Oh, darling, Ethereum has been putting on quite the theatrical performance lately-stuck in a tight little trading range like a debutante who’s lost her dance card. 🕺💃

Since July 21, this altcoin diva has repeatedly flirted with resistance near $3,859 while clinging desperately to support at $3,524, unable to decide whether it wants to soar or sulk. Momentum? Fading faster than a soufflé at a weight-loss retreat. Key on-chain metrics now whisper (or perhaps scream) that ETH might be settling in for an extended period of sideways shuffling-or worse, a dramatic price breakdown. Oh, the drama!

The Titans of Ethereum Take a Bow… and Then a Break 🎭

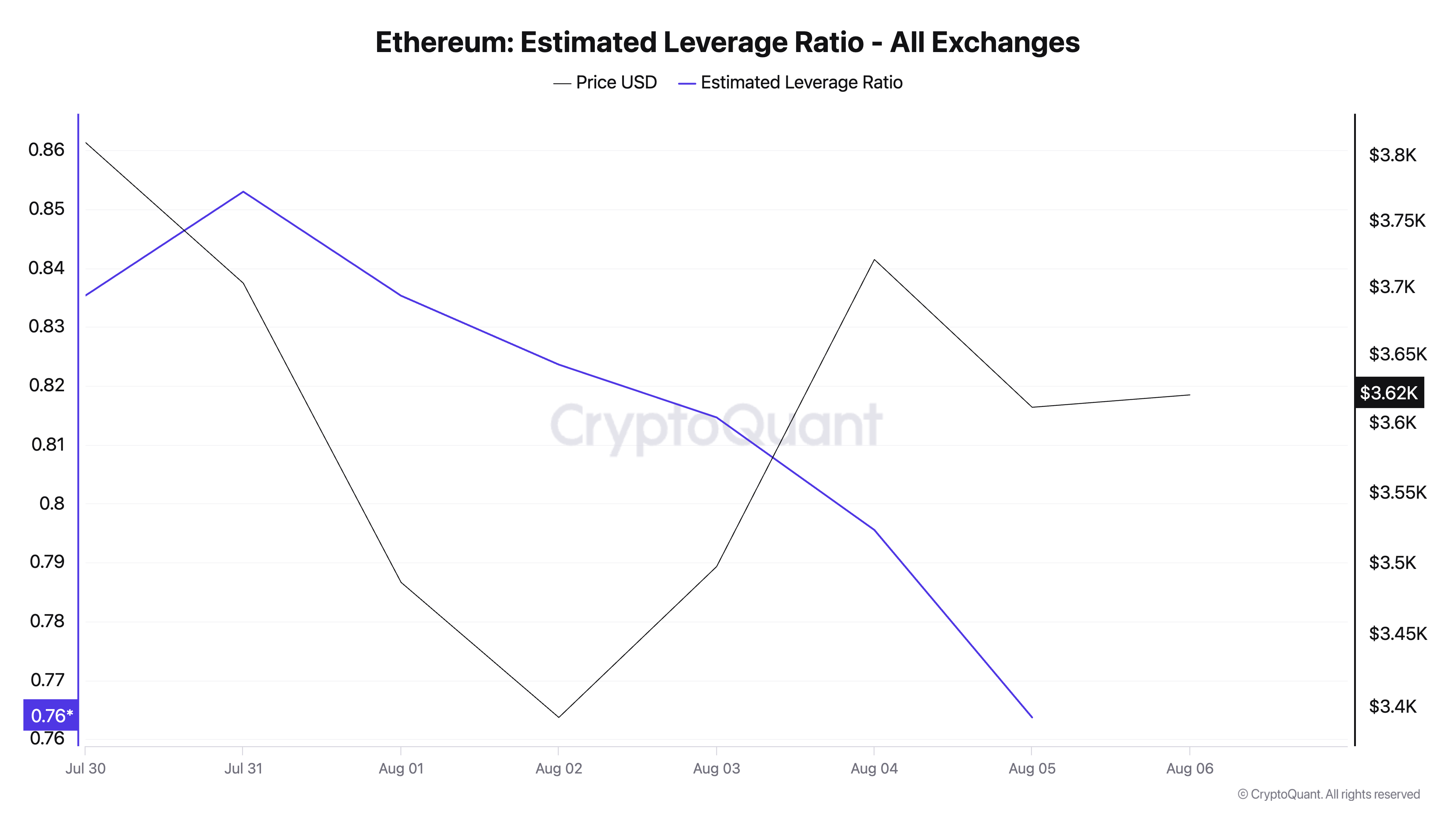

According to the ever-so-serious folks at CryptoQuant, ETH’s estimated leverage ratio (ELR) is looking rather limp across all exchanges. It seems our big players have stepped back, leaving the stage eerily quiet. The ELR now languishes at a weekly low of 0.76-a figure so dreary it could make even Noël Coward himself reach for his pearls.

For those craving more token gossip: Want to stay au courant with the latest market tittle-tattle? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here. Honestly, darling, you’ll thank me later.

Now, let us explain this ELR business without boring you to tears. It measures how much leverage traders are using to play their dangerous games, calculated by dividing open interest by exchange reserves. A declining ELR suggests these thrill-seekers are opting for caution over chaos-a sign they’d rather sip tea than gamble their fortunes away. How terribly civilized of them.

If this trend continues, dear reader, prepare yourself for a snooze-worthy sideways market. And heaven forbid-if support crumbles, we may witness a descent more alarming than a tipsy guest tripping over the host’s Persian rug. 😱

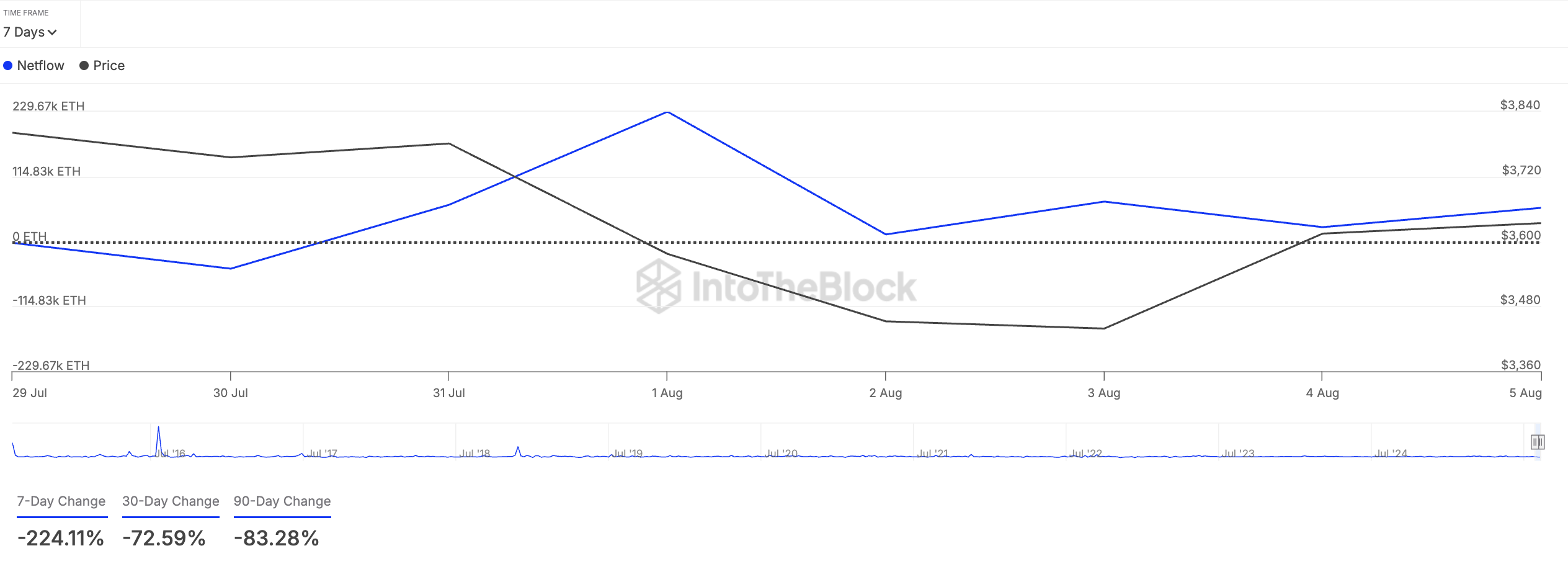

But wait, there’s more! ETH whales-the ones with enough coins to buy small islands-have also taken a holiday from accumulation. IntoTheBlock reveals that large holders’ netflow plummeted by a staggering 224% last week. One can only assume they’ve decamped to Monaco or are simply cashing out to fund their yachts. Either way, it’s bad news for bullish romantics hoping for a grand revival.

Large holders, for context, are addresses controlling over 0.1% of ETH’s circulating supply. When they’re buying, it’s champagne corks popping; when they’re selling, well… let’s just say someone’s forgotten to refill the ice bucket.

Bulls vs. Bears: Who Will Win This Tug-of-War? 🐂🐻

All signs point to waning confidence among ETH’s key players, who seem as reluctant to commit capital as a bachelor dodging matrimonial vows. If this apathy persists, bearish forces will grow stronger, potentially toppling support at $3,524. Should that happen, brace yourselves for a plunge toward $3,067-a fate too grim to contemplate.

However, should the bulls rally with the fervor of a Broadway finale, they might propel ETH above resistance at $3,859. Success would see prices climbing past $4,000, proving once again that hope springs eternal-even in the crypto world. But darling, one must always temper optimism with realism. After all, life (and markets) are nothing if not unpredictable. 🎲✨

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Silver Rate Forecast

- Bitcoin’s Wild Ride: Will You Laugh or Cry? 🤔💸

- Brent Oil Forecast

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- Unbelievable XRP Futures Volume: What You Didn’t See Coming! 😲💰

- ZEC Surges 17%-Is $750 Just Around the Corner? 🚀💰

2025-08-06 17:44