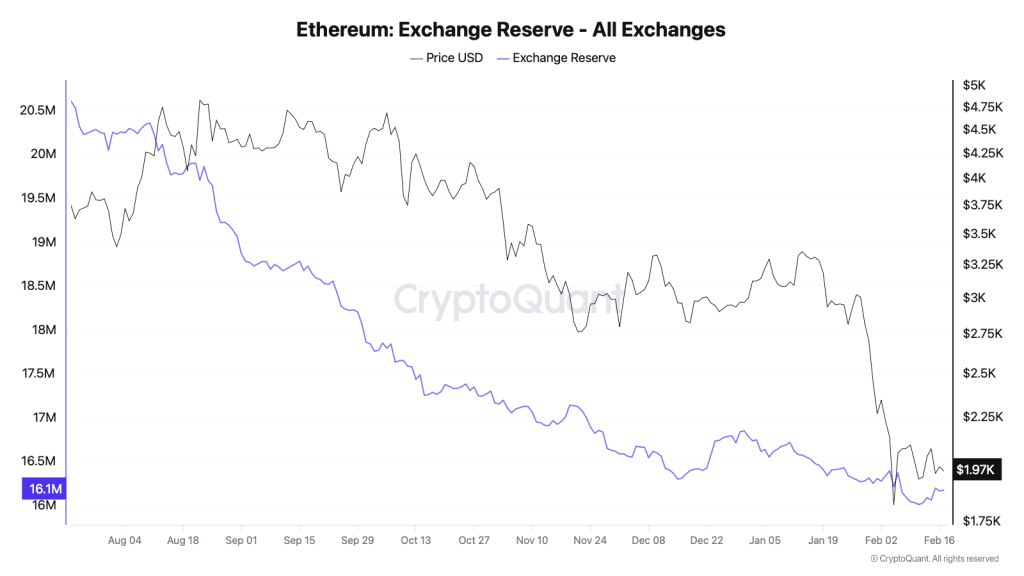

ETH, now trading near $1,977, bears the marks of a high-volume breakdown, a lower-high structure etched into the weekly chart like the scars of a sinner. Open interest, once a proud $23 billion, now crumbles to $11.3 billion-a near-50% collapse, as though the market itself has been gutted by its own greed. Active addresses, too, have dwindled since February’s fleeting glory, while exchange reserves, after months of outflows, now swell with ominous intent. Is this but a routine pullback? No! This is the reckoning of a world unmoored from reason.

The Agony of Open Interest: A Symphony of Forced Liquidations

Ah, open interest-the lifeblood of speculation-has fallen to ruin. From $23 billion to $11.3 billion, a descent so swift it mirrors the fall of a tyrant. What does this signify? The longs, those deluded optimists, are being gutted by the wolves of leverage. Derivatives markets, once a gilded palace, now resemble a charnel house. Yet here lies irony: such collapses often birth local bottoms, as if the market must purge its sins before ascending anew. But for now, let the bulls tremble. Unless they reclaim lost ground, the abyss beckons.

When open interest plummets thus, it is not the quiet sigh of a retreating tide but the roar of a waterfall swallowing all in its path. And yet, the market, ever the jester, hints at nuance: perhaps this reset is but a prelude to a grander farce. For downside continuation to accelerate, open interest must rebuild-or else spot selling must intensify. A choice between Scylla and Charybdis, as all great tragedies would have it.

The Hollowing of Active Addresses: A Nation’s Soul Forged Cold

On-chain activity, that pulse of the network, now beats feebly. Active addresses, which once soared in February, now retreat toward 520K, a number as bleak as a winter’s night. A minor uptick on February 16? A fleeting flicker in the darkness. Declining participation whispers of a populace weary of the game, of transactions that once crackled with fervor now reduced to ash. Is this structural weakness? No. But it is the shadow of weakening momentum, a mirror to the market’s cooling passion.

And yet, let us not mistake this for defeat. Participation wanes in breakdowns, as surely as it swells in bull markets. The contraction is but a sigh, a momentary pause before the next act of madness.

The Return of Exchange Reserves: A Ominous Rebirth

For months, exchange reserves trended lower, a signal of hope-a people accumulating, a market accumulating strength. But now, the trend shifts. Balances rise, as if ETH, that restless spirit, has returned to trading platforms in search of solace. What does this mean? Increased liquidity for selling, defensive positioning by holders, or a prelude to distribution? The answer lies in the cryptic heart of volatility itself.

Rising reserves, you see, are the market’s way of saying, “Fear not, for I am preparing for the storm.” And what a storm it may be, especially when paired with falling participation and a confirmed technical breakdown. The bearish case, once a whisper, now roars with the voice of a thousand prophets.

The Weekly Breakdown: A Death Knell for $2,360

Technically, Ethereum has committed apostasy. The $2,300-$2,360 region, once a bastion of support, now lies in ruins. The breakdown came with volume like thunder, a testament to seller dominance. No low-liquidity dip this, but a cataclysmic surrender to the void.

ETH now faces support at:

- $1,820-$1,850 – a demand zone as desperate as a gambler’s final bet

- $1,530 – a structural support so ancient, it predates the market’s memory

The weekly RSI, that barometer of sentiment, now hovers near 30, a number that screams “oversold” yet offers no salvation. Divergence? None. The price, still shackled below broken support, awaits the day it may reclaim $2,150-$2,200. Until then, the sellers reign, their grip unyielding. And yet, the CMF, that cunning trickster, drops to -0.12, hinting at capital flight. But the rising trendline-neckline of the head-and-shoulders pattern-remains a fragile lifeline for the bulls.

The $1,800 Abyss: A Test of Faith

Will the ETH price fall below $1,800? The bearish narrative weakens only if bulls reclaim $2,150-$2,200, if open interest stabilizes, and if exchange reserves resume their downtrend. Absent these miracles, the market remains a stage for caution. Momentum, that fickle muse, points lower. Participation, that once-vibrant chorus, now sings in minor keys. The $1,820 zone looms as a test of humanity’s resolve.

In the coming sessions, Ethereum shall either stabilize-a phoenix from the ashes-or descend further, a Sisyphus forever rolling his boulder down the hill of despair. The choice, dear reader, is not yours to make. It is written in the stars-or perhaps in the algorithms of the bots.

Read More

- Gold Rate Forecast

- Unlocking the Secrets of Solana: A Liquidity Adventure Awaits!

- Bitcoin Hits $110K: Is the Moon Finally Within Reach? 🚀🤣

- Brent Oil Forecast

- When Crypto Flows Turn into a Billion-Dollar Flood 🌊💰

- Pi Coin Plunges 21% After Consensus 2025 — What Could Possibly Go Wrong? 🚀🤡

- Circle Seeking at Least $5,000,000,000 for Coinbase Acquisition, Potentially Nixing IPO Plans: Report

- Silver Rate Forecast

- When Crypto Meets Geopolitics: A Week of Drama, Deals, and Ripple Rumors 🚀💰

- ETH PREDICTION. ETH cryptocurrency

2026-02-17 12:27