Ah, Ethereum (ETH), that darling of the digital realm, teeters precariously at the precipice of its 2021 glory, a mere 2% from its zenith. Yet, like a tragedian in a poorly scripted play, selling pressure has already stolen the scene, dragging its price below the $4,700 mark. And lo! A veritable avalanche of ETH, over $3.5 billion worth, awaits its unstaking in the latter half of August, threatening to transform this drama into a farce of financial proportions. 🤑

The sages of the industry, ever divided in their wisdom, offer opinions as varied as the hues of a peacock’s tail. What shall become of this impending deluge? A tempest in a teapot, or the harbinger of a market maelstrom? 🤔

The Unstaking Queue: A Four-Year High in High Comedy

Staking, that sacred ritual of Ethereum’s Proof-of-Stake (PoS) mechanism, introduced with great fanfare in 2022 after The Merge, demands its acolytes to stake no less than 32 ETH. A noble endeavor, no doubt, securing the network and reaping rewards in return. Yet, the unstaking process, my dear reader, is a bureaucratic nightmare, a queue so tedious it would make even the most patient saint weep. 😩

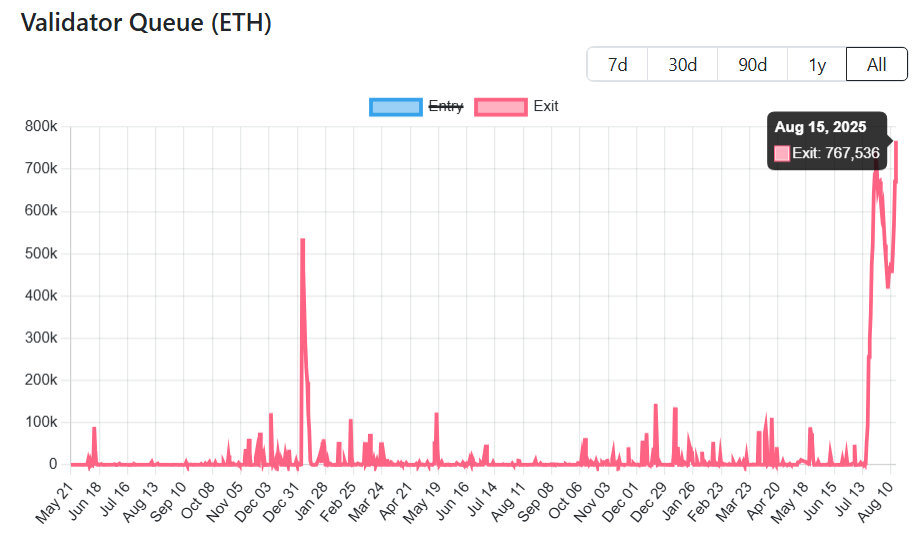

According to the oracles at ValidatorQueue, as of August 15, a staggering 767,536 ETH-a sum so vast it boggles the mind-waits in this queue, the highest since May 2021. A spectacle, indeed, but one that may yet sour the market’s palate before the curtain falls. 🎭

Yet, the market, ever fickle, may not await the full unstaking to feel the tremors. The mere shadow of this sum casts a long, ominous pall over investor sentiment. Samson Mow, the CEO of JAN3, a man of no little repute, warns of a deeper correction, with the ETH/BTC pair potentially plummeting to 0.03 BTC or lower. A dire prophecy, indeed, but one that aligns with the cold logic of supply and demand. ⚖️

“And there’s the pullback. Ethereum still has to come down a lot more. There’s around $3B in ETH that is being unstaked right now, which is a tedious process (by design) whereby you have to queue first and then withdraw. Once the floodgates open, I expect ETHUSD to drop massively,” Mow declared, with the gravitas of a Shakespearean tragedian. 🎤

Kyle Doops, a luminary of X, offers a counterpoint, reminding us that unstaking does not necessarily spell doom. Some ETH, he posits, may find new purpose in DeFi protocols, or simply be held, sparing the market from a deluge of sell-offs. A voice of reason, perhaps, but one that does little to quell the murmurs of uncertainty. 🧐

“Doesn’t automatically mean selling… some of it could be restaked, moved into DeFi, or just held. With withdrawals capped daily, the line’s only getting longer,” Doops explained, with the calm of a philosopher in a storm. 🌪️

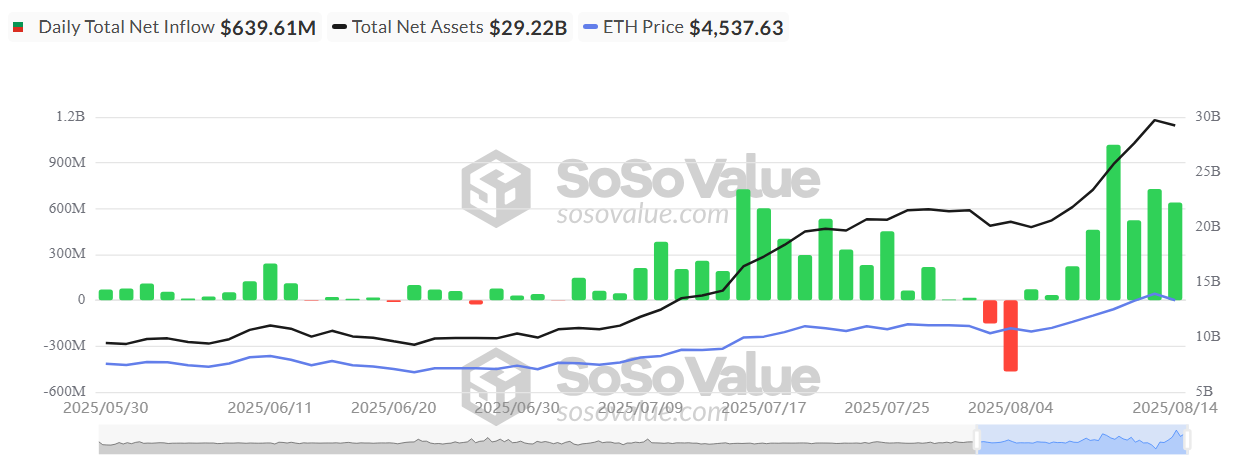

DefiMoon, a sage of DeFi, adds a twist to this tale, suggesting that ETF inflows might yet save the day, absorbing the unstaked ETH and potentially driving prices higher. A silver lining, perhaps, but one that remains to be seen. 🌙

“If ETF inflows average $300m per day that should nullify most of these outflows, but still should be part of the analysis!” DefiMoon proclaimed, with the confidence of a soothsayer. 🔮

And so, the stage is set, the players in place, and the audience awaits with bated breath. Will Ethereum weather this storm, or shall it be swept away in a torrent of unstaked ETH? By the third week of August, the drama will reach its climax, and the market, ever the critic, will deliver its verdict. 🌪️🎭

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- USD RUB PREDICTION

- EUR UAH PREDICTION

- USD TRY PREDICTION

- ADA’s Desperate Hug: 3 Signs It Won’t Kiss $0.45 Goodbye 💸

- Brent Oil Forecast

- Bitcoin Hits $10M? Doubters Still Say It’s Hogwash 🤡📉

- 🚨 DOJ’s $14B Bitcoin Heist: Pig-Butchering Scammer’s Fortune Seized!

- TRX PREDICTION. TRX cryptocurrency

2025-08-15 15:53