In the wild west of digital coins, where tumbleweeds of capital twirl about like a dance-off in a saloon, Ethereum seems to be strutting into 2025 like a peacock wearing a tuxedo—its value now strutting above $3,600, mind you! But wait! What’s this? A horde of ETH, more than enough to fill a small city’s junkyard, is lined up anxiously for unstaking, waiting with all the enthusiasm of a child on Christmas morning with empty stockings.🎄

So what does this delightful conundrum mean for our beloved Ethereum’s price trend? Strap on your tinfoil hats, folks, as we dive into the mind-numbing insights of our so-called experts.

Over 350,000 ETH on Hold—What Could This Possibly Imply?

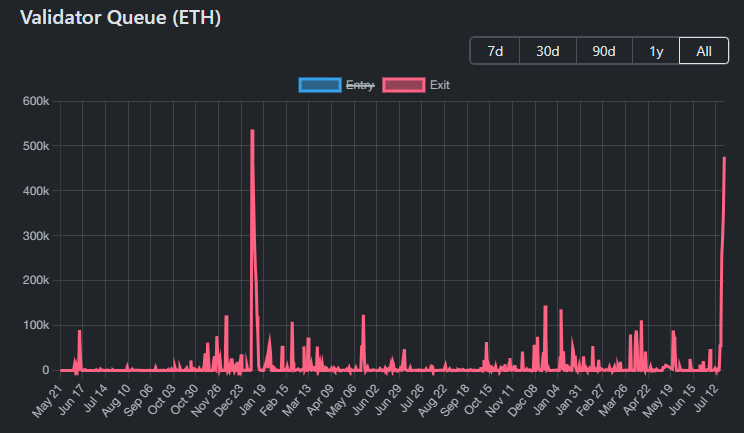

Enter Udi Wertheimer, crypto sage and general alarmist, who burst into the scene waving his crypto scorpion flag upon discovering that well over 350,000 ETH, or around $1.3 billion—a sum that could buy quite a number of fancy hats—are idly waiting in the unstaking queue. It’s like the world’s worst traffic jam, only with more zeros involved.

“There’s 350,000 ETH queued up to unstake. About $1.3 billion. The last time such a stampede of ETH decided to leave, it was January 2024, right after a rally that made everyone think they were shooting for the moon on a pogo stick. Spoiler alert: it went down faster than a lead balloon,” Udi Wertheimer quipped.

Unstaking is like letting your favorite pet out of its cage to roam free, turning those staked ETH back into assets you can actually use—like buying snacks or, more importantly, more ETH.

A surge in unstaking might send a message: the buyers are packing their bags, looking to cash in after a wild 160% joyride since April. 🍾 Meanwhile, a recent bout of unstaking left ETH bouncing between $2,100 and $4,000 like a hyperactive puppy in a room full of squirrels.

Where Will This Unstaked Stash Wander?

Viktor Bunin, crypto prophet from Coinbase, posited that rather than just fleeing in panic, this ETH might instead decide to wisely meander into the serene lands of internal treasury funds, perhaps to retire in the sunny beaches of Long-Term Investments or explore the thrilling hills of Portfolio Diversification.

If that’s the case, then fret not, for it’s not a mad dash for the exits—it’s more like a strategic shuffle across the chessboard. In fact, this could be just the thing to inject some stability into the chaotic crypto realm! 🤔

Meanwhile, our friends over at Lookonchain have discovered that around 23 wealthy whales or maybe just really clever mermen have been quietly amassing a staggering 681,103 ETH (worth a jaw-dropping $2.57 billion) since the first day of July. And the accumulation seems as persistent as your uncle at a buffet!

“This morning, the latest ETH treasury—fittingly dubbed The Ether Machine—announced a new acquisition of $1.5 billion in ETH! That’s akin to winning the lottery! But hold on, just last week Tom Lee from Fundstrat Capital claimed he was poised to snag $20 billion in ETH while Joseph Lubin hinted at at least a further $5 billion. It’s a game of ‘who’s got more ETH’—and to be honest, my crystal ball is quite foggy on who’ll win this ridiculous game!” said Ryan Sean Adams, a crypto sage with a flair for the dramatic.

And What of the ETH Merrily Being Staked?

Wertheimer’s rants may sound like the town crier, warning of impending doom. However, one must consider the perspective of those eager ETH partygoers waiting to join the staking fiesta! 🎉

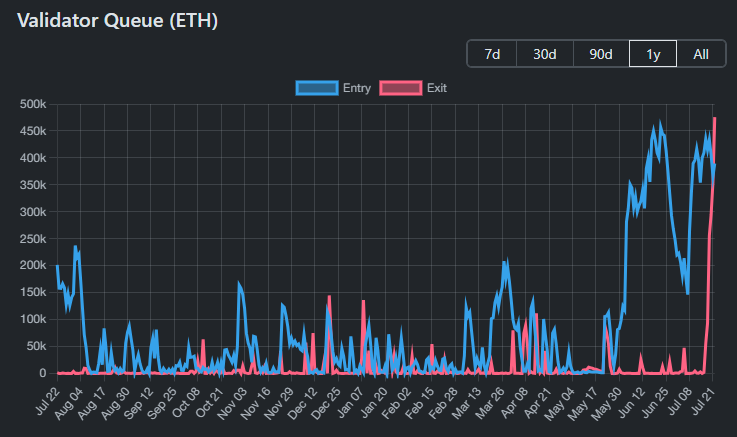

ValidatorQueue’s data suggests there’s a burgeoning pile of ETH just itching to be staked—surpassing the unstaked brigade by a landslide! Since June, there’s been a steady stream of over 450,000 ETH prepping for the latest dance—oh la la!

It reflects a vibrant enthusiasm among investors eager to participate in the Ethereum jive! 💃

“Also, there’s a healthy amount of ETH queued up for staking at this time, which is like finding vegetables in a candy store,” Wertheimer added, slightly bemused.

According to beaconcha.in, over 35.7 million ETH is currently enjoying the sweet embrace of various staking protocols, representing a hearty 29.5% of the circulating supply. It seems our dear crypto doesn’t plan to leave the party anytime soon!

In conclusion, the dance of ETH moving in and out of the staking arena is like a high-stakes game of limbo. The real question remains: is there genuine panic selling, or are these mere strategic maneuvers by institutions and individual investors seeking to seize their fortune on this crypto merry-go-round?

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Coinbase’s Meme Coin Frenzy: A Tale of Farts and Fortunes 🚀💰

- Crypto Courtroom Bombshell: The Surprising Maneuver That Could End It All

- 🤑 New Hampshire’s Bitcoin Bond: Revolution or Reckless Gamble? 🤑

- Bitcoin Billionaire’s Bizarre Stock Scheme: Will It Collapse or Conquer? 🤔

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

2025-07-22 16:52