In the last few hours, Ethereum has been struggling to find its footing, much like a ballet dancer on roller skates. On-chain data suggests that more traders are jumping ship, adding to the selling frenzy. As the pressure mounts and crucial price levels crumble, the risk of massive liquidations looms large, potentially sending Ethereum into a nosedive. 😱

Ethereum Faces a Titanic $6 Billion Risk

Over the past 24 hours, Ethereum has taken a sharp turn south, with increased selling pressure pushing it below key support levels. According to Coinglass, a staggering $117 million worth of Ethereum trades have been liquidated. Buyers took a hit of about $72.24 million, while sellers had to close around $44.7 million in short positions. It’s like a game of musical chairs where everyone loses their seat. 🎶💔

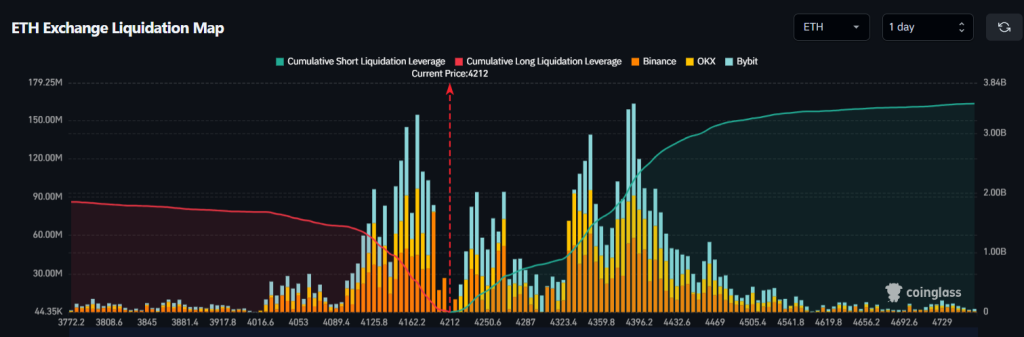

Ethereum has been trying to break through resistance levels, but it’s as if the market is holding up a “No Entry” sign. Coinglass also warns that about $6 billion in long (buy) positions could be at risk if Ethereum dips to $4,200. That’s a lot of money to be on the line, isn’t it? 💸💰

A heatmap of liquidation points reveals a dense cluster of trades that could be forced to close if prices continue to fall. This could trigger a cascade of selling, as traders rush to cut their losses. It’s like a domino effect, but with digital tokens. 🌪️💥

Currently, the majority of traders are betting against Ethereum, which might prompt market makers to push prices higher, possibly up to $4,500, to trigger stop-losses or liquidate short positions. Ethereum’s long/short ratio stands at 0.8447, indicating that about 54% of traders expect the price to decline further. It’s a game of cat and mouse, with the market as the playground. 🐱🐭

However, demand for ETH remains robust among companies with significant holdings. BitMine, the largest holder, announced that it increased its ETH stash by $1.7 billion over the past week, bringing the total to $6.6 billion. That’s like adding a mountain to an already towering hill-373,000 ETH coins, growing their collection from 1.15 million to 1.52 million. This large-scale buying exerts upward pressure on the price, a bullish sign for Ethereum. 📈🔥

What’s Next for ETH Price?

After breaking below the critical support level at $4,400, ETH has continued its downward spiral. This suggests that short-term traders are cashing out. As of writing, ETH is trading at $4,205, down over 2% in the last 24 hours. It’s a rollercoaster ride, and we’re all strapped in. 🎢,

The next crucial level to watch is $4,143. A strong bounce from this level could indicate that buyers are stepping in, potentially turning it into a new support zone. In such a scenario, the ETH/USDT pair might rally, possibly reaching $4,777. Breaking above $4,777 could open the door to a climb towards $5,000. 🚀✨

However, if ETH falls below $4,143 and stays there, it could signal a deeper correction. The price might then dip to around $3,800, and possibly even down to the 50-day moving average at $3,556. It’s a high-stakes game, and only time will tell who wins. 🕰️🔮

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Silver Rate Forecast

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- Bitcoin’s Wild Ride: Will You Laugh or Cry? 🤔💸

- Brent Oil Forecast

- BTC Plummets: ETFs & Risk Aversion Send Crypto into Crisis 🚨

- Unbelievable XRP Futures Volume: What You Didn’t See Coming! 😲💰

2025-08-19 18:53