Once again, Ethereum flexes its muscles, as though preparing to break free from its self-imposed chains. After a rather dramatic tumble in early October, ETH seems intent on clawing its way back, inching toward the coveted $4,150 mark. A triumphant bounce from the bottom of the descending channel-oh, the drama!-signals that the bulls are back in town. But, don’t get too excited yet; there’s that pesky resistance looming on the horizon, lurking like a shadow, ready to spoil the party. 💀

Technical Analysis

By Shayan

The Daily Chart

On the daily chart, ETH is flirting with a supply zone just beneath the highest point of the descending channel. Last week, the sellers made their move with a vengeance, but today’s candle is coming back for seconds. Could this be the breakout we’ve all been waiting for? Or are we about to be let down again? Only time will tell, but if ETH can manage to close above $4,200 and break through the upper boundary, we could see a glorious rise to $4,600. A word of caution though: ETH needs more than just a strong coffee to make that leap. ☕

The 4-Hour Chart

On the 4-hour chart, ETH tried to get all fancy, pushing into the orange supply zone at $4,200. But, oh, the rejection came swift and brutal, like a reality check after a night of questionable decisions. This zone is just shy of the top of the descending channel, making it even more of a high-stakes game.

The RSI, ever the drama queen, screamed ‘overbought’ and swiftly turned down, giving us a warning that a short-term pullback or consolidation may be on the way. But don’t be too quick to write it off. Higher lows are still being formed, and that sharp rally from $3,600 shows that buyers are stepping in like heroes in a soap opera. 💪

Sentiment Analysis

Funding Rates

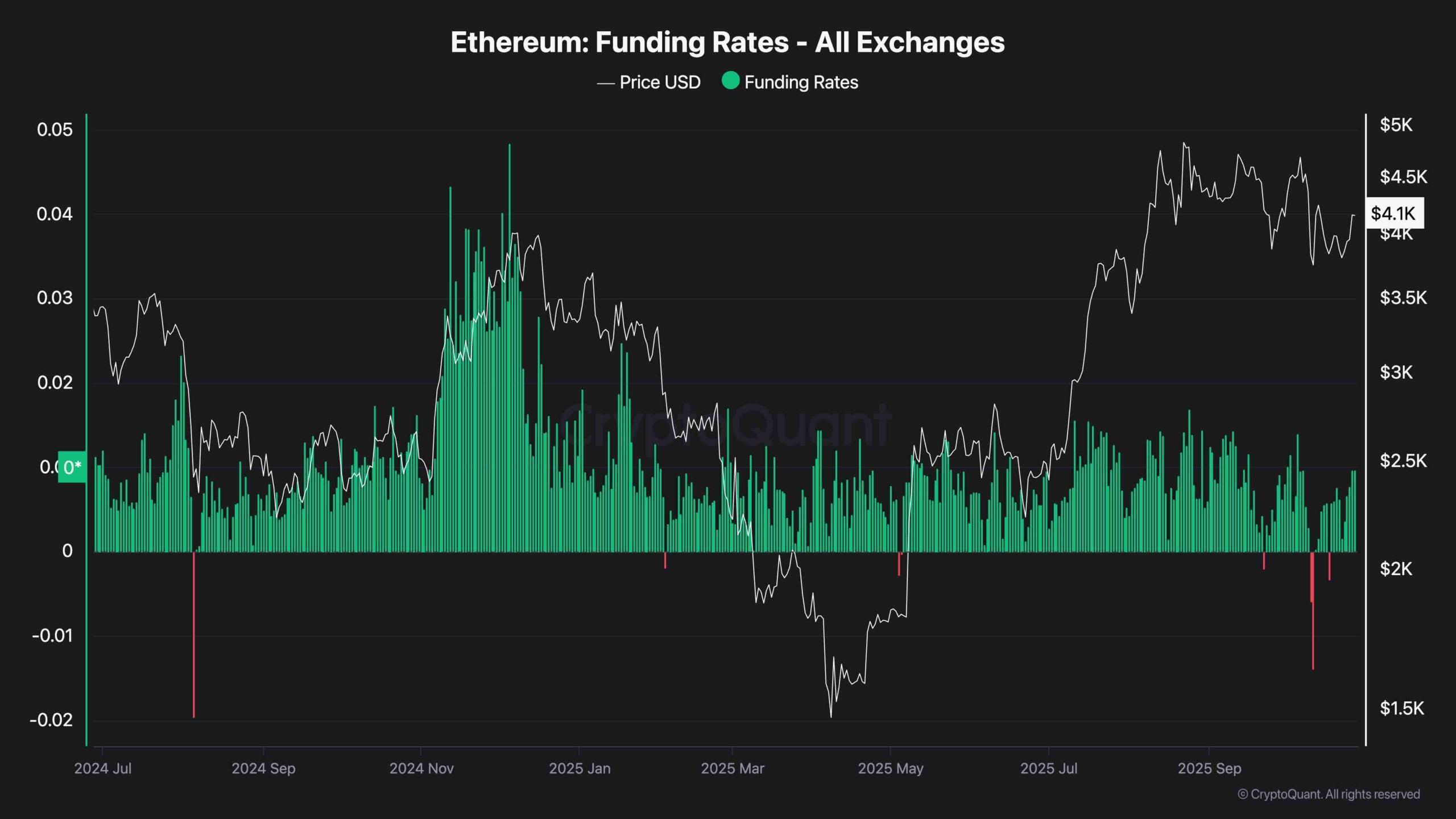

The sentiment in Ethereum’s futures market is growing steadily, like a slow burn, but we’re not at a boiling point yet. After the wild swings in funding rates throughout September and early October, they’ve now turned consistently positive. Traders are leaning toward long positions, hoping the bull runs will carry them to victory. 🏇

But-hold your horses-funding rates aren’t sky-high yet. That’s right, folks, no euphoric frenzy here. We’re not seeing a reckless, over-leveraged frenzy. It’s a sign of cautious optimism, a healthy precursor to a potential breakout. If ETH can manage to clear that resistance, we may be looking at more upside. Fingers crossed! 🤞

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Discover the Hidden Gems: Altcoins Under $1 That Could Make You Rich! 💰

- When Crypto Meets Geopolitics: A Week of Drama, Deals, and Ripple Rumors 🚀💰

- Brent Oil Forecast

- FTX’s Billion-Dollar Circus: When Crypto Goes Rogue and Everyone’s Suing

- When Crypto Flows Turn into a Billion-Dollar Flood 🌊💰

- ETH PREDICTION. ETH cryptocurrency

- SOL’s October Drama: ETFs, Upgrades, and $350 Dreams? 😱💸

- XRP’s DeFi Adventure: The Liquidity Awakens! 🚀💸

2025-10-27 17:58