Ah, Ethereum! That digital darling, ever striving for recognition in the vast, capricious landscape of cryptocurrencies. It seems but yesterday the US Securities and Exchange Commission (bless their bureaucratic hearts) deigned to approve options trading for several spot exchange-traded funds (ETFs). A move, they say, to increase liquidity, attract the monied gaze of institutional investors, and, dare we dream, solidify Ethereum’s position as a major player. One can only hope it doesn’t end up as another fleeting fancy 😔.

Yet, dear reader, let us not be naive. Ethereum, with its somewhat diminutive market cap compared to the hulking Bitcoin, is, alas, vulnerable to those dreaded gamma squeezes. A situation, I assure you, that does little to soothe the nerves of cautious investors. BeInCrypto, in its infinite wisdom, consulted an expert in the dark arts of derivatives trading, along with representatives from FalconX, BingX, Komodo Platform, and Gravity, to dissect the potential impact of this most curious of developments. Will it be a boon, or a burden? Only time, and the whims of the market, will tell 🤔.

Ethereum ETF Options Receive the SEC’s Nod (Finally!)

The Ethereum community, a fervent bunch to be sure, erupted in joyous celebration earlier this month when the SEC (after what seemed like an eternity) granted its blessing for options trading on existing Ethereum ETFs. This, my friends, marks a most significant regulatory milestone for digital assets. One almost expects trumpets to sound and doves to take flight 🕊️!

This week, the curtain rose on the official debut of options trading for spot Ethereum ETFs in the United States. BlackRock’s iShares Ethereum Trust (ETHA), ever the eager debutante, was the first to list options, with trading commencing on the Nasdaq ISE. Such haste! Such eagerness!

Shortly thereafter, a veritable flood of options followed, including those for the Grayscale Ethereum Trust (ETHE) and the Grayscale Ethereum Mini Trust (ETH), as well as the Bitwise Ethereum ETF (ETHW), all of which began their dance on the Cboe BZX exchange. A veritable cotillion of crypto opportunities!

This allows a wider array of investors, beyond the usual crypto speculators, to partake in the joys of hedging and speculation on Ethereum’s price. All through the familiar and comforting vehicle of ETFs, without the messy business of direct ownership. How very civilized!

The timing of this news, wouldn’t you agree, is rather opportune, as Ethereum has been, shall we say, losing a bit of ground in the market lately. Perhaps this is the tonic it needs 🍸.

Options Trading: A Tonic for Ethereum’s Ailing Market Position?

A palpable decline in market confidence has indeed surrounded Ethereum this week, with BeInCrypto (ever the diligent chronicler) reporting its price had plummeted to its lowest depths since March 2023. A most unfortunate coincidence with a broader market downturn, exacerbated, some might say, by Donald Trump’s rather… spirited Liberation Day 😬.

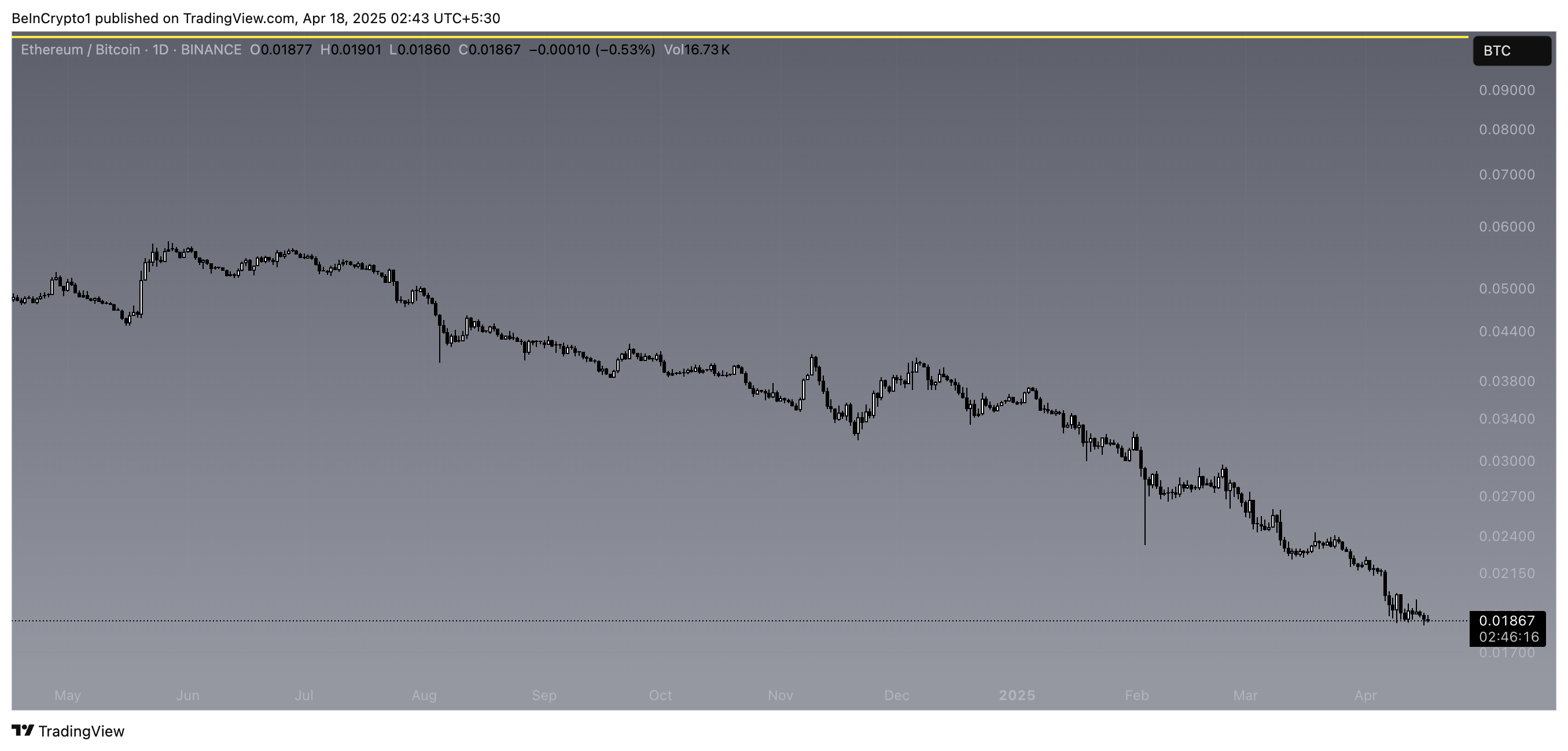

Further fueling this bearish fire, the ETH/BTC ratio has sunk to a five-year low, a stark reminder of Bitcoin’s ever-growing dominance over its younger sibling. Will Ethereum ever escape its shadow? 🤷

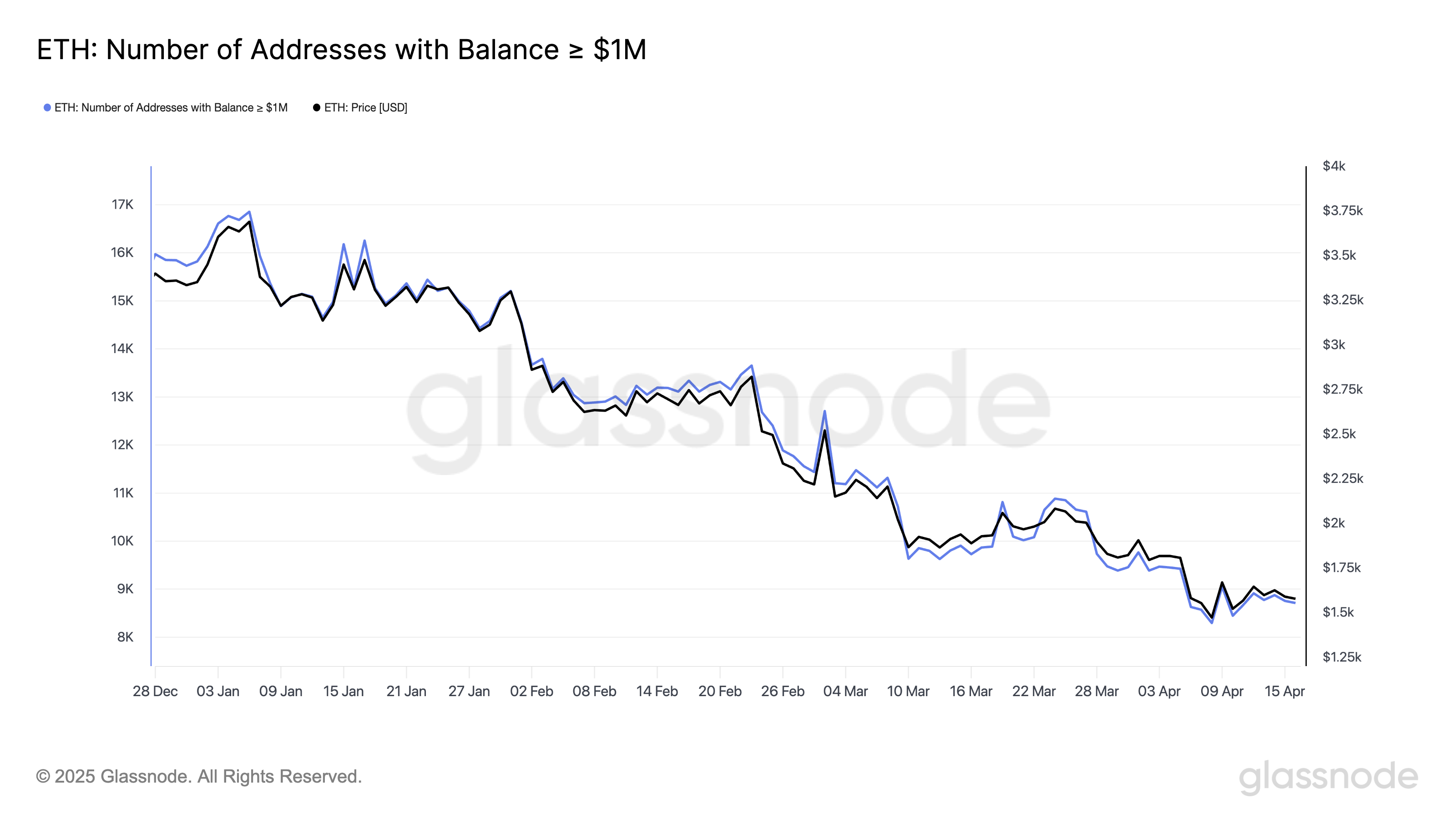

Meanwhile, the grandees of the Ethereum world, those large holders, are increasingly divesting themselves of substantial amounts, putting downward pressure on prices. Ethereum’s value has taken a rather undignified tumble of 51.3% since the dawn of 2025, and investor confidence has waned, as evidenced by a noticeable decrease in addresses holding at least $1 million in ETH. Oh, the indignity!

With options trading now within reach of a wider audience, experts (those ever-optimistic souls) anticipate that Ethereum’s market position will, in fact, improve. One can only hope they are not wearing rose-tinted spectacles 🌹.

“ETH’s been leaking dominance, stuck sub-17%. Options give it institutional gravity. It becomes more programmable for fund strategies. More tools mean more use cases, which then in turn means more capital sticking around,” declared Martins Benkitis, CEO and Co-Founder of Gravity Team. A bold prediction, indeed!

This newfound accessibility of options trading, we are told, will unlock a treasure trove of opportunities for investors and the broader Ethereum ecosystem. Riches beyond measure, perhaps? 💰

Greater Investor Access and, Dare We Say, Liquidity

The SEC’s approval of Ethereum ETFs in July 2024 was, without a doubt, a watershed moment. It allowed traditional investors to dip their toes into the crypto waters without the perceived risk of directly holding the assets. Now, with options trading added to the mix, these benefits are expected to multiply exponentially. A veritable explosion of opportunity!

“It will provide additional opportunities for portfolio diversification and create more avenues for ETH-based products. With options beyond the limited Bitcoin ETF offerings, investors may reconsider how they allocate their funds. This shift could result in more sophisticated trading strategies and greater participation in Ethereum-based products,” Vivien Lin, Chief Product Officer at BingX, informed BeInCrypto. A symphony of financial instruments, it seems!

The Ethereum ETF market, naturally, will become more liquid with increased participation through options trading. A veritable river of riches flowing through the digital veins of Ethereum 💸.

High Trading Volumes and the Insatiable Demand for Hedging

The SEC’s recent blessing of options trading for Ethereum ETF investors suggests that the market will likely experience an initial surge in trading volume. As a result, market makers must be prepared for the onslaught. One can almost hear the gears grinding and the calculators whirring ⚙️.

An increase in call options will necessitate that institutional market makers hedge their positions by acquiring more Ethereum to meet the ever-growing demand. A delicate dance of supply and demand!

“This is the canonically accepted dynamic of options markets bringing better liquidity to spot markets,” explained derivatives trader Gordon Grant. A truism, no doubt, but one worth repeating!

Ethereum will also secure a unique advantage, particularly in the realm of institutional trading, enhancing its perceived quality and fostering optimism among key market participants. A veritable coming-of-age for the digital currency!

“ETH just got a serious institutional tailwind. With options now in play, Ether is stepping closer to BTC in terms of tradable instruments. This levels up ETH’s legitimacy and utility in hedging strategies, narrowing the gap on Bitcoin’s dominance narrative,” Benkitis declared to BeInCrypto. A bold statement, but one that resonates with a certain truth.

Yet, let us not forget, rapid surges in options trading could also unleash unintended consequences on Ethereum’s price, especially in the short term. A cautionary note amidst the celebrations!

Will Investors Fall Prey to a Gamma Squeeze?

As market makers scramble to acquire more of the underlying asset in anticipation of a higher volume of options calls, Ethereum’s price will naturally rise. This situation, my friends, could lead to a rather pronounced gamma squeeze. A squeeze, I assure you, that is far less pleasant than it sounds!

When market makers hedge their positions in this scenario, the resulting buying pressure would create a positive feedback loop. Retail investors, ever eager to join the fray, will feel compelled to participate, hoping to profit from Ethereum’s soaring price. A self-fulfilling prophecy, perhaps?

The implications of this scenario are particularly acute for Ethereum, given its market capitalization is notably smaller than that of Bitcoin. A David versus Goliath situation, if you will!

Retail traders’ aggressive buying of ETHA call options could compel market makers to hedge by acquiring the underlying ETHA shares, potentially leading to a more pronounced effect on the price of ETHA and, by extension, Ethereum. A domino effect of digital proportions!

“We believe option sellers will generally dominate in the long-run but in short bursts we could see retail momentum traders become massive buyers of ETHA calls and create gamma squeeze effects, similar to what we’ve seen on meme coin stocks like GME. ETH will be easier to squeeze than BTC given it is only $190 billion market cap vs BTC’s $1.65 trillion,” Joshua Lim, Global Co-head of Markets at FalconX, revealed to BeInCrypto. A chilling prospect, indeed!

Meanwhile, Grant predicts that arbitrage-driven flows will further exacerbate price swings. A veritable tempest in a teacup!

Arbitrage Opportunities: A Siren Song for Experienced Investors

Seasoned investors in options trading, those cunning strategists, may well pursue arbitrage to reap profits and mitigate risk exposure. A game of cat and mouse in the digital marketplace!

Arbitrage, as you may know, involves exploiting price discrepancies for the same or nearly identical assets across different markets or forms. This is achieved by buying in the cheaper market and selling in the more expensive one. A simple concept, yet devilishly complex in execution!

According to Grant, traders will increasingly seek out and exploit these price differences as the market for ETH options on different platforms matures. A veritable gold rush for the financially astute!

“I would expect more arbitrage behaviors between deribit CME and spot eth options and while one sided flows across all three markets could be temporarily destabilizing, greater liquidity through a diverse array of venues should ultimately dampen the extrema of positioning driven dislocations and the frequency of such dislocations. For instance, it appears – anecdotally as the data is still inchoate – that vol variance on btc is declining post intro of iBit options,” he explained. A mouthful, to be sure, but one that speaks of intricate market mechanics!

While arbitrage activity is expected to refine pricing and liquidity within the Ethereum options market, the asset continues to operate under the long shadow of Bitcoin’s established market leadership. A constant reminder of the hierarchy in the crypto kingdom 👑.

Will This Landmark Options Approval Help Ethereum Close the Gap on Bitcoin?

Though Ethereum has achieved a significant milestone this week, it faces fierce competition from its formidable rival: Bitcoin. A battle for supremacy that has captivated the crypto world!

In the late autumn of 2024, options trading commenced on BlackRock’s iShares Bitcoin Trust (IBIT), becoming the first US spot Bitcoin ETF to offer options. Though less than a year has elapsed since its inception, options trading on Bitcoin ETFs has experienced robust trading volumes from both retail and institutional investors. A testament to Bitcoin’s enduring allure!

According to Kadan Stadelmann, Chief Technology Officer of Komodo Platform, options trading for Ethereum ETFs will be comparatively underwhelming. Bitcoin, he believes, will remain the cryptocurrency of choice for investors. A somewhat pessimistic outlook, wouldn’t you say? 😒

“Compared to Bitcoin’s Spot ETF, Ethereum’s ETF has not seen such stalwart demand. While options trading adds institutional capital, Bitcoin remains crypto’s first mover and enjoys a greater overall market cap. It is not going anywhere. It will remain the dominant crypto asset for institutional portfolios,” Stadelmann declared to BeInCrypto. A stark assessment of the current state of affairs!

Consequently, his prognosis does not include Ethereum’s market position surpassing Bitcoin’s in the foreseeable future. A dashed dream for Ethereum enthusiasts, perhaps? 💔

“The once-promised flippening of Bitcoin’s market capitalization by Ethereum remains unlikely. Conservative and more-monied investors likely prefer Bitcoin due to its perceived safety compared to other crypto assets, including Ethereum. Ethereum, in order to achieve Bitcoin’s prominence, must depend on growing utility in DeFi and stablecoin markets,” he concluded. A long and arduous road ahead for Ethereum, it seems!

While that may indeed be the case, options trading certainly does no harm to Ethereum’s prospects; it only bolsters them. A silver lining amidst the clouds of doubt!

Can Ethereum’s Options Trading Era Capitalize on Opportunities?

Ethereum now holds the distinction of being the second cryptocurrency with SEC approval for options trading on its ETFs. This singular act will further legitimize digital assets in the eyes of institutions, augmenting their presence in traditional markets and amplifying overall visibility. A step in the right direction, undoubtedly!

Despite the recent blows to Ethereum’s market position, this news is a decidedly positive development. Although it may not suffice to dethrone its primary competitor, it represents a step forward on the path to crypto glory. Onward and upward, Ethereum! 🚀

As investors acclimate themselves to this new opportunity, their level of participation will ultimately reveal the true extent of its benefits for Ethereum. Only time, as always, will tell. The future, dear reader, remains unwritten ✍️.

Read More

- Silver Rate Forecast

- ZK PREDICTION. ZK cryptocurrency

- SPEC PREDICTION. SPEC cryptocurrency

- DOT PREDICTION. DOT cryptocurrency

- USD CHF PREDICTION

- Will XRP Break $3 or Just Break Our Hearts? 🤡

- ETH CAD PREDICTION. ETH cryptocurrency

- Ethereum’s Sudden Surge: A 10% Spike in Active Addresses! Is $1,850 Next?

- Bitcoin’s Wild Ride: Is a Market Squeeze on the Horizon?

- Brent Oil Forecast

2025-04-18 12:23