Ah, the capricious whims of the market! On this fine Wednesday, the U.S. stocks, like a troupe of overzealous actors, burst onto the stage with a flourish of optimism, only to stumble mid-performance, their enthusiasm waning as the curtain of reality descended. Stronger-than-expected jobs data, that mischievous imp, pushed Treasury yields higher, and lo, the hopes for near-term Federal Reserve rate cuts were trimmed like a hedge in a Russian garden.

Wall Street’s Early Frolic Fades as Jobs Data Plays Spoilsport

At the hour of this scribbling, on the 11th of February, 2026, the Dow Jones Industrial Average, that venerable barometer of capitalist fervor, had retreated some 120 points, or 0.2%, to linger near 50,068. A brief ascent of 300 points earlier in the session was but a fleeting dream. The S&P 500, ever the cautious companion, slipped about 0.2% to circa 6,928, while the Nasdaq Composite, that enfant terrible of the trio, trailed with a 0.5% drop to roughly 23,000. The markets, ever fickle, remain open, their intraday swings a ballet of uncertainty.

The catalyst for this drama? January’s nonfarm payrolls report, delayed by the farcical government shutdown, revealed 130,000 jobs added-a figure that far exceeded the meager 50,000 foretold by the soothsayers of economics. The unemployment rate, too, ticked down to 4.3% from 4.4%, a testament to the labor market’s stubborn resilience. Yet, as in all tragedies, this strength came with a catch.

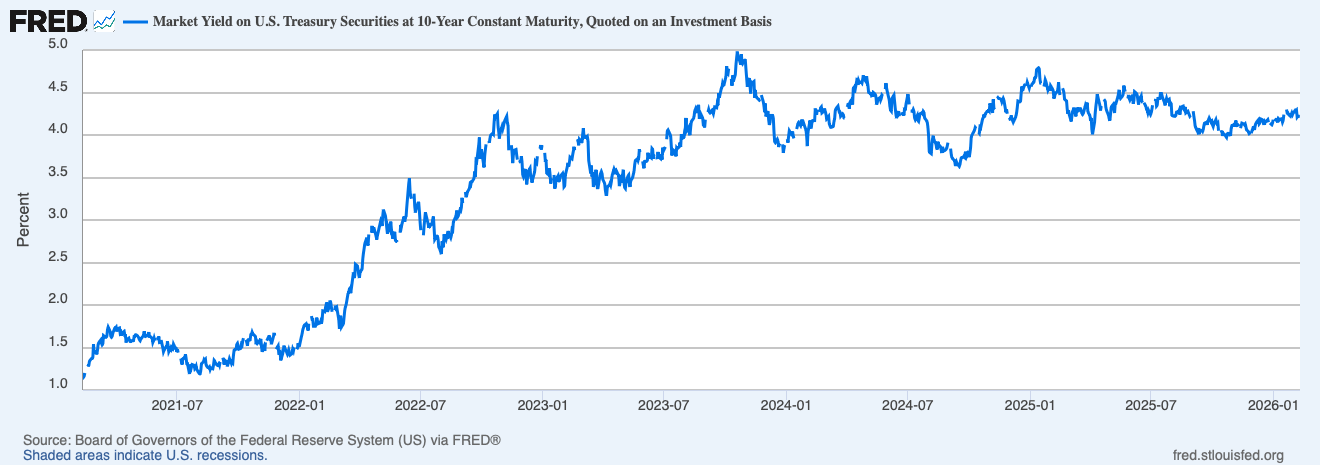

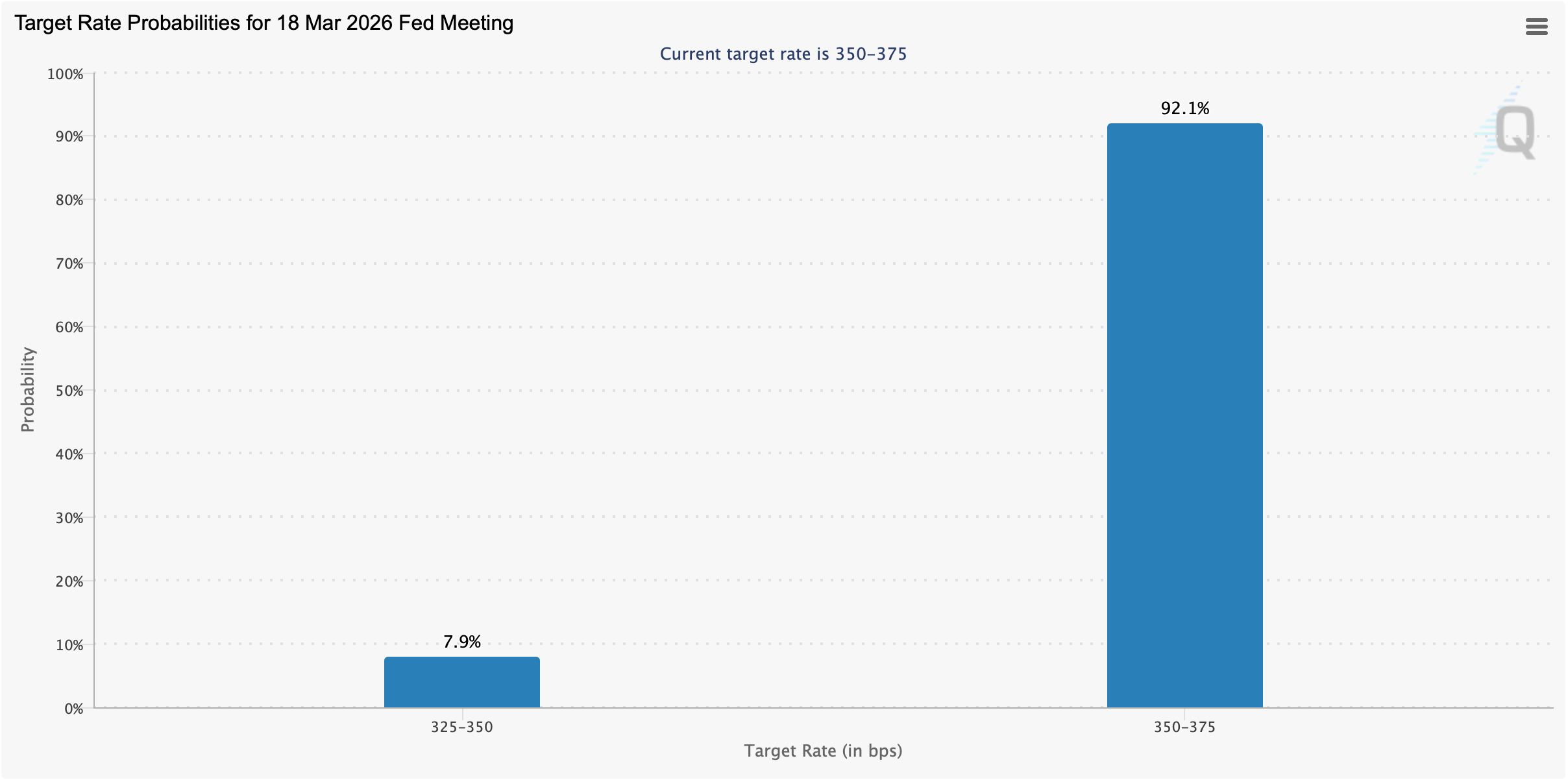

Treasury prices, those delicate flowers, wilted, sending the 10-year yield to about 4.22%, up from its previous 4.18%. Higher yields, those gravitational forces, pulled equity valuations earthward, particularly in the growth-heavy corners of the market. Traders, ever the pragmatists, recalibrated their expectations for the Federal Reserve, with limited cuts now priced in and most bets shifting to the languid days of midyear or later.

This reversal marks a stark contrast to Tuesday’s close, when the Dow notched its third consecutive record at 50,188.14. The S&P 500 and Nasdaq, however, ended that session lower, their spirits dampened by weaker retail sales data and the selective profit-taking in technology shares. A tale of two markets, one might say.

Earnings season, that perennial circus, added its own layer of complexity. Vertiv Holdings, with its upbeat guidance tied to data center demand, rallied sharply, while Lyft, Robinhood, and Mattel declined following softer results and outlooks. Stock-specific reactions have widened sector performance gaps, keeping volatility elevated, even as index-level moves appear modest. A comedy of errors, if ever there was one.

Technology and communication services stocks, those darlings of the recent artificial intelligence (AI) enthusiasm, faced renewed scrutiny. Financials, ever the stalwarts, showed relative resilience as rising yields supported net interest margins, while energy stocks found solace in firmer oil prices amid geopolitical tensions. A tapestry of fortunes, woven with threads of greed and fear.

Precious metals, those eternal refuges, logged gains on Wednesday, with gold rising 0.66% above the $5,000 range. Silver, too, traded at $83 per ounce, up 2.43% over the last day. The crypto economy, like its equity brethren, is down, shedding 3.2% to drop to $2.28 trillion by mid-day. Bitcoin, that digital enigma, has lost 3.8% against the greenback over the last seven days. A reminder, perhaps, that all that glitters is not gold.

Looking ahead, Friday’s consumer price index (CPI) report looms as the week’s marquee event. Inflation data, that ever-present specter, could either reinforce the “higher for longer” narrative or reopen the door to earlier rate relief. Analysts, those eternal optimists, estimate blended fourth-quarter earnings growth near 12% for the S&P 500, with 2026 projections in the mid-teens, though these assumptions hinge on stable inflation and steady demand. A house of cards, built on the sands of uncertainty.

For now, the market’s message is clear: strong economic data is welcome-but not if it complicates the Fed’s path. With CPI on deck and earnings still rolling in, Wall Street appears poised for more intraday whiplash before the week is done. A drama, indeed, worthy of the great Russian novels.

FAQ 📉

- Why did U.S. stocks turn lower midday on Feb. 11, 2026?

Stronger-than-expected January jobs data pushed Treasury yields higher and reduced expectations for near-term Fed rate cuts. A classic case of too much of a good thing. - How are Treasury yields affecting the stock market?

Higher yields increase borrowing costs and weigh on equity valuations, particularly for growth-oriented stocks. Gravity, it seems, applies to markets as well. - Which index is underperforming today?

The Nasdaq Composite is lagging with a larger percentage decline compared to the Dow and S&P 500. The enfant terrible, ever the outlier. - What’s the next major catalyst for markets this week?

Friday’s CPI report could shape expectations for inflation and Federal Reserve policy. The plot thickens, as they say.

Read More

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- Gold Rate Forecast

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Whale of a Time! BTC Bags Billions!

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

- FTX’s Billion-Dollar Circus: When Crypto Goes Rogue and Everyone’s Suing

- XRP’s Comedy of Errors: Still Falling or Just Taking a Break? 😂

- Stripe’s Latest Acquisition: A Crypto Wallet Adventure Awaits! 🚀💰

2026-02-11 21:37