- FET plunged to a dismal $0.34 amidst a ruthless market purge, only to stage a nearly 50% comeback.

- The silent whispers of on-chain data reveal covert accumulation and the sly machinations of so-called smart money.

In the bleak corridors of modern finance, the Artificial Superintelligence Alliance [FET] was cast down to a pitiable $0.34 during a merciless selloff. Yet, with a twist of irony and a sardonic smile 😊, it has clawed its way back, nearly defying its fate by rallying 50%.

Over the last 72 hours, an excess of 1 million FET has been slyly scooped up in the spot market—an act of stealth accumulation akin to a quiet revolution in the dead of night.

Now, market puppeteers, ever the cynics of a crumbling order, fixate on the $0.34 level as a bulwark of structural support, ready to bet on a dramatic upward surge.

Should the fickle inflows persist, might FET stage a quiet rebellion against its former low, daring to approach the elusive $1 macro resistance—a ghostly memory from a January of debauchery? 🤔

Weekly Growth: The AI Uprising in Full Swing

On the weekly canvas of chaos, the combined market cap of AI tokens swelled from $21.33 billion to $24.43 billion—a robust surge that paints a surreal picture of capital’s restless ambition. FET, our unlikely antihero, showcased a defiant display of price action.

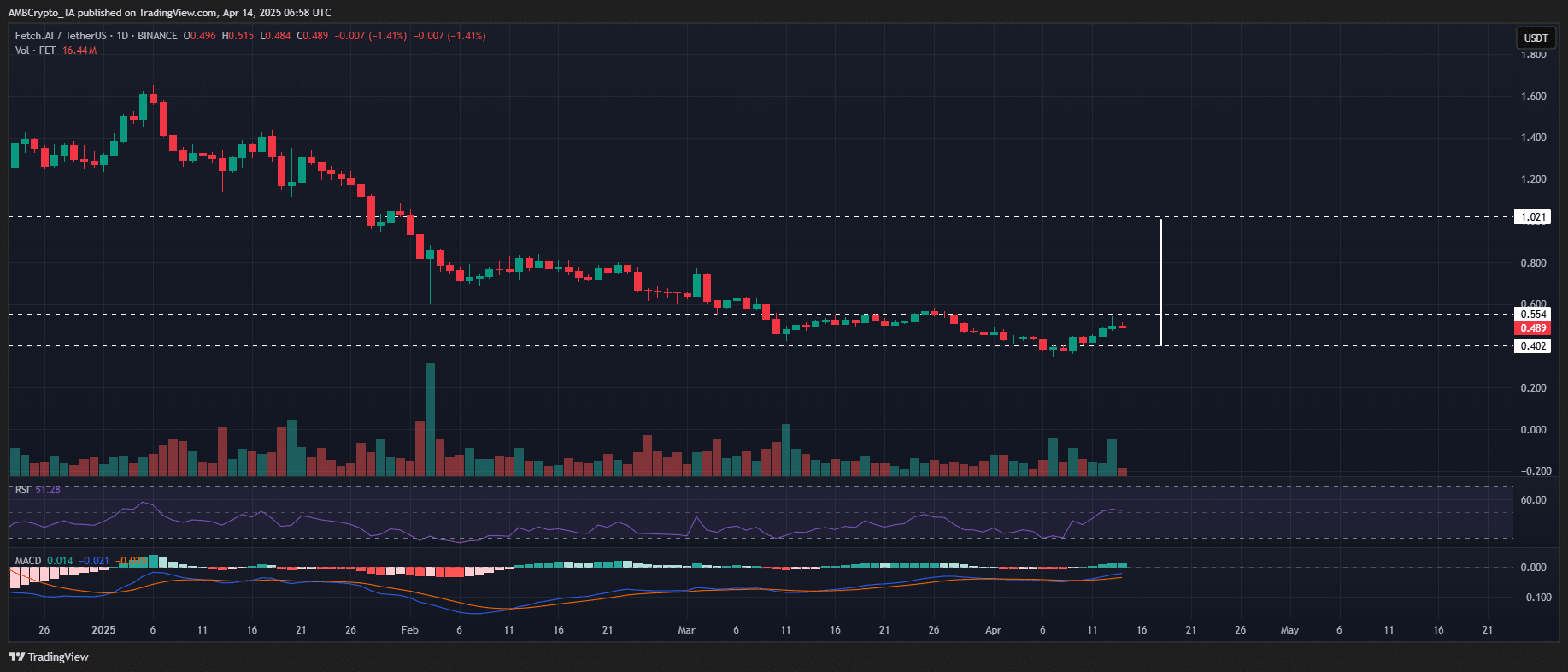

In a scene dripping with dark humor, FET outpaced its colossal peers with a 47% rally to $0.54 on April 13th, after a tedious period of range-bound accumulation. A textbook drama of volatile redemption, it seems the market loves its bittersweet irony.

The same cryptic signals echo in on-chain whispers and CEX murmurs, hinting at smart money stealthily front-running the breakout. As capital dances its absurd pirouette into AI majors, rumors of an all-time high retest by Q2’s end become the market’s punchline. 🍿

With FET now among the week’s top gainers and spot demand swelling like a rebellious tide, $0.34 is touted as a structural launchpad—a stepping stone for either miraculous revival or impending collapse.

Is this elaborate theater merely a transformation of FET’s recent dip into a paradox of high risk and reward?

FET’s Undervaluation: A Farcical Blindspot for the Wise

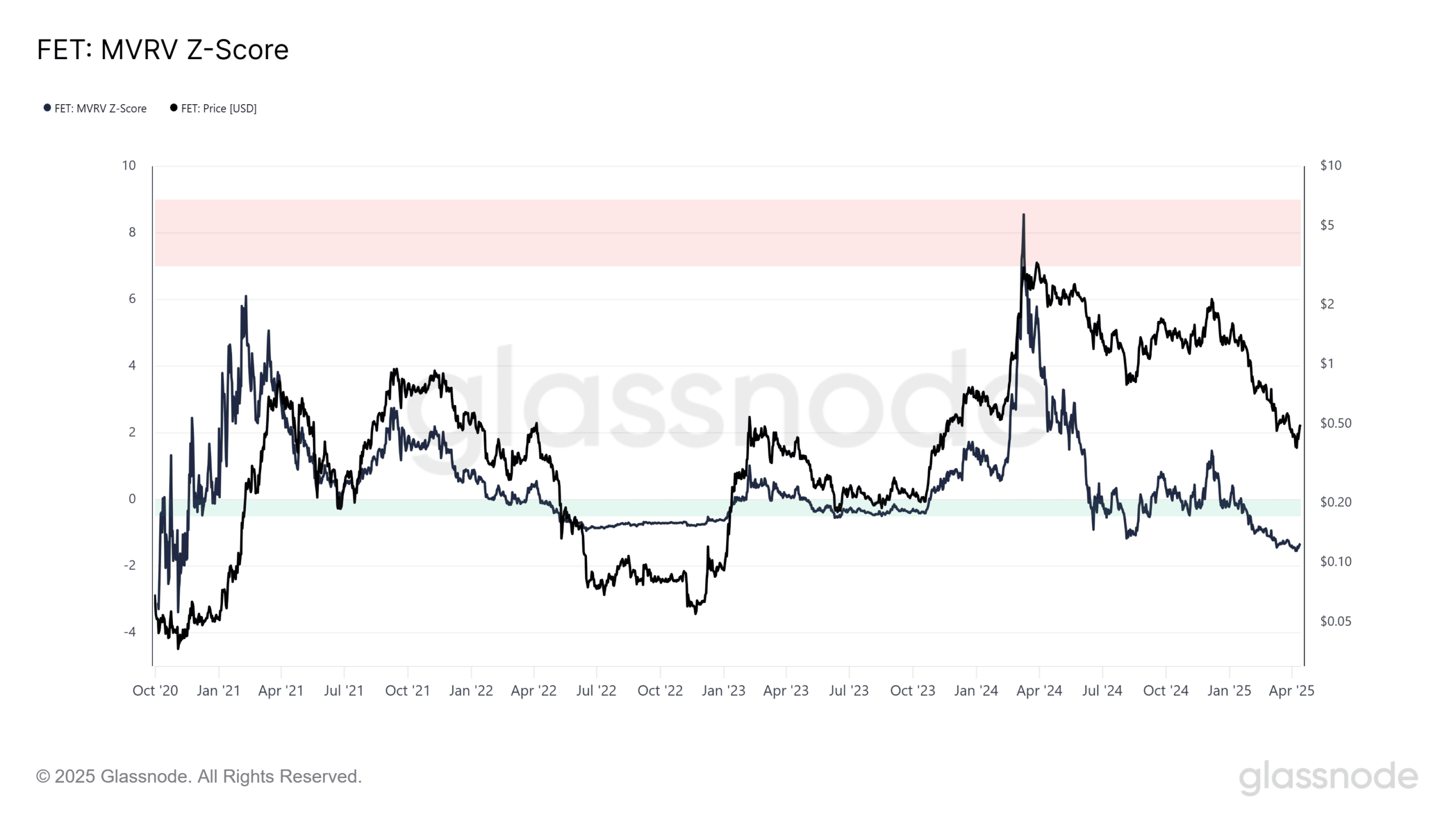

The tragic undervaluation of FET is embodied in its MVRV Z-score: a woeful two-year nadir of -1.50, lurking beneath the ghastly green band where oversold despair meets clandestine accumulation.

The ancient charts whisper that the $1.12 level may serve as a potential local bottom—a beacon in the murk for souls daring enough to hope.

Yet, FET’s Net Unrealized Profit/Loss (NUPL) languishes in the red since the halcyon days of January’s $1.60 peak, echoing a 70% Fibonacci retracement that drags the asset to a grim $0.50—a testament to prolonged capitulation.

In this dark comedy, the institutional titans and smart money remain passive on the sidelines, unable or unwilling to banish the sell-off’s relentless tide, thus denying $1.12 its much-anticipated role as a safe haven.

The persistently negative NUPL, coupled with an ever-so-optimistic positive SOPR, suggests that profit-taking continues unabated. The market, it seems, has yet to exhaust its selling fervor 😒.

Though early murmurs of smart money accumulation infuse a hint of hope, the net flows remain tragically insufficient to dispel the overwhelming supply overhead. Thus, the valiant $0.34 now teeters on the brink of collapse—an echo of past failures at $1.12.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Bitcoin Hits $111K: Is This the Start of a Crypto Comedy Show? 🎭💰

- Bitcoin’s Wild Dance: Fed’s Snip Sends It Soaring, Then Tumbling! 🪙💨

- LINEA’s Wild Ride: From Sky-High to Down in the Dumps 🚀📉

- 🚨 Senate Drops Crypto Bill: CFTC to the Rescue? 🚨

- Is Onyxcoin’s Rocket Losing Steam or Just Fueling Up? 🚀🧐

- TRON’s USDT Surge: Billionaire Secrets Revealed! 🐎💸

- Interactive Brokers: Crypto Cash, Now With More Sarcasm!

- Bitcoin Billionaire’s Bizarre Stock Scheme: Will It Collapse or Conquer? 🤔

2025-04-14 13:17