On a fateful Saturday, August 9, the digital canine known as Dogecoin, that whimsical creation of the internet, leapt forth with a vigor not seen in a fortnight, crossing the hallowed threshold of $0.25. Ah, the sweet taste of victory! It outshone even the mighty Ethereum, claiming the title of the most illustrious performer among the top ten cryptocurrencies, as if it were a dog chasing its own tail, blissfully unaware of the absurdity of its own existence.

This jubilant ascent was not merely a stroke of luck; nay, it was propelled by a heady concoction of ETF-related optimism and a surge in speculative trading, as if traders were throwing darts at a board blindfolded, hoping for the best. 🎯

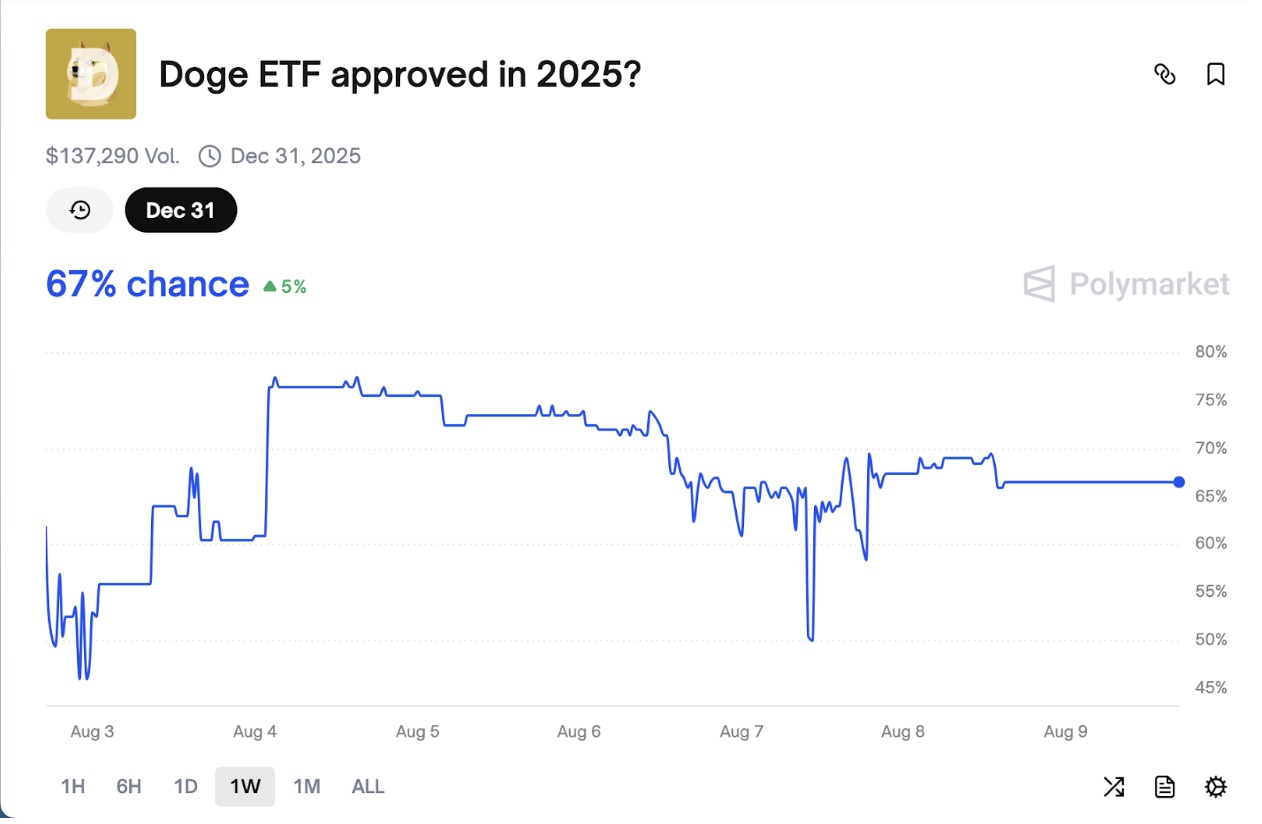

Dogecoin ETF Approval Odds as of August 9, 2025 | Source: Polymarket

Market sentiment, that fickle mistress, improved as confidence in the potential approval of a Dogecoin ETF swelled by a staggering 5%. According to the ever-reliable prediction market Polymarket, the odds of approval soared to 67%-a veritable rocket ship of optimism! This surge added fuel to an already roaring market rally, sending DOGE soaring above its 14-day moving resistance level, as if it were a bird freed from its cage, flapping its wings in joyous abandon.

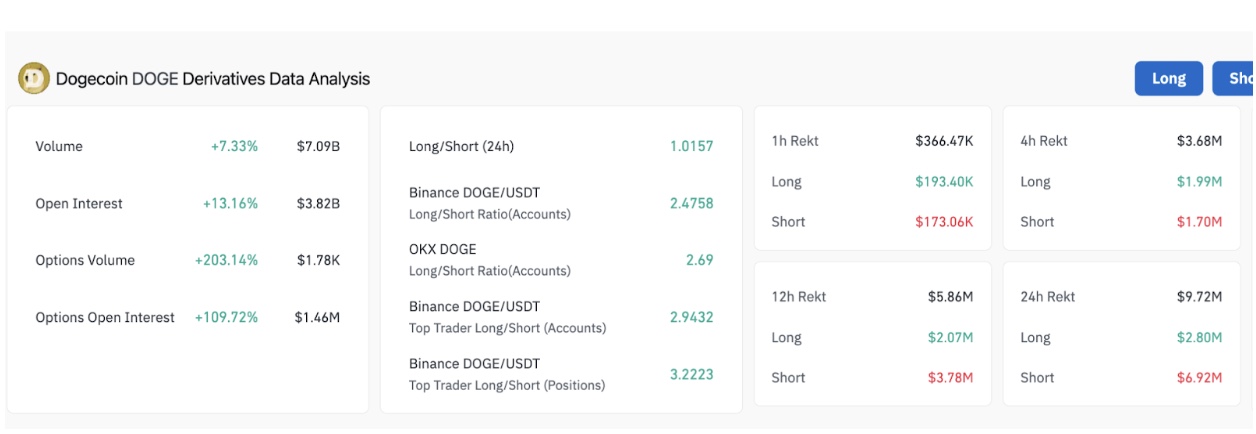

Dogecoin Derivative Market Analysis, August 9, 2025 | Coinglass

The metrics of Dogecoin derivatives trading over the past 24 hours reflected this newfound bullish appetite. As illustrated in the Coinglass chart above, open interest surged by 13.16% to a staggering $3.82 billion, outpacing the spot price gains. It seems that leveraged traders are positioning themselves for further upside, as if they were preparing for a grand feast, eyes gleaming with anticipation.

The long/short ratio across major exchanges further confirmed this bullish bias. On Binance, the overall account-based long/short ratio stood at 2.47, while the top traders, those daring souls, held an even more aggressive bullish ratio of 3.22. The same sentiment echoed on OKX, with a ratio of 2.69, as if the entire market were a chorus singing in unison, “To the moon!” 🚀

Liquidations over the past 24 hours totaled a staggering $9.72 million, skewed toward shorts, with $6.92 million wiped out compared to a mere $2.80 million for longs. This confirms that the short squeeze effect has likely propelled DOGE’s latest price breakout toward the coveted $0.25 mark, as if the shorts were caught in a net, flailing helplessly.

Dogecoin Price Forecast: Bulls Eye $0.268 Breakout Target

Technically speaking, Dogecoin has decisively broken above the mid-Bollinger Band and the 50-day moving average at $0.225, on pace to post four consecutive daily gains. As seen below, DOGE’s next major overhead resistance now lies at the $0.26 level, marked by the upper Bollinger Band-a level not seen since the dark days of late July.

Dogecoin Derivative Market Analysis, August 9, 2025 | Coinglass

The daily RSI sits at 61.39, reflecting strong momentum while still shy of overbought conditions. Considering that top assets like Ethereum and Solana have already claimed new monthly time frame peaks, strategic short-term traders may consider Dogecoin price undervalued, despite its current overbought signals. It’s a curious paradox, much like a cat that enjoys a bath-unexpected yet oddly delightful.

A daily close above $0.243 with sustained volume could see DOGE push toward $0.258 as an interim resistance, before retesting the $0.268 band top. A breakout above $0.268 would open the door for a rally toward $0.285, where prior selling pressure capped gains last month, as if the market were playing a game of hide and seek.

However, failure to maintain $0.225 support could see a pullback to $0.211, the mid-range of the recent rally. A drop below $0.211 would expose the $0.182 lower Bollinger Band, effectively erasing the current monthly timeframe gains, much like a magician’s disappearing act.

Yet, this scenario currently appears unlikely. Dogecoin derivatives positions are heavily skewed long, and Bitcoin’s 2% intraday rally to $117,900 on Saturday, after Harvard took a $116 million stake in Blackrock iBit BTC ETF, has sparked fresh upside momentum. It’s a wild world we live in, where academia meets the absurdity of cryptocurrency! 🎓💰

Read More

- Gold Rate Forecast

- USD HUF PREDICTION

- ETH PREDICTION. ETH cryptocurrency

- Silver Rate Forecast

- Schumer’s Secret Stablecoin Standoff—What They Don’t Want You To Know 🪙🤐

- Brent Oil Forecast

- Crypto Chaos Unleashed: Shocking Gains and Ironic Downfalls 😂

- Unmasking the Whale: Ethereum’s Shocking, Witty Crypto Power Move Revealed 😎

- Shiba Inu’s Wild Race to Bitcoin’s Castle: Will It Leap or Trip? 🐕💥

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

2025-08-09 23:39