The Ethereum supply on exchanges has hit rock bottom, with whales gobbling up every last bit. Could this be the prelude to a price explosion, or are we all just waiting for another crash?

So, the Ether stash on big exchanges has dropped to its lowest level since May 2024. This isn’t just some random market hiccup; it’s a full-on investor behavior overhaul. The kind of stuff you tell your friends about at dinner parties (if you’re into crypto at dinner parties, which you probably shouldn’t be).

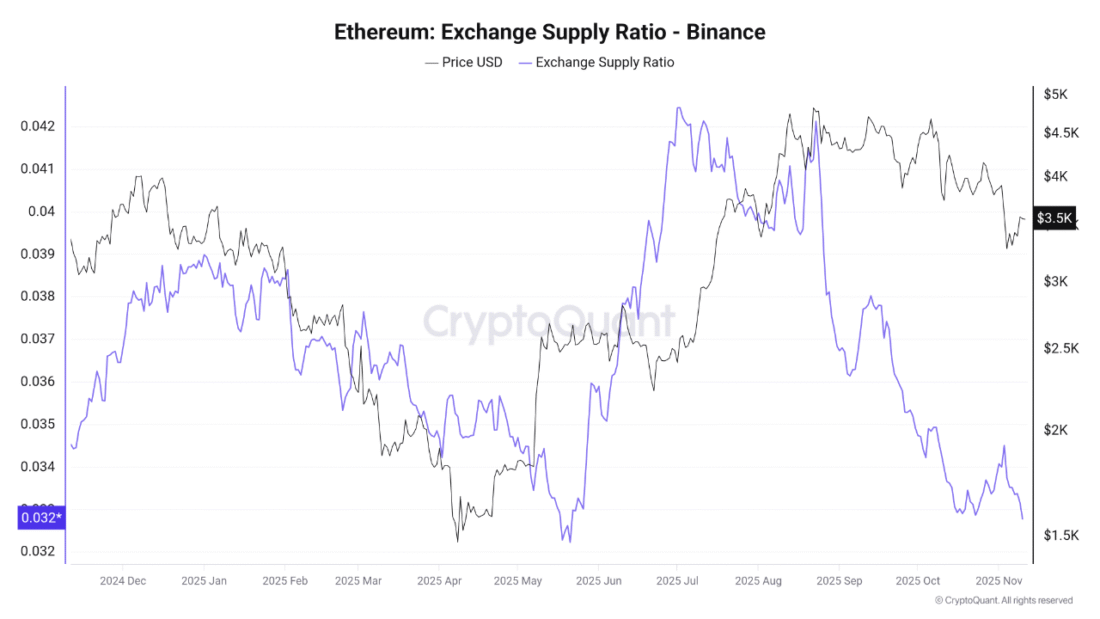

According to the experts over at CryptoQuant and Binance, Ethereum is leaving exchanges faster than your ex left the restaurant after you suggested splitting the bill. More specifically, Binance-the world’s biggest Ethereum trading playground-is seeing a steady stream of ETH packing its bags.

Source – cryptoquant.com/

This isn’t your average “oops, I left my wallet on the table” scenario. No, no-traders are moving their ETH into cold wallets (a.k.a. private vaults) like it’s a secret stash of family heirlooms. And when people stop selling and just hold? Well, that’s often a sign that the future is looking a little more… bullish. 📈

Sure, Ethereum’s price dipped like a bad date after it hit $4,500 (maybe even $5,000!) in mid-2025, but the fact that nobody’s rushing to sell means most investors are in it for the long haul. Like, “I’ll see you in five years” kind of long haul.

Whale Mania: Big Fish Are Buying, Little Fish Are… Not

In case you thought you were the only one stacking ETH, think again. Whales-those charming, deep-pocketed investors holding between 10,000 to 100,000 ETH-have been on a shopping spree. Since April 2025, they’ve added 7.6 million ETH to their bags. That’s a 52% increase, for those keeping track.

Meanwhile, retail investors? Not so much. They’re pulling back like a cat when you try to give it a bath. This little dance is just a reminder that different types of investors have very different attitudes. It’s like comparing a yacht party to a broke college student’s backyard barbecue.

One major player in the ETH game is BitMine Immersion Technologies. Ever heard of them? No? Well, they’ve recently bought up 110,000 ETH, bringing their total holdings to 3.5 million ETH-worth about 12.5 billion. And guess what? They’re not stopping. Their goal is to own 5% of all Ethereum. That’s some serious commitment, folks.

According to BitMine’s chairman (who may or may not have a personalized yacht with a “#1 Ethereum Fan” bumper sticker), the flood of interest is due to Ethereum’s strong fundamentals and upcoming network upgrades. Spoiler alert: This is probably going to make Ethereum even more attractive to investors. So, yeah, if you’re not holding ETH, you might want to ask yourself why. 😬

Ethereum’s Upgrades Are About to Make It Even More Irresistible

Oh, and speaking of upgrades-Ethereum’s next big update, Fusaka, is slated for December 2025. This upgrade promises scalability and efficiency, meaning Ethereum will be even better at handling decentralized apps, decentralized finance (DeFi), and those ridiculously overpriced NFTs that make you question your life choices.

With a lower supply on exchanges and whales buying up more ETH than a hoarder at a garage sale, it’s clear the stage is set for some price stabilization. And when the market catches wind of this? Buckle up, baby. The bullish run might just be around the corner. 🚀

Read More

- Silver Rate Forecast

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Bored Rich Men and Fickle Fortunes: Bitcoin’s Latest Dance with Destiny (and Whales)

- Gold Rate Forecast

- Brent Oil Forecast

- Pi Network’s New Apps: The Future of Crypto or Just Another Snake Game? 🐍

- SHIB PREDICTION. SHIB cryptocurrency

- Crypto’s Dandy Escape: Band-Aids and Banter for the Currency Conundrum 😏

- ProShares Dives into XRP Futures ETF: The Countdown Begins! 🚀

- ETC PREDICTION. ETC cryptocurrency

2025-11-12 06:46