As the calendar turned its pages to December, the Bitcoin ETFs greeted the month with a modest inflow, a feat akin to a well-timed tea tray at a garden party, while ether and solana products, ever the dramatics, returned to outflow territory with the flair of a Shakespearean tragedy. 🎭

Mixed Start to December for Bitcoin, Ether, and Solana ETFs 🎩🎩

The first trading day of December delivered a mixed tone across the crypto ETF markets, a veritable circus of resilience and stumble, as investors, ever the fickle ones, repositioned themselves in anticipation of the year’s grand finale. Bitcoin ETFs, ever the paragons of prudence, maintained their positive stance, while ether products, in a fit of pique, tumbled into deep withdrawals. Solana funds, having enjoyed a brief stint in the spotlight, reversed their recent strength with a sharp outflow, much to the dismay of their admirers. 📉

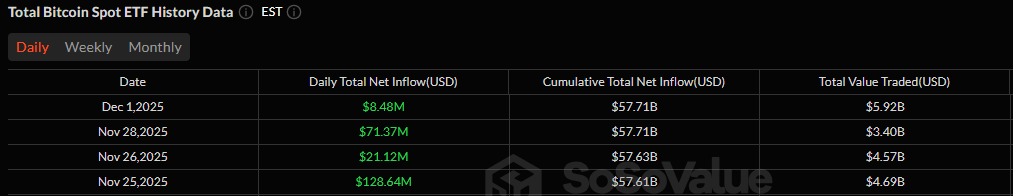

Bitcoin ETFs continued their recent pattern of tight, cautious flows, closing the day with a net $8.48 million inflow. Fidelity’s FBTC, the stalwart of the bunch, attracted a notable $67.02 million, while ARK & 21Shares’ ARKB chipped in another $7.38 million. Blackrock’s IBIT, however, saw a substantial $65.92 million exit, nearly erasing the gains produced by the other two major players. Still, the category held its ground, a testament to the enduring allure of Bitcoin, albeit with a touch of caution. 🚀

Ether ETFs opened the month on a decidedly negative note, a performance that would make even the most stoic of investors wince. Blackrock’s ETHA, ever the optimist, posted a strong $26.65 million inflow, but it wasn’t nearly enough to counter the heavy withdrawals across the rest of the sector. Grayscale’s ETHE, the reigning champion of outflows, led the decline with a $49.79 million exit, followed by Fidelity’s FETH at $31.62 million. A veritable exodus of funds, one might say, as traders rotated away from ETH exposure with the urgency of a man fleeing a particularly zealous parrot. 🦜

Solana ETFs, which had been on an impressive multiday inflow streak, finally hit resistance, a development as surprising as a well-dressed man at a pirate convention. Bitwise’s BSOL brought in a strong $17.18 million, complemented by a $1.82 million gain for Grayscale’s GSOL. But 21Shares’ TSOL, ever the contrarian, saw a sharp $32.54 million outflow, enough to flip the entire category negative for the day. The group closed with a $13.54 million net outflow, a reminder that even the most steadfast of trends can be derailed by a single rogue investor. 🛑

FAQ 🤔

- Why did Bitcoin ETFs stay positive today?

A combination of FBTC and ARKB’s prowess, though one must wonder if Blackrock’s IBIT is merely taking a nap. 🛌 - What caused the sharp outflows in ether ETFs?

A confluence of ETHE, FETH, and others, with ETHA’s inflow as a mere drop in the ocean. 🌊 - Why did Solana ETFs turn negative after multiple green days?

A $32.54 million exit from TSOL, a reminder that even the best-laid plans can go awry. 🤯 - What does this mixed start mean for crypto ETF sentiment?

Investors are actively rotating positions, creating uneven but high-volume trading, a spectacle as entertaining as a circus with a penchant for financial jargon. 🎪

Read More

- USD HUF PREDICTION

- Gold Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Bitcoin’s Wild Ride: Will You Laugh or Cry? 🤔💸

- The Future of Lido [LDO]: Retail Darlings vs. Profit-Hungry Whales 🐋💰

- SEC Suddenly Goes Soft on Crypto? Dragonchain Case Dropped—What Happened?! 🐉💼

- Brent Oil Forecast

- Banks Might Actually Need XRP When Sh*t Hits the Fan—CEO Spills Tea

- Schumer’s Secret Stablecoin Standoff—What They Don’t Want You To Know 🪙🤐

- Silver Rate Forecast

2025-12-02 18:38