Ah, Ethereum-how the mighty have fallen. The beloved ETH, once a beacon of digital hope, has descended to the humble price of $2,700, marking a 8% decline in the last 24 hours. But, dear reader, don’t be fooled by the numbers on your screen; it is not merely the price chart that sends traders into a state of despair. No, according to the ever-astute 10x Research, Ethereum’s gravest concern lies within its very own network-an ever-weakening, sleepily unambitious creature that hasn’t shown much life for nearly two years.

Less users, fewer fees, and a DeFi market so quiet it might as well be napping-Ethereum’s network is simply not making the money it once did. Truly, a sad tale of a once-proud empire.

And now, as this waning demand casts a long, ominous shadow, traders are left to wonder: how, in the name of all things digital, do we assign value to ETH in the future?

ETH’s Activity Has Gone the Way of the Dodo-And Lower Fees Won’t Save It

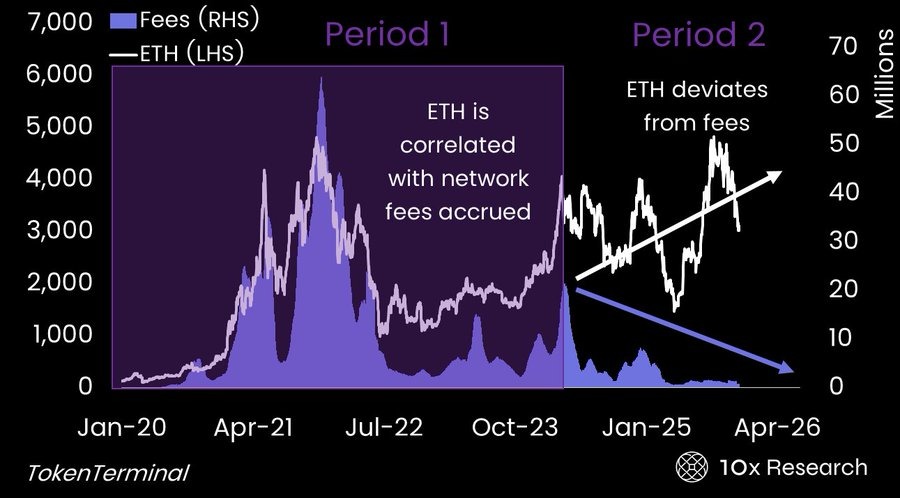

ETH has long been tied to the rhythm of network demand, like a devoted lover to their partner. In the heady days of 2020-2021, when the world was wild with DeFi, NFTs, staking, and crypto gaming, ETH fees soared to the heavens, keeping ETH’s price high even when the market was in a state of turmoil. Ah, the glory days!

But since the summer of 2024, a dark cloud has loomed over Ethereum. Despite the allure of cheaper fees and the mass exodus of users to Layer-2 networks like Arbitrum, Optimism, and Base, Ethereum’s main network is like a ghost town.

DeFi? Weak. NFTs? A mere shadow of their former selves. Fee generation? Down the drain. It’s as if the entire network is in a permanent state of ennui.

Net Inflation: Ethereum’s Party Is Over

Ethereum was once touted as the digital asset that would defy the norms, becoming “deflationary,” burning more ETH than it created. But alas, as with all things too good to be true, reality came crashing in. The last three years have witnessed Ethereum issuing a rather grand total of 4.2 million ETH, but burning only 3.5 million. The result? Net inflation, where burning isn’t quite enough to cancel out the new supply.

Can Ethereum Recover, Or Is It Doomed to Exist in the Land of Speculation?

Ah, the question on everyone’s lips: will Ethereum recover? According to the sagacious 10x Research, recovery hinges not on hype, but on actual usage. Two distinct paths might see ETH’s fortunes rise from the ashes:

- First, regulatory clarity in the United States that could unlock institutional DeFi participation-like a knight in shining armor, if you will.

- Secondly, a fresh wave of Web3 activity could once again spark higher fees and, dare we hope, more robust usage.

Until then, alas, the market may continue to treat Ethereum as a speculative plaything-just another digital asset to toss around like a child with a toy.

Read More

- Gold Rate Forecast

- XRP: The Calm Before the Storm?

- SEC’s Crypto Custody Circus: Who’s Guarding Your Digital Gold? 🎪💰

- Suspected Team Wallet Sent $47M of TRUMP to Crypto Exchanges: Dump Incoming?

- X Accounts Go Rogue: The Flare Security Scare You Won’t Forget

- Is Now the Time to Buy Bitcoin? Shocking Market Signals Unveiled!

- Bitcoin’s Plunge: Are Traders Running for the Hills? 🤑💨

- Silver Rate Forecast

- Mysterious Moves: Crypto Titans’ Bold Bet or Folly? 🤔

- Bitcoin’s $90K Standoff: Is It Playing Hard to Get or Just Confused? 🤔💸

2025-11-21 13:10