What to know:

By Omkar Godbole (All times ET unless indicated otherwise)

The crypto market, like a sun-bleached carcass on the Mojave Desert floor, lies cracked and brittle. Bitcoin’s feeble rally from Monday’s $84,000 plunge wheezed to a halt at $87,000-less a recovery than a gasp. XRP, ETH, SOL, and DOGE? They’re all circling their wagons near Monday’s lows like pioneers staring down a blizzard. 🥶

The CoinDesk 20 and 80 Indices? They crept up less than 1% in 24 hours. A pittance. A spit in the wind.

“This is a dangerous lull,” warns Alex Kuptsikevich of FXPro, squinting at the market cap teetering below $3 trillion. “The bulls better hold that $2.83 trillion line, or we’ll see a stampede faster than a prairie fire.”

One glimmer? The ETF bloodletting paused. $8.48 million dribbled into U.S. spot ETFs-hardly enough to fill a thimble, let alone plug the $229 million gap since October. The bulls might as well be trying to dam the Mississippi with corn husks. 🌽

Meanwhile, the world frets over Japan’s interest rates like a farmer worrying about rain while his barn burns. Jeroen Blokland scoffs: “Japan’s got an aging population and a budget deficit. They’ll cling to yield curve control like a drunk clings to a lamppost.” 🍣

KAS token, the Kaspa blockchain’s pride, bucked the trend last month with an 8% rise. Investors cheered “vProgs”-whatever that means-as if a new religion had promised salvation. But now it’s back to coughing up dust. 🚀

In the real world, Treasury yields dig their heels, giving the dollar index a fighting chance. Stay alert, partner. The wolves are at the door. 🔫

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead.”

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead.”

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead.”

- Day 2 of 7: Solana Economic Zone (Dubai, UAE)

- Dec. 2: Boston Institutional Digital Assets Forum 2025

- Dec. 2: Digital Finance Summit 2025 (Brussels)

- Day 1 of 2: Blockchain for Europe (Brussels)

- Day 1 of 2: India Blockchain Week 2025 (Bangalore)

- Day 1 of 2: FinTech Connect 2025 (London)

- Day 1 of 2: MENA FinTech and Insurtech Festival (Doha, Qatar)

- Day 1 of 2: Modern Investor Summit 2025 (Virtual)

- Day 1 of 2: TOKENIZE:LDN (London)

- Day 1 of 3: FT’s Global Banking Summit (London)

Market Movements

- BTC is up 0.4% from 4 p.m. ET Monday at $86,801.55 (24hrs: +0.27%)

- ETH is up 0.27% at $2,799.42 (24hrs: -1.27%)

- CoinDesk 20 is up 0.15% at 2,727.64 (24hrs: -0.47%)

- Ether CESR Composite Staking Rate is up 7 bps at 2.87%

- BTC funding rate is at 0.0069% (7.5829% annualized) on Binance

- DXY is unchanged at 99.49

- Gold futures are down 1.29% at $4,219.70

- Silver futures are down 2.89% at $57.44

- Nikkei 225 closed unchanged at 49,303.45

- Hang Seng closed up 0.24% at 26,095.05

- FTSE is unchanged at 9,709.62

- Euro Stoxx 50 is up 0.5% at 5,695.65

- DJIA closed on Monday down 0.9% at 47,289.33

- S&P 500 closed down 0.53% at 6,812.63

- Nasdaq Composite closed down 0.38% at 23,275.92

- S&P/TSX Composite closed down 0.9% at 31,101.78

- S&P 40 Latin America closed down 0.27% at 3,163.56

- U.S. 10-Year Treasury rate is unchanged at 4.09%

- E-mini S&P 500 futures are unchanged at 6,831.75

- E-mini Nasdaq-100 futures are up 0.14% at 25,428.00

- E-mini Dow Jones Industrial Average Index futures are unchanged at 47,366.00

Bitcoin Stats

- BTC Dominance: 59.55% (+0.24%)

- Ether-bitcoin ratio: 0.03228 (-0.5%)

- Hashrate (seven-day moving average): 1,075 EH/s

- Hashprice (spot): $36.95

- Total fees: 4.1 BTC / $352,115

- CME Futures Open Interest: 121,220 BTC

- BTC priced in gold: 20.7 oz.

- BTC vs gold market cap: 5.81%

Technical Analysis

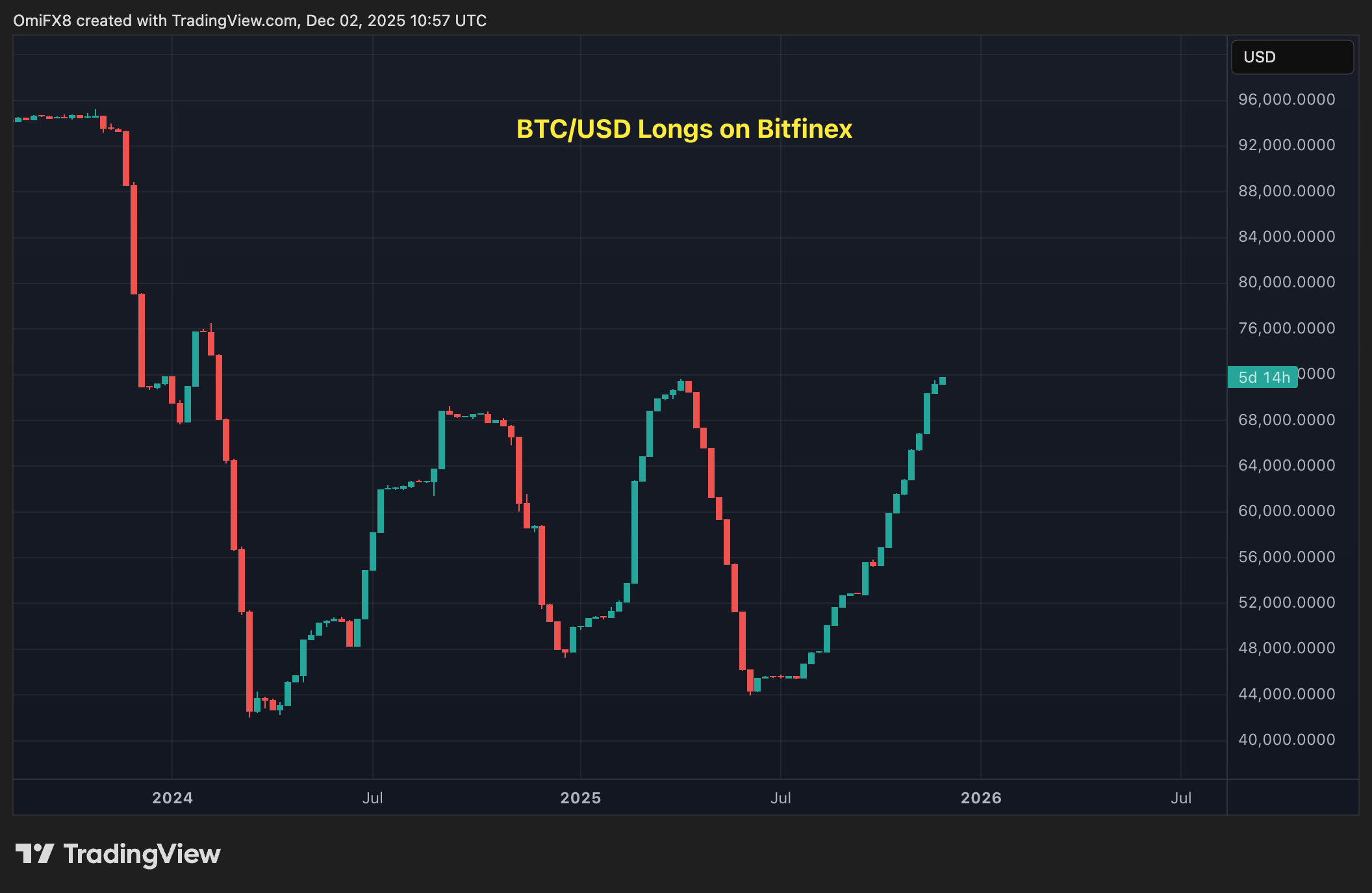

- The number of long positions in the Bitfinex-listed BTC/USD pair has risen to 71,809, the highest since February 2024.

- It’s a sign that traders are increasingly taking bullish exposure.

- Historical data shows that a sharp increase in the number of bullish bets typically occurs during a downtrend.

Crypto Equities

- Coinbase Global (COIN): closed on Monday at $259.84 (-4.76%), +0.83% at $261.99

- Circle Internet (CRCL): closed at $75.94 (-4.99%), +1.41% at $77.01

- Galaxy Digital (GLXY): closed at $24.8 (-6.73%), unchanged in pre-market

- Bullish (BLSH): closed at $41.03 (-5.94%), +1.1% at $41.48

- MARA Holdings (MARA): closed at $11.52 (-2.46%), +0.78% at $11.61

- Riot Platforms (RIOT): closed at $15.48 (-4.03%), +1.1% at $15.65

- Core Scientific (CORZ): closed at $16.59 (-1.78%), +0.12% at $16.61

- CleanSpark (CLSK): closed at $14.08 (-6.76%), +1.56% at $14.30

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $47.26 (-2.42%)

- Exodus Movement (EXOD): closed at $14.8 (-10.41%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $171.42 (-3.25%), +0.62% at $172.48

- Semler Scientific (SMLR): closed at $19.75 (-9.07%)

- SharpLink Gaming (SBET): closed at $9.6 (-9.6%), +1.56% at $9.75

- Upexi (UPXI): closed at $2.65 (-5.18%)

- Lite Strategy (LITS): closed at $1.71 (-9.52%)

ETF Flows

Spot BTC ETFs

- Daily net flows: $8.5 million

- Cumulative net flows: $57.7 billion

- Total BTC holdings ~1.31 million

Spot ETH ETFs

- Daily net flows: -$79 million

- Cumulative net flows: $12.88 billion

- Total ETH holdings ~6.27 million

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- Bitcoin’s Wild Ride: Will You Laugh or Cry? 🤔💸

- Silver Rate Forecast

- Brent Oil Forecast

- ZK Price: A Comedy of Errors 📉💰

- ZEC Surges 17%-Is $750 Just Around the Corner? 🚀💰

2025-12-02 16:07