What to know:

Dogecoin takes a nosedive—down 4% in just 24 hours. For those keeping track (aka anyone who’s ever checked their phone after midnight in a cold sweat), that’s $0.20 to $0.19. And apparently, this is because global economics decided to go a little “Curb Your Enthusiasm” on everyone. Boom, just like that, your meme coins are in trouble.

Trading volumes? Surged. Because people LOVE watching their money evaporate, apparently. Huge selling, tons of people running to the exits like somebody yelled “Fire!” at a vegan BBQ.

DOGE tried to get past $0.203, but—shockingly—failed, hitting its head on resistance like George Costanza versus a bathroom door. Support is barely holding at $0.188–$0.190. You like roller coasters? Good. This is that, minus the fun and with more existential dread.

Dogecoin, living up to its reputation, fell 4% in 24 hours ending August 3 at 04:00 (UTC+7)—because nothing says “fun” like checking charts at 4 in the morning. Dropped from $0.20 to a low $0.19. Trading activity spiked faster than your aunt at a Black Friday sale, and the “macroeconomic headwinds” (don’t you just love that term?) are still blowing strong. Outflows across “volatile” assets—translation: meme coins especially—make you wonder why your neighbor Gary is still all-in on DOGE. 🤦♂️

What to Know

- DOGE traded a volatile $0.01 range (yes, that’s somehow a big deal, it’s crypto)—from $0.20 to $0.19 before staging what I’d call a “meh” bounce.

- Volume shot up to 918.53M at 06:00 (yes, nearly a billion—relax, it’s not real money anyway) and 502.81M at 14:00. Above average! If only your cholesterol tests did this well.

- Support: $0.188–$0.190. Volume: 667.44M. DOGE’s version of “please don’t leave me.” Brief recovery to $0.194, which nobody noticed because they already gave up.

- Resistance at $0.202–$0.203. Like that one friend who always has an excuse to not help you move. “No, can’t do it, sorry!”

News Background

DOGE’s little meltdown comes right after global trade tensions ramped up—surprise, apparently someone forgot to renew the planet’s “let’s get along” contract (92 countries, no less). The Fed’s sitting on their hands instead of cutting rates, which means the market is now one big ball of anxiety and everything fun must be sold. High-beta assets? More like “high blood pressure” assets.

$0.203. Hah! (Just kidding, never got there for long…)

Technical Analysis

- DOGE hit resistance at $0.202–$0.203—again, and again, and again. Definition of insanity, look it up.

- That $0.188–$0.190 spot? It’s soaking up sellers like your couch with spilled soup—with just as much stress.

- The last hour, DOGE dropped 0.53%. Tiny, but significant. Like the way your mother-in-law critiques your cooking: technically minor, emotionally devastating. 😬

- Volume calmed down late (sure, now it chills), but it’s still high. Translation: the drama isn’t over.

What Traders Are Watching

- Will DOGE hold $0.19? Will anyone care if it doesn’t? The suspense is killing exactly three people in a Discord chat right now.

- All eyes on U.S. rates, random global policy changes, and the slow-motion car wreck that is liquidity leaving meme coins.

UK Regulator to Allow Retail Investors Access to Crypto ETNs in October

Trump Media Confirms $2B Bitcoin Treasury and $300M Options Strategy in Q2 2025 Earnings Report

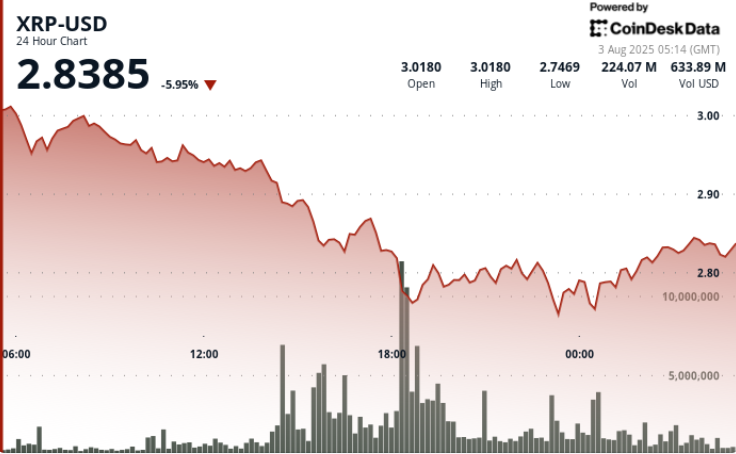

What Next For XRP as $2.75 Level Holds After Sharp Decline From $3

SEC’s Crypto Task Force Will Tour U.S. to Hear From Small Startups on Policy Reform

Arkham Says $3.5B LuBian Bitcoin Theft Went Undetected for Nearly Five Years

‘Chokepoint 3.0’ Has Arrived? a16z Warns of Anti-Crypto Bank Tactics

Bitcoin, Ether Start August on a Shaky Note as Dollar Index Tops 100; Yen Hits 4-Month Low Ahead of Nonfarm Payrolls

Arthur Hayes Dumps Millions in Crypto Amid Bearish Bet on U.S. Tariff Impact

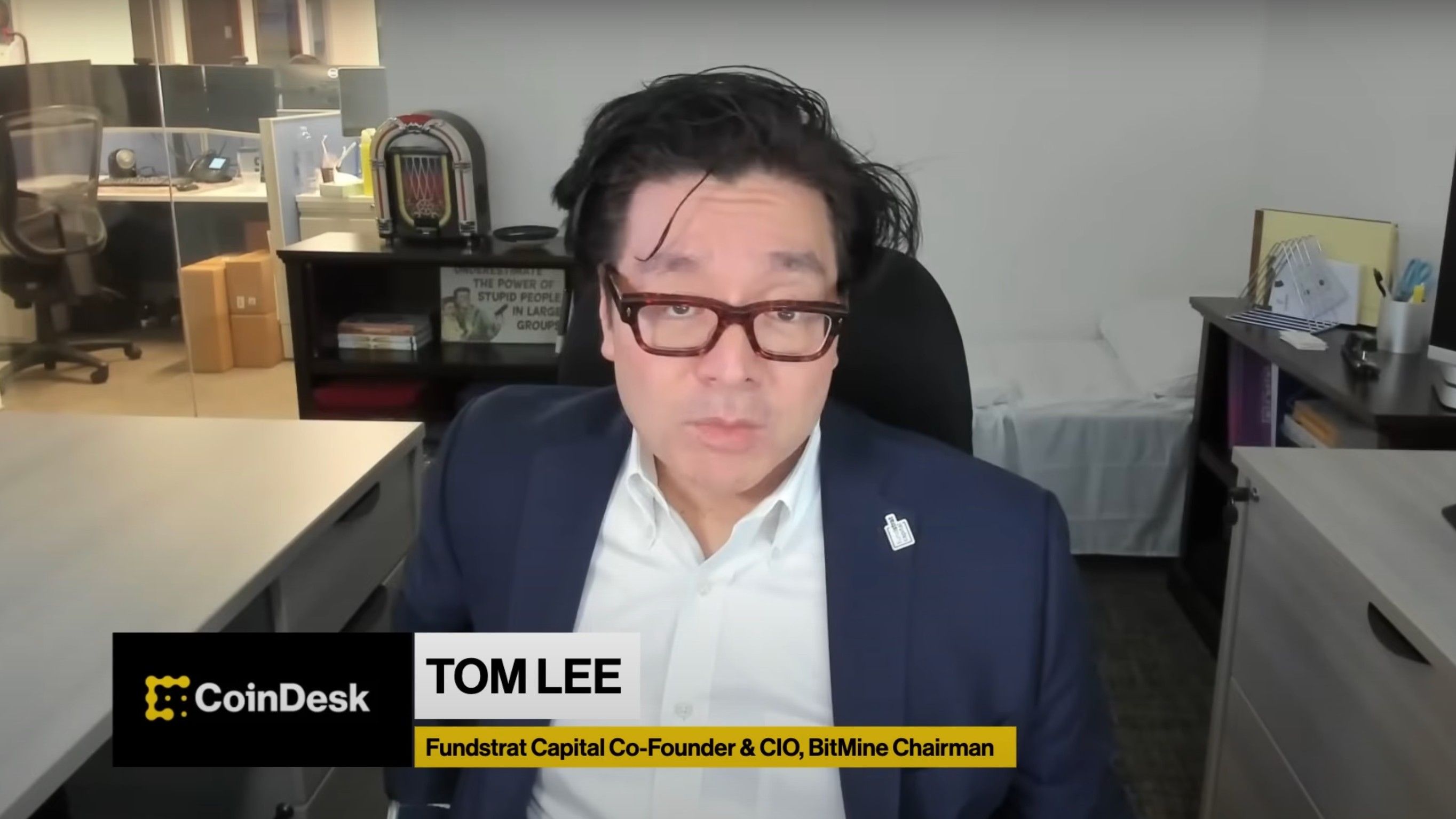

Wall Street Is Buying Crypto ‘Quietly’ — And That’s Bullish, Says Bitmine’s Tom Lee

Why Michael Saylor Calls Strategy’s STRC Preferred Stock His Firm’s ‘iPhone Moment’

Crypto ETFs See Record $12.8B Inflows in July as Market Rallies to New Highs

Gemini’s Tyler Winklevoss Says Trump CFTC Pick Quintenz Has ‘Disqualifying’ Views

Read More

- Gold Rate Forecast

- USD HUF PREDICTION

- Brent Oil Forecast

- Crypto Clash: Bitcoin, Ethereum, or Solana – Who’s the September Superstar? 🌟

- Crypto Chaos: Will the White House’s New Report Save the Day? 🤔💰

- Bitcoin’s Price Madness: A Comedy of Bulls and Bears 🎭💰

- Traders Rush Back to XRP: The Silent Storm Brewing in the Crypto World! 😱🚀

- When Will the Long Traders Finally Give Up? 🤔

- Ethereum’s Fee Fiasco: When Blockchains Play Hard to Get! 🤡

- Mysterious Moves: Crypto Titans’ Bold Bet or Folly? 🤔

2025-08-03 10:40