Ethereum Soars to $3,000? The Truth You Can’t Ignore! 🚀🤡

Ah, yes, Ethereum has decided to throw a party, reaching a daring high of $2,832—since February 4, no less. Who knew that blockchain magic could make numbers dance like a drunken ballerina? 🕺💃

In April, ETH was limping like a wounded bear, but now it’s up 102 percent—more than doubling! Its market cap? A staggering $333 billion, enough to buy… well, perhaps a small planet or at least a very expensive coffee. Prices hover around $2,800, but hold onto your hats, because the blockchain press is buzzing with four reasons it might just leap into the $3,000 club. Yep, the “maybe” club, where dreams and numbers collide.

1. Ethereum ETF inflows continue—Money Just Keeps Coming!

Wall Street fat cats are throwing money at ETH like it’s free samples at a grocery store. Data from SoSoValue shows inflows hit $124.9 million on June 10; cumulatively, these funds have poured in $3.5 billion since the dawn of time—or at least since they started tracking it. These inflows have set a record, 17 days straight! BlackRock’s ETHA fund alone has gobbled up $4.97 billion—because nothing says “I love this scam” like aggressive buying. 🎩🐇

2. ETH supply on exchanges is shrinking—Hurry, It’s a Bargain!

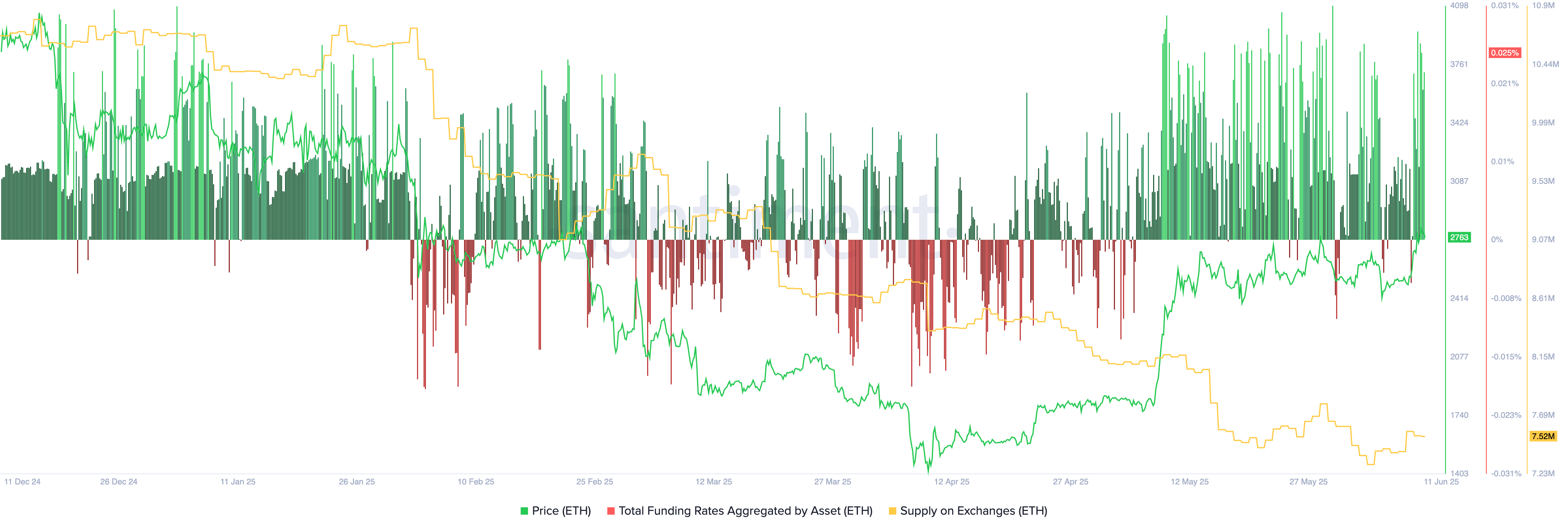

As whales swim happily, Ethereum sitting on centralized exchanges has plummeted from 10.3 million ETH to just 7.52 million—that’s less than your average Monday morning. Since April, when the exchange wallets peeked at 8.75 million, they’ve been on a diet, slimming down faster than a fashion model in Paris.

Some fancy on-chain data reveals a mysterious account—probably belonging to Consensys—snagged 17,864 ETH worth a cool $49.57 million. Now, it’s worth over $213 million. Because what’s life without a little whale-sized gamble? 🐳💰

Within 24 hours, a wallet—maybe belonging to #Consensys—bought 17,864 ETH from #Galxy_Digital OTC. Now, his portfolio’s looking like a small country: 71,671 ETH ($215.9M) plus more, because why not? — The Data Nerd (@OnchainDataNerd) June 11, 2025

And, get this, Ethereum’s funding rate remains positive—meaning traders are betting their shiny coins on even higher prices. Confidence? Maybe. Foolhardiness? Certainly.

3. Ethereum’s Turf: DeFi, RWA, and Stablecoins—The Big League

Ethereum doesn’t just sit around; it dominates like a king ruling over a very lucrative kingdom. DeFi Llama reports a 9.5% increase in total value locked—$143 billion—because apparently, everyone loves to vault their cash here. Ethereum has 62% market dominance, outshining Solana, Tron, and Sui as if they were mere children trying to keep up.

Stablecoins? A hefty $125 billion, because nothing screams stability like a bunch of dollar-pegged tokens in a digital piggy bank. Real-world assets tokenized on Ethereum? A staggering $7.4 billion—more than enough to buy a small yacht or, at least, a fancy coffee machine. 😎

4. Technical Analysis—The Crystal Ball

Looking at charts, ETH bottomed at a humble $1,368 back in April, then decided to climb like a mountain goat. The golden cross—when the 50-day moving average crosses above the 200-day—suggests this isn’t just luck; it’s a sign of more riding the bullish wave. 🏄♂️

The bullish flag pattern looks like a superhero’s cape—long vertical surge, followed by horizontal dreaming. Crossing above the $2,738 Fibonacci level? That’s like waving a red flag saying, “Go to $3,000, buddy!” So hold tight, because the numbers might just lie in wait for that magic number. Or so the chart gods whisper.

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Bitcoin’s Wild Ride: Will You Laugh or Cry? 🤔💸

- Brent Oil Forecast

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Silver Rate Forecast

- Crypto Boom: Figure and Friends Leap into the Market-Is it Genius or Madness? 🤔💸

- Schumer’s Secret Stablecoin Standoff—What They Don’t Want You To Know 🪙🤐

2025-06-11 16:11