- Imagine, if you will, a whale—tormented by cosmic gloom—who sells 30,000 ETH in a single gesture, wringing $6.72 million in profit from his own trembling flippers, only to dash back to the market and snatch 16,500 ETH at a loftier $2,818 apiece. Madness or divine inspiration? Or merely indigestion from last night’s borscht?

- The people murmur: should this orgy of profit-taking subside, Ethereum, in some fever dream, may attempt $3,000 once more; otherwise, we gnaw stale bread in a purgatory range of $2,400–$2,700.

Ah, Ethereum! Over the last day, she shook off her melancholy and burst the iron shackles of stagnation—her price ascending to a high not glimpsed for four months. But even as her price soared, the great whales, those gods of our monetary sea, grew impatient with her languid ways. As Dostoevsky might say, “Man grows tired of all things, except, it seems, price swings.”

The Whale’s Gambit: Sell Low, Buy High (Or Vice Versa?)

One whale, feeling perhaps the existential weight of his own enormity, decided to unburden himself. After unloading 30,000 ETH—enough digital ether to intoxicate even the most jaded of nihilists—for a sum of $78.63 million, he retired to rub his hands in profit. How fleeting is the taste of victory! 🤦

Yet what’s this? Not even a day had passed when pangs of regret, nostalgia, or good old-fashioned FOMO drove our hero to scramble back, buying 16,500 ETH at a price even dearer: $2,818. One could almost imagine him muttering, “God sees the truth, but waits… I’m not so patient.”

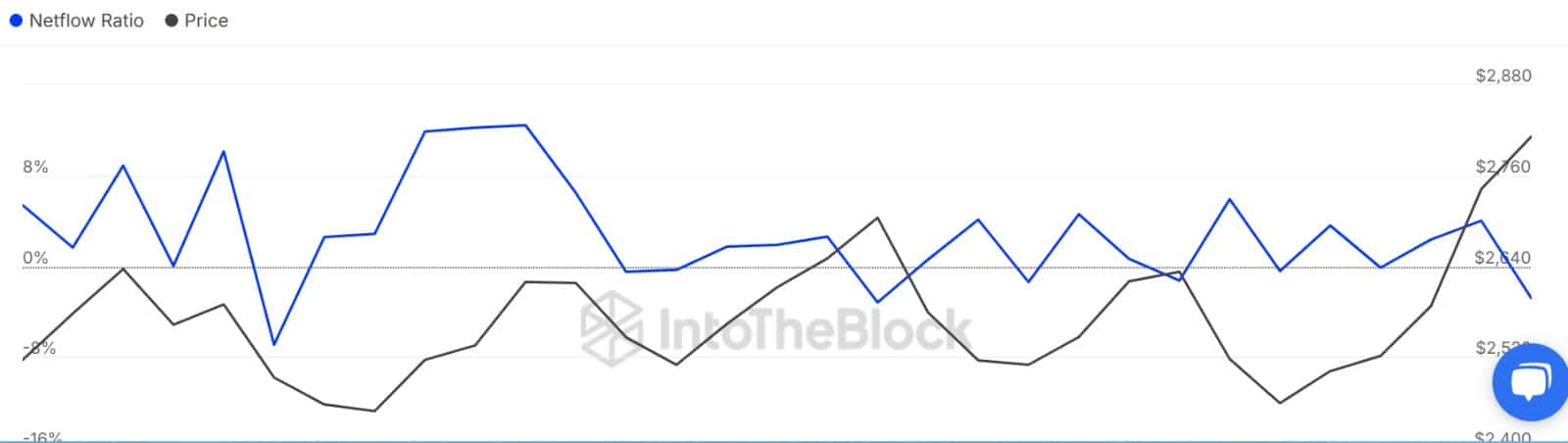

He was not alone. The data philosophers at Spotonchain watched (likely through pince-nez) as this theater of wallets unfolded. Meanwhile, the broader whale congregation huddled, swirling through charts showing a Netflow Ratio of -2.83—a monument to their habit of clutching ETH close in cold storage coffins, far from mortal exchanges.

As if on cue, 140,000 ETH vanished from exchanges—$393 million gone in a single day! The largest exodus in a month. Some say it’s proof of demand; others suspect everyone just forgot their passwords.

In this mad scramble, both whales and the sweaty-palmed retail masses seize Ethereum, lurching between hope, fear, and whatever is left in their wallets after paying gas fees. 🔥

Retreat from the Summit: Profit-Takers Lurk in the Shadows

But lo! The euphoria could not last. Ethereum’s ascent faltered, slipping by 1.76% to $2,756, while the whales stuffed their digital sacks but the commoners—that ever-anxious, eternally suspicious crowd—succumbed to the lure of profit-taking.

Netflow Ratio reversed, exchange inflows overtook outflows—a classic sign of people running for the exits, perhaps muttering, “To sell or not to sell? That is the question.”

This chaotic ballet, a dance of whales and sardines, continues. With ETH crossing her arms and refusing to commit, traders are left in suspense: will she soar to $3,000, or pout within her $2,400–$2,700 prison?

Only when the profit-takers grow weary, or the whales forget their passcodes, might Ethereum bulls storm the barricades. Till then, the market waits… brooding, existentially, as if Dostoevsky himself were trading crypto.

Read More

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Silver Rate Forecast

- 🚀 Ants Gone Wild: $1.24B Korean Crypto Frenzy During Chuseok! 🤑

- Bitcoin’s Bold $112K Move – Is It A Breakout Or A Breakdown? Find Out! 💥💸

- Dogecoin’s $2B Volume Spree: Bearish Brouhaha or Bullish Blunder? 🐕💸

- Schumer’s Secret Stablecoin Standoff—What They Don’t Want You To Know 🪙🤐

- TRX: The Bullish Saga of $0.30 – Will the Whales Save Us? 🐋💰

- The XRP Rollercoaster: Will $2.08 Save or Sink the Altcoin? 🚀💥

- Deutsche Telekom: Now Validating Crypto, Still Not Fixing My Wi-Fi 🤷♂️

2025-06-13 02:20