Ah, the crypto circus! Once a dazzling spectacle of explosive rallies, now a somber sideshow of stalled momentum. 🌟 In October 2024, the market cap leaped from $2.7 trillion to $3.8 trillion in a mere two months-a feat as breathtaking as a tightrope walker without a net. A similar acrobatics display occurred in early 2024, when the market cap vaulted from $1.7 trillion to $2.85 trillion by mid-March. But now? The once-nimble performer seems to have tripped over its own shoelaces. Since June 2025, the market has inched from $3.5 trillion to a mere $3.94 trillion. Bullish? Perhaps. But the rallies? As fleeting as a magician’s rabbit. 🐇✨

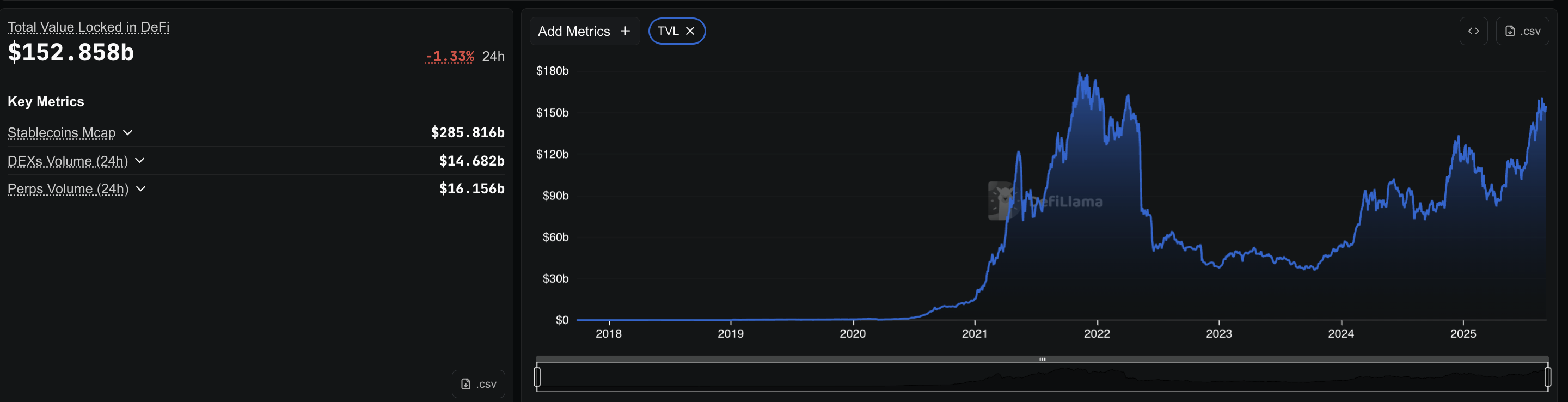

One culprit lurks in the shadows of DeFi, where borrowing reigns supreme. At press time, DeFi’s total value locked (TVL) stands at $152 billion, with nearly $49 billion borrowed across protocols. Imagine a lending pool needing $123 billion in deposits to support $49 billion in loans-a staggering 81% of the total TVL. But remember, this is DeFi, where numbers are as reliable as a fortune teller’s predictions. 🪄

Borrowing Growth and Stablecoin Dominance

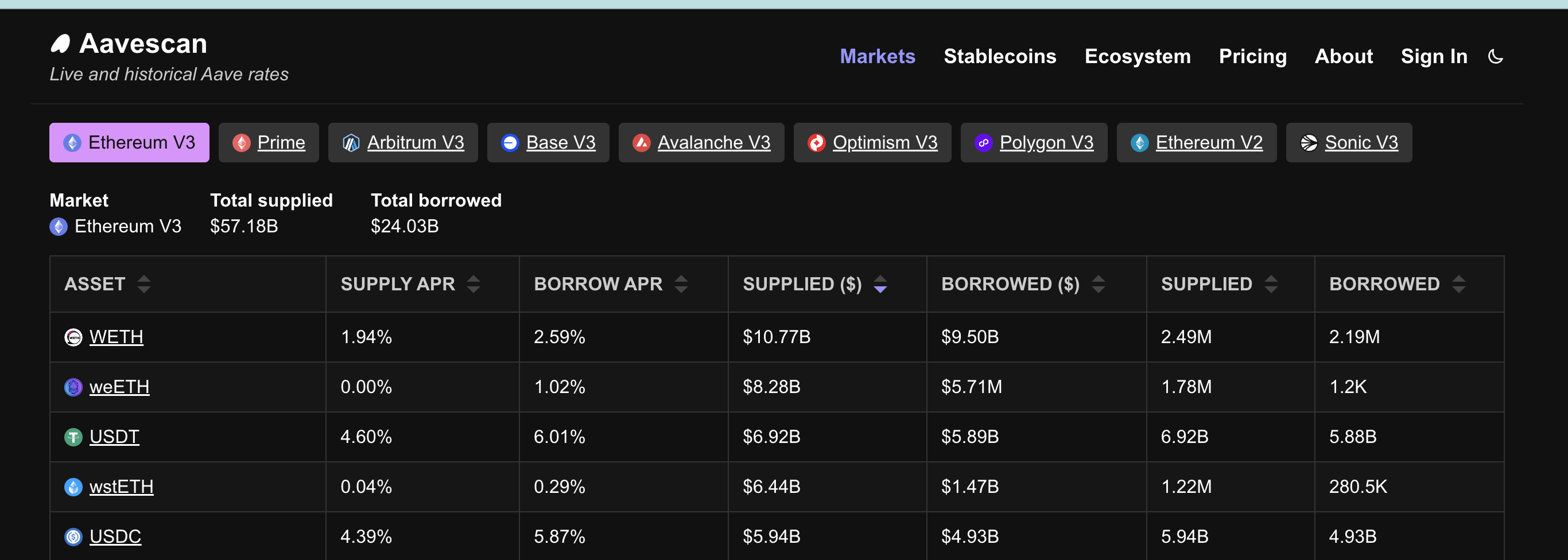

Aave, the ringmaster of this circus, leads with $24 billion in outstanding debt on Ethereum alone. Compound, the loyal sidekick, adds a modest $986 million. And what do traders borrow? Not ETH or volatile coins-heaven forbid! They borrow stablecoins, the crypto equivalent of a safety net. On Aave, $5.94 billion in USDT and $4.99 billion in USDC are borrowed. Compound mirrors this pattern, with $500 million in USDC and $190 million in USDT. Traders don’t hold these loans; they fling them into exchanges for trading. But what kind of trading, you ask? The kind that makes a high-wire act look safe. 🪢

Stablecoin reserves reveal the destination: derivative exchanges. Spot exchanges hold a paltry $4.5 billion, while derivatives platforms hoard $54.1 billion. Why? Because traders prefer leveraged bets to simple spot purchases. It’s like choosing a cannonball act over a juggling routine-far more thrilling, far more dangerous. 🎡

Stablecoin liquidity hits a record $68B.

Binance dominates with $44.2B (67% share), while OKX holds $9B.

Growth over the past 30 days driven by Binance (+$2.2B) and OKX (+$800M).

– CryptoQuant.com (@cryptoquant_com) September 4, 2025

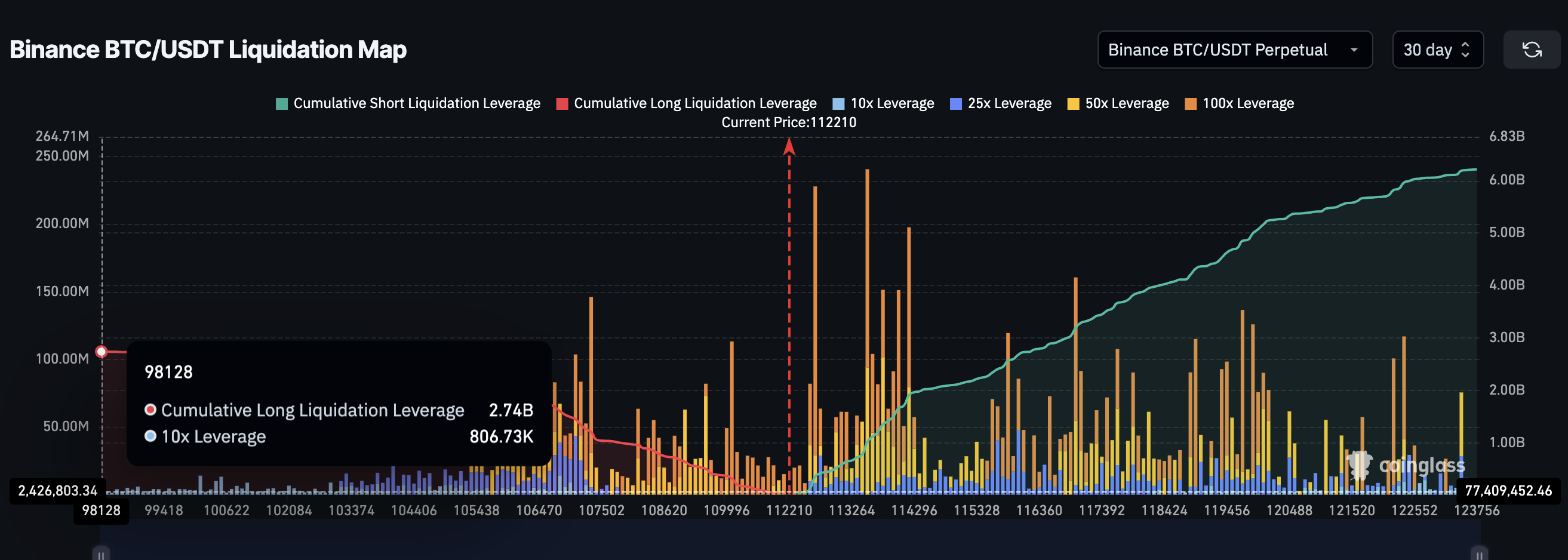

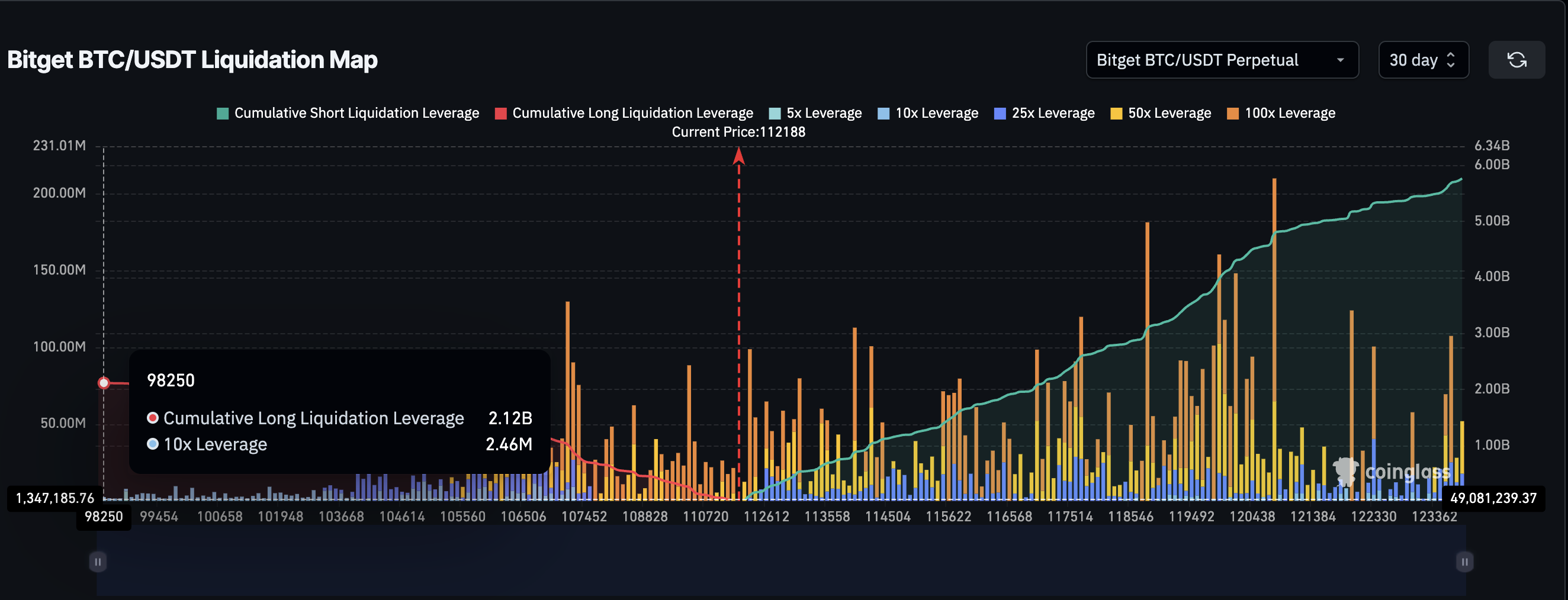

Leverage Builds Fragile Positions

Leverage, the double-edged sword of crypto, amplifies both gains and fragility. Liquidation maps show how a 2-3% pullback can trigger a cascade of forced liquidations, turning rallies into reversals. Short positions, often part of delta-neutral strategies, rarely sustain rallies when squeezed. Long positions, on the other hand, cluster like spectators at a freak show, ready to vanish at the slightest wobble. 🎭

🚫 No, there’s no ETH short squeeze happening.

What you’re seeing is a classic cash & carry trade:

→ Long spot ETH

→ Short ETH futuresIt’s a delta-neutral strategy.

Smart money is chasing risk-adjusted yield, not upside.– Maartunn (@JA_Maartun) September 4, 2025

Borrowing Costs Push Traders Toward Leverage

Borrowing stablecoins isn’t free. On Aave, the borrow APR for USDT is 6%, or about $1.15 a week for $1,000. With 10x leverage, a 0.011% price move covers the cost-a threshold so low it’s practically an invitation to gamble. But the longer positions stay open, the higher the costs climb, creating a pressure cooker of quick exits and stalled rallies. And liquidation? Always lurking, ready to pounce like a circus tiger. 🐯

So, is DeFi the reason crypto rallies are stalling? Perhaps. But it’s not just DeFi-it’s the entire circus, with its borrowed stablecoins, leveraged bets, and fragile positions. The market is still bullish, but the rallies? They’re juggling knives, and the crowd is holding its breath. 🎪🔪

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- When Crypto Meets Geopolitics: A Week of Drama, Deals, and Ripple Rumors 🚀💰

- Discover the Hidden Gems: Altcoins Under $1 That Could Make You Rich! 💰

- Brent Oil Forecast

- FTX’s Billion-Dollar Circus: When Crypto Goes Rogue and Everyone’s Suing

- When Crypto Flows Turn into a Billion-Dollar Flood 🌊💰

- SOL’s October Drama: ETFs, Upgrades, and $350 Dreams? 😱💸

- You Won’t Believe What Bitcoin Whales Are Doing—And How It Could Wreck the Market 🚨

- Tokens, Trinkets, and Trials: The Crypto Conundrum Unveiled!

2025-09-09 21:01